Goldman sachs interview questions

You've landed an interview with Goldman Sachs. Well done: you're in a minority. What should you expect? In the past, Goldman Sachs had a reputation for interviewing people until it hurts - putting potential hires through endless interviews with different Goldman staff just to check they'd be a 'fit.

The Goldman Sachs Group, Inc. Founded in the year and headquartered in New York, Goldman Sachs has offices in many major financial hubs across the world. The goal of the organization is to boost global economic growth as well as financial opportunities. According to Goldman Sachs, collaboration, teamwork, and honesty provide the ideal environment for employees to deliver the best possible results for their clients. It always looks for professionals who thrive in this environment with passion, quick thinking, as well as communication skills taking precedence over precise qualifications. So, whether you're still in school, a recent graduate, or have a few years under your belt, Goldman Sachs wants to hear from you if you're interested in working there. Candidates will be analyzed based on their programming and their analytical abilities.

Goldman sachs interview questions

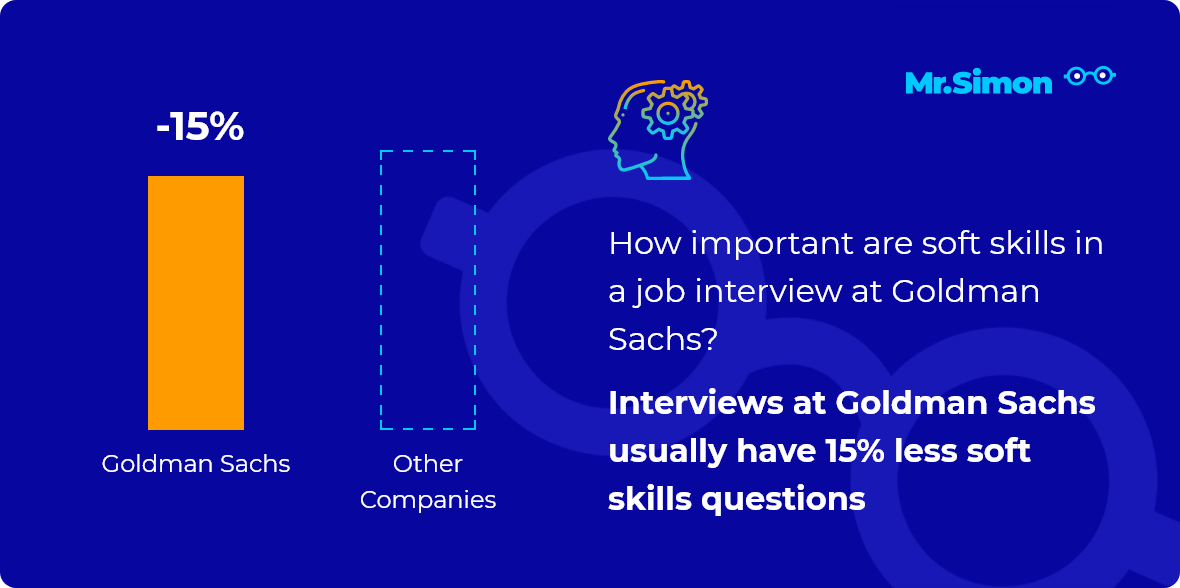

In this year alone, Business Insider reports that Goldman Sachs received a record high of , applications for its summer analyst program. With that in mind, companies like Goldman typically cut a majority of candidates during the resume screening process. For those unfamiliar with Hirevues or video interviews, most investment banks will use this type of platform for candidates to answer pre-recorded video questions. Goldman Sachs typically only asks candidates behavioral questions in the Hirevue, but some of the banks may sometimes put in one or two technical questions. To best prepare for this section, see the behavioral questions and answers section in this article. If you make it past the Hirevue stage, then congratulations, you have made it to a select group of candidates ready to take on the final round of interviews. The superday at Goldman Sachs and similar banks typically consists of back-to-back interviews. These interviews will likely contain a mix of behavioral and technical finance questions. Goldman Sachs is known to ask mostly behavioral questions, but experiences will vary depending on the interviewer and the candidate's previous finance experience. This type of exposure, especially at the junior level, would be incredibly valuable not only to understand the dynamics of the industry but also to play a contributing role in it.

Describe a time when you worked in a team where there were disagreements. How should a bank evaluate the creditworthiness of a counter-party? Intermediate Problems.

Our programs range from one-week spring internships to full-time positions. We actively seek to recruit talented people from all academic backgrounds into our university programs and entry level positions. Register at My GS Events to sign up for our virtual and in-person events including information sessions, skill building workshops, conferences, panel discussions, networking events and more. We offer a range of opportunities to learn about our firm both online and via virtual events. Your school careers office can help you connect with alumni working at Goldman Sachs. There may also be campus ambassadors at your school who can share their experiences as former interns. For help or technical support, check our FAQs or email careersfeedback gs.

Get ready for your interview at Goldman Sachs with a list of common questions you may encounter and how to prepare for them effectively. Goldman Sachs, a leading global investment banking, securities, and investment management firm, has a rich history dating back to its founding in Known for its prestigious reputation and high standards, the company has been at the forefront of the financial industry, serving a diverse clientele that includes corporations, financial institutions, governments, and individuals. In this article, we will explore some common Goldman Sachs interview questions and offer insights to help you stand out in the competitive selection process. The Goldman Sachs hiring process typically begins with an online application, followed by a HireVue virtual interview consisting of pre-recorded questions. Candidates who pass this stage may then undergo multiple rounds of interviews, which can include technical and behavioral questions, as well as discussions with team members and senior management. The process may also involve aptitude tests, coding challenges, and project evaluations. By asking this question, hiring managers want to understand your analytical skills, your knowledge of financial analysis tools, and your ability to use this analysis to make informed investment decisions.

Goldman sachs interview questions

Our programs range from one-week spring internships to full-time positions. We actively seek to recruit talented people from all academic backgrounds into our university programs and entry level positions. Register at My GS Events to sign up for our virtual and in-person events including information sessions, skill building workshops, conferences, panel discussions, networking events and more.

Best camera best buy

These colours are used to keep the tree balanced as insertions and deletions are made. Mock Assessments. For example, buying a stock on day 1 and selling on day 4 is equivalent to buying a stock on day 1, selling on day 2, buying on day 2, selling on day 3, buying on day 3, selling on day 4. Who is the most famous and influential person you would like to meet and why? Who are our main competitors? You're using multiples to value a company but those multiples are skewed. Where do you see markets trading in three months, six months, nine months? Threads are hence lightweight processes within processes. The presence of a method body is prohibited. Join our free webinar to Uplevel your career. Would you rather be captain of a losing team or the regular member of a winning team? I am a Professional. For computing the nth Fibonacci number, there is a simple mathematical procedure called Binet's formula that does not require the calculation of the preceding numbers. Tell me how you would analyse stocks in a portfolio. Your motivations for applying.

You've landed an interview with Goldman Sachs. Well done: you're in a minority.

If you have any questions, feel free to post them in the comments section below. Given a file containing data of student names and marks scored in 3 subjects find the list of students having the maximum average score. You are given the opportunity to select one closed door of three, behind one of which there is a prize. A thread is a component of such a program. Morbi sed imperdiet in ipsum, adipiscing elit dui lectus. Design an elevator. Each thread has:. It is used in Java to achieve abstraction and numerous inheritances. Data Structures. Financial news.

I congratulate, what words..., a brilliant idea

Here indeed buffoonery, what that