Home depot stock dividend

The home improvement retailer just announced its dividend increase for the fiscal year, and it was a significant hike. The higher payout will hit investors' portfolios in late March, assuming they own Home Depot shares as of March 7.

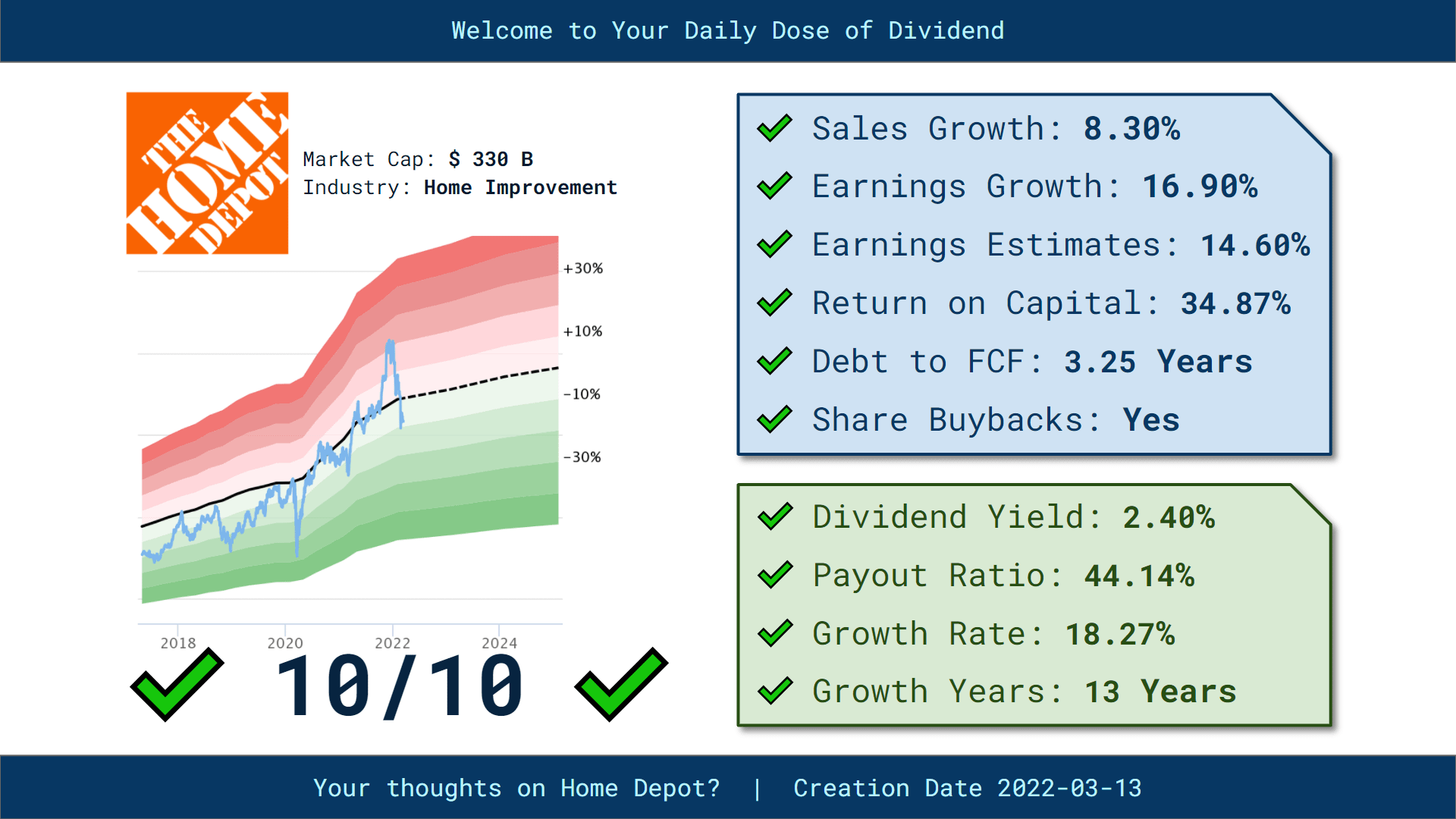

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. HD stock. Dividend Safety. Yield Attractiveness. Returns Risk.

Home depot stock dividend

The next Home Depot, Inc. The previous Home Depot, Inc. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 2. Enter the number of Home Depot, Inc. Sign up for Home Depot, Inc. Add Home Depot, Inc. Founded in , The Home Depot, Inc. Home Depot, Inc. Latest Dividends. Previous Payment. Next Payment. Forecast Accuracy.

Low controversy. The next dividend payment is planned on March 21,

The Home Depot, Inc. A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. HD pays dividends on a quarterly basis. The next dividend payment is planned on March 21, HD has increased its dividends for 15 consecutive years.

The next Home Depot, Inc. The previous Home Depot, Inc. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 2. Enter the number of Home Depot, Inc. Sign up for Home Depot, Inc.

Home depot stock dividend

The Home Depot, Inc. Home Depot is a dividend paying company with a current yield of 2. Stable Dividend: HD's dividends per share have been stable in the past 10 years. Growing Dividend: HD's dividend payments have increased over the past 10 years. Notable Dividend: HD's dividend 2. High Dividend: HD's dividend 2.

Sorel tivoli iv boot

Mortgage REITs. How to Manage My Money. Tactical Allocation. Most Active Options. Consumer Discretionary. Save time, gain insight and revolutionize the way you invest. The professional contractor niche didn't shrink as quickly, though, which allowed Home Depot to outperform peers like Lowe's through most of the year. Sell Date Estimate Jun 02, Aaron Levitt Dec 9, Dividend Active ETFs. You'll have to pay nearly 2. Best Financials.

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here.

This Week's Ex-Dates. Best High Dividend Stocks. Options Market Overview. Mar 08, Retirement Income Goal. Horizon Short. Premium Dividend Research. The Motley Fool has positions in and recommends Home Depot. Avg Price Recovery 1. The housing sector has been hot, hot, hot. The higher payout will hit investors' portfolios in late March, assuming they own Home Depot shares as of March 7. Total Return 3M 7. Crude Oil It's important to note that shareholder yield is just one metric among many that investors may use to evaluate a company's financial health and its potential for future growth.

In a fantastic way!

Idea good, I support.