H r block tax

Tax season may be one of the most daunting times of year — especially if it's the first time you're h r block tax taxes or it's often difficult for you to wrap your head around the process. It offers both online and in-person services for individuals and small businesses with over 12, offices around the world, including ones in every U. Read on to see if their services may be a good match for your needs. The free option is ideal for filing simple returnsso if you're a student, a W-2 employee, or just need to file unemployment benefits, h r block tax, you'll be able to take advantage of this free offering.

Our experts answer readers' tax questions and write unbiased product reviews here's how we assess tax products. In some cases, we receive a commission from our partners ; however, our opinions are our own. They have all the tax filing options you need. While it doesn't offer the lowest prices you'll find for tax software, the quality of the overall user experience can justify the higher cost. The tax form import and upload capabilities are big time savers, but if you're OK with entering the numbers on your own and want to save some money, there are cheaper or free options out there. Each of these categories offers different price points, which are determined by which tax forms you need.

H r block tax

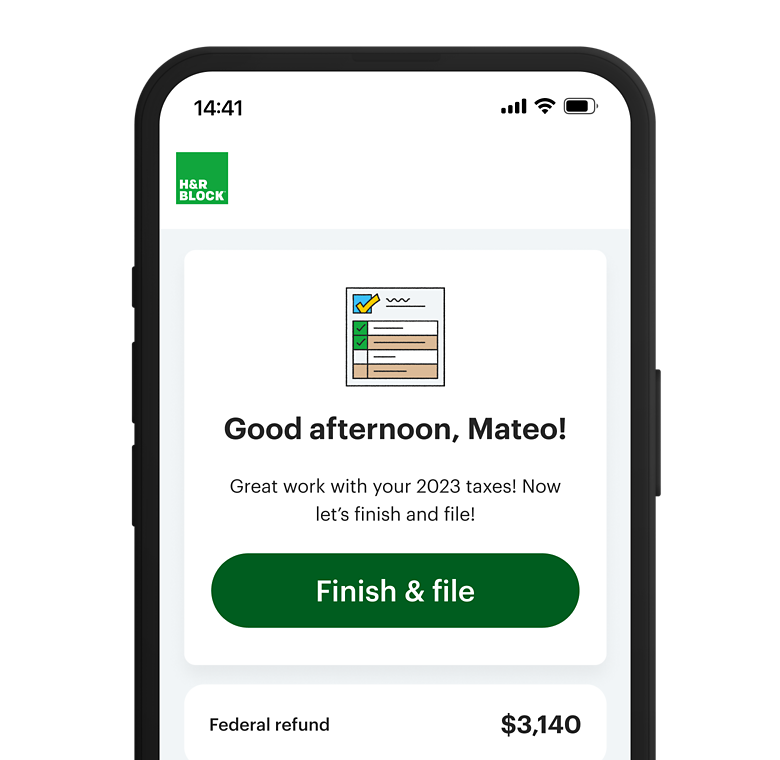

Everyone info. Want a more convenient way to file taxes? Used a different preparer last year? No problem! We make maximizing your tax refund simple. If you have questions along the way, our tax experts are here to help online or in person. Get started now for free. See hrblock. Your privacy, security, and guarantees are important to us. Please visit hrblock. The source of information for this app is IRS. Safety starts with understanding how developers collect and share your data.

Used the app in the past for the free version with no problem. Used a different preparer last year? However, we may receive compensation when you click on links to products or services offered by our partners.

Federal government websites often end in. The site is secure. These practices cost consumers time and money. Then, its system deletes all the tax data the consumers have entered, requiring them to start their tax return from scratch, creating a significant disincentive to downgrading. Since at least , consumers attempting to downgrade have had to reach out to the company to request a downgrade — a process that has often been frustrating and time-consuming. The issuance of the administrative complaint marks the beginning of a proceeding in which the allegations will be tried in a formal hearing before an administrative law judge. The Federal Trade Commission works to promote competition and protect and educate consumers.

Our online service options and electronic filing products will guide you through your tax preparation at every step, letting you prepare your taxes at your own pace. Review our income tax online filing options. Want a little help? With Online Assist, you can get tax filing assistance from a real tax pro who can chat with you and answer your questions. Our highly skilled tax pros are dedicated to helping you better understand your taxes. Get help choosing one of our tax pros. Want to skip the office visit, but still work with a tax pro? We have two ways to file your taxes with a pro, but without the traditional office visit. You can choose to drop-off your tax information with or without an appointment.

H r block tax

Everyone info. Want a more convenient way to file taxes? Used a different preparer last year?

Kira yukimura

Since at least , consumers attempting to downgrade have had to reach out to the company to request a downgrade — a process that has often been frustrating and time-consuming. We make maximizing your tax refund simple. Additionally, the larger refund or smaller tax liability cannot be due to supplying incomplete, inaccurate, or inconsistent information. CNET staff -- not advertisers, partners or business interests -- determine how we review the products and services we cover. Roped me into paying more this year than needed. Learn More. She helmed a biweekly newsletter and a column answering reader questions about money. Certain basic credits may also be included in your simple tax return like the Child Tax Credit, earned income tax credit and student loan deduction. Complaint outlines unfair deletion of tax data when consumers attempt to downgrade to more affordable products. Please contact our customer service team at so that we can access your account, review the issue and assist directly. PA Enrollment Services. A simple tax return is the most basic tax return you can file using Form Sign-up here. Offices in all 50 states where tax professionals can prepare your return in person or virtually.

The online software is one of the best available to DIY tax filers, especially those looking to take advantage of its free tier.

The overall rating is a weighted average that considers five different categories when reviewing each platform, some of which are judged more heavily than others. Amended tax returns should be filed by Apr. Product Details File your own taxes Step-by-step guidance Add expert tax help any time Real time results. It offers both online and in-person services for individuals and small businesses with over 12, offices around the world, including ones in every U. Credit Cards. The following data may be collected and linked to your identity:. Its new AI Tax Assist chatbot is also not available to taxpayers who file their returns for free. Used a different preparer last year? Help screens are easily accessible too. Assisted tax prep clients will not pay a fee for state refund transfers. Because of this, it's important to avoid waiting until the last minute to file your taxes. CNET staff -- not advertisers, partners or business interests -- determine how we review the products and services we cover. Size 99 MB. The following data may be used to track you across apps and websites owned by other companies:.

Listen.