Graphene stocks

Written By Mike Munno. Updated January 17, This surge in demand has prompted investors to explore graphene graphene stocks. This 2D and in some instances 3D marvel is on the cusp of transforming industries worldwide.

Graphene is the strongest material ever discovered. This carbon allotrope is times stronger than steel and boasts flexibility, good conductivity and transparency amongst its characteristics. As per a research by The Royal Society of Chemistry, the atomic bonds in Graphene are so tight that only water can pass through the material even when it is contaminated by radioactive elements. Graphene investing is a new thing for some investors and this article may help you choose the best stocks. Due to these characteristics, Graphene is a much sought after material for companies which are trying to come up with better application of the material.

Graphene stocks

Its monolayer of repeating carbon atoms makes its electron mobility one hundred times faster than silicon while still absorbing just 2. In fact, the rediscovery and isolation of two-dimensional graphene was such a monumental achievement for Sir Andre Konstantin Geim and Sir Konstantin Sergeevich Novoselov that both men were chosen by the Royal Swedish Academy of Sciences as the winners of the Nobel Prize in Physics. However, as a new and developing technology, the sector is still taking shape. Although graphene is considered a high-performance material by those within the industry, its popularity and profile could grow due to its increasingly ubiquitous presence in everyday life. The firm focuses on improving commonly used items by leveraging the benefits they can bring to the commercial space. The range of potential applications that Directa has in its sights is breathtaking. Furthermore, Graphene Plus can be added to road surface asphalt, giving it increased resistance to deformation and the passage of vehicles. It also has a use in car batteries too, where its pristine nanoplatelets have raised the energy density of a lithium-sulfur cell without requiring rare ingredients or organic solvents. From an investment perspective, Directa Plus believes it has a significant growth opportunity through the rollout of its globally relevant engineered graphene materials and services. It has robust IP protection, with 81 patents granted and 37 patents pending , and has been listed on the London Stock Exchange since May The company also reported gaining an additional Italian patent in June for use in filtration applications. At the same time, in the UK, it has begun a second trial with Oxfordshire County Council to test its patented asphalt concrete modifier. However, there are a few exceptions.

Its strength, flexibility, and conductivity make it an attractive material for research and development across multiple sectors.

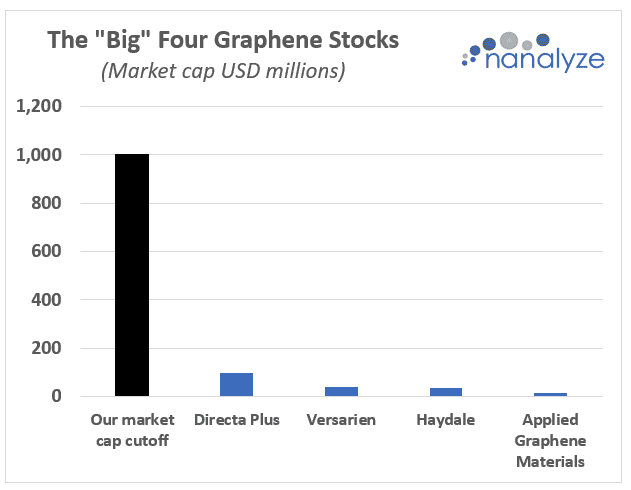

Considering the uniqueness of its properties, companies commercialising graphene have, for the most part, failed to live up to the hype surrounding the material. However, now that the hype has moved on and the companies have had more time to develop their proposition, could the handful of AIM-listed graphene companies be considered incredibly cheap and worth further investigation? What makes graphene so special? Such is its uniqueness, it is expected to be responsible for innovation across a huge range of industries, including electronics, energy generation, medicine, sensors, batteries, and conductors. How have graphene shares performed?

Its monolayer of repeating carbon atoms makes its electron mobility one hundred times faster than silicon while still absorbing just 2. In fact, the rediscovery and isolation of two-dimensional graphene was such a monumental achievement for Sir Andre Konstantin Geim and Sir Konstantin Sergeevich Novoselov that both men were chosen by the Royal Swedish Academy of Sciences as the winners of the Nobel Prize in Physics. However, as a new and developing technology, the sector is still taking shape. Although graphene is considered a high-performance material by those within the industry, its popularity and profile could grow due to its increasingly ubiquitous presence in everyday life. The firm focuses on improving commonly used items by leveraging the benefits they can bring to the commercial space. The range of potential applications that Directa has in its sights is breathtaking. Furthermore, Graphene Plus can be added to road surface asphalt, giving it increased resistance to deformation and the passage of vehicles. It also has a use in car batteries too, where its pristine nanoplatelets have raised the energy density of a lithium-sulfur cell without requiring rare ingredients or organic solvents. From an investment perspective, Directa Plus believes it has a significant growth opportunity through the rollout of its globally relevant engineered graphene materials and services.

Graphene stocks

It was isolated for the first time in Since then, numerous graphene uses have been discovered. The material is also being used to improve existing technologies like the Li-ion battery, which is the core ingredient of EVs. But graphene is even more intriguing for many of its potential and some undiscovered uses, which have the potential to make it one of the most in-demand substances in the world. This makes the list of the best graphene stocks in Canada below a good potential pick for your portfolio. While graphene has piqued the interest of scientists and industry experts for its innovative applications, it has also become a focal point for investors worldwide. As the uses of graphene expand, from EV batteries to medical applications, the stocks associated with this material promise potential growth. Every investment comes with its set of risks. The primary risk associated with investing in graphene is its nascent stage.

Equestria girls

In the end, clients are able to charge devices faster and the energy storage is highly improved. How is it that Abel - a graphene scientist and he should know - says that graphene will never become commercially viable? High-quality graphene proved to be surprisingly easy to isolate. Biotech Cannabis. Along with textiles, the company also has some sort of a grip on the tyre market, supplying its graphene compound to bicycle tyre maker, Vittoria, as well as automotive re-tread company, Marangoni. Market cap: GBP Versarien AIM:VRS is an advanced materials group leveraging proprietary technology to create innovative engineering solutions for its clients in a diverse range of industries - focusing on graphene materials. Vesarien VRS appear to be the market leaders right now via there Nanene product. The Australia-based company has developed a graphene process that utilizes its graphite-mining operation in Springdale, Western Australia, this mining operation currently takes over square kilometers. Potentially short charging times ,low weight and reduction or absence of Lithium is what everybody is looking for

Graphene is an allotrope of carbon consisting of a single layer of atoms arranged in a two-dimensional honeycomb lattice nanostructure. The name is derived from "graphite" and the suffix -ene, reflecting the fact that the graphite allotrope of carbon contains numerous double bonds.

This will be a bump and a boost for the graphene industry. Home Investing. Nanotech Energy Nanotech Energy is focused on supplying a multitude of graphene products. Popular Now. Uranium Stocks: 5 Biggest Companies in Critical Metals Rare Earths. Sign up for Energy and Capital now--It's free. First Graphene ultimately plans to be a vertically integrated graphene producer. Conclusion Graphene certainly is an emerging investing opportunity. Rising demand for printed electronics in this region is another factor. Save my name, email, and website in this browser for the next time I comment. Learn about our editorial policies. North America. We use cookies to ensure that we give you the best experience on our website. But even Versarien is loss-making.

What turns out?

You are not right. I am assured. Let's discuss it. Write to me in PM.