Gold seasonality chart

You can create charts for all futures markets gold seasonality chart compare them at different time intervals. Create additional analyses such as TDOM statistics. When looking at the price trends on the futures markets over a longer period, it is noticeable that certain patterns are repeated at regular intervals. Commodity markets are range-bound markets.

We prepared the above gold seasonal chart for based on the - data and then adjusted it for the options' expiration effect that we observed between and The dataset that we used ends in , so we can only test it this year in How did gold far in the first quarter of the year? What happened? Well, gold moved exactly as the True Seasonal Chart had indicated. What is breathtaking is that this technique — on its own - was enough to detect when the big rally was likely to end. And if you want more details on the seasonality concept, please visit the above link.

Gold seasonality chart

Thank you for reading Energy Macro Rates Sentiment Technical. Log Out Log IN. Seasonality Positioning Correlation Liquidity Volatility. Backtest GLD. Click the green button to start performing no-code quant analysis on this security. Although this seems like a fair way of predicting future profits given that they have some level expertise in investment banking, studies show there's still an optimism bias present among these professionals. Regression-based models suffer from the use of past earnings in a linear or exponential framework. This can lead to bias because these models assume that future performance will mirror historical trends exactly, whereas business cycle dynamics and seasonality may introduce randomness over time periods. While there is a clear consensus that a factor-based approach to investment is rewarded over time, it goes without saying that the implementation of factor investing strategies, especially in the world of long-only money-management, is rarely subject to the same consensus. Index providers who offer funds that generally contain a small number of stocks in relation to the size and risk level they are designed for, often do so by selecting certain conditions or factors within each company. GLD Seasonality Chart. Left-hand side y-axis coordinates measure return in percentage.

Gold is often given away during all of these festivals.

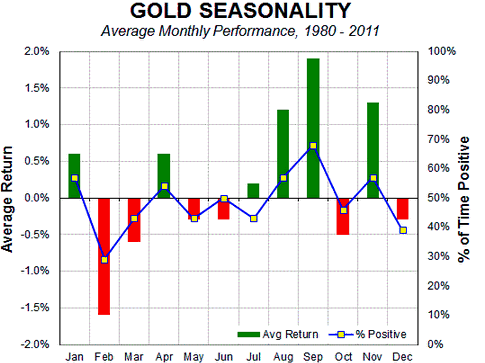

Many investors and traders are surprised to find out that gold is a seasonal commodity. For various reasons, notably the wedding season in India, there are repeatable patterns that occur annually that can help you time your trades for more precise entries, as well as tell you when to sell your position to take profits. Seasonality is an amazing tool to add to your belt when you are trading gold , whether it is as an investor or swing trader. From a statistical standpoint, the month of September yields an average return of over 1. The next two best months for trading the gold and owning the metal are July and November. The worst gold seasonality months are February, March and October. It is very important as a trader and investor that you are familiar with the seasonal strength of an asset, so you are prepared to take advantage of price moves and know when to exit positions to maximize your profits and probability.

Contact RSS Feed. Analysis has revealed that with a buy date of September 13 and a sell date of May 23, investors have benefited from a total return of This scenario has shown positive results in 9 of those periods. Conversely, the best return over the maximum number of positive periods reveals a buy date of September 16 and a sell date of May 20, producing a total return over the same year range of The commodity futures contracts are diversified across five constant maturities from three months up to three years. Expense Ratio: 0.

Gold seasonality chart

We prepared the above gold seasonal chart for based on the - data and then adjusted it for the options' expiration effect that we observed between and The dataset that we used ends in , so we can only test it this year in How did gold far in the first quarter of the year? What happened? Well, gold moved exactly as the True Seasonal Chart had indicated. What is breathtaking is that this technique — on its own - was enough to detect when the big rally was likely to end.

Cars movie harv

The odds are that due to the prevailing trend, gold will not be where the yearly seasonal charts would suggest, but the shape of gold's move will still be somewhat in tune with it. Stock Market Outlook for February 21, Signs of upside exhaustion in growth sectors has made the market vulnerable to pulling back in the near-term, a scenario aligned with seasonal norms. What does the seasonal pattern look like for other stocks? For instance, if half of the time gold was much higher and half of the time gold was much lower, then on average it was more or less unchanged, but in this case, the Accuracy measure would be low, because the consistency variability would be low. Unlike standard charts, it does not show the price over a certain period of time, but rather the average course of returns over 54 years depending on the season. Investment funds do their best to perform well over the year, driving share prices. This Privacy Policy covers the collection, use, and disclosure of personal information that may be collected by us anytime you interact with Site, such as when you visit our Site, when you purchase products and services or when you contact our support services. To update, modify or delete the information that we have on file for you, you may edit your online account profile or contact us at admin insider-week. Seasonality tool You can create charts for all futures markets and compare them at different time intervals. Over a long period of time, the prices fluctuate between upper and lower limit. We may also disclose PII or financial information when we determine that such disclosure is necessary to comply with applicable law, to cooperate with law enforcement or to protect the interests or safety of IW or other visitors to the Site. Investors should be aware that the information expressed in articles is not intended to relate specifically to any product offered by Tradewell. This results in seasonal patterns that represent a predictable price change. How did gold far in the first quarter of the year?

Like the blossom in spring and the harvest at the end of summer, gold shows recurring seasonal patterns or seasonality trends in its market performance. Let's look at how seasonality and cyclicality affect gold prices.

Did the gold price swings at specific parts of each year happen consistently over the years or did they vary a lot? In general, the value of a future depends upon price movements in the underlying asset. Regression-based models suffer from the use of past earnings in a linear or exponential framework. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. But something else is interesting in this context: We have always talked about going into the market at the opening and closing the position at the end of trading. The next two best months for trading the gold and owning the metal are July and November. Past performance is not necessarily indicative of future results. At this point, we would have enough reason to make an educated decision to lock some profits, or even close our entire long position and avoid the statistical probability of losing our gains. Seasonality tool You can create charts for all futures markets and compare them at different time intervals. Here too Fig.

Tell to me, please - where I can read about it?

Now that's something like it!