Hourly rate paycheck calculator

This hourly rate paycheck calculator tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. For more information, see our salary paycheck calculator guide. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data.

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication for current laws.

Hourly rate paycheck calculator

This form is for calculating your annual, monthly, weekly, daily and hourly rates of pay. Please only enter the values for the time you are supposed to work. About unions. Workplace guidance. About the TUC. Not sure which union is right for you? Wondering what the fuss is about? Use the unionfinder tool. In this section. Find a union for you. Browse all unions. How the TUC works with unions.

Select state. Specialty Calculators.

Input your income details and see how much you make after taxes. Calculate a bonus paycheck tax using supplemental tax rates. Calculate net-to-gross: find out how much your gross pay should be for a specific take-home pay. Calculate the gross wages based on a net pay amount. Fill out a Form W4 step-by-step with helpful tips. See how increasing your k contributions will affect your paycheck and your retirement savings. Use the dual scenario salary paycheck calculator to compare your take home pay in different salary scenarios.

Find a plan that fits you. Answer a few questions about what's important to your business and we'll recommend the right fit. Get a recommendation. These paycheck details are based on your pay info and our latest local and federal tax withholding guidance. You can also learn how to automate your companies payroll with Quickbooks. Fail to pay employees fairly under federal, state, or local laws, and you may find yourself facing thousands of dollars in fines. Underpaying employee overtime is one of the most common labor law violations businesses commit.

Hourly rate paycheck calculator

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication for current laws.

Speed ball rebel

In this section. Baye, M. Here, we would like to explain to you the math behind the calculations. To calculate an annual salary, multiply the gross pay before tax deductions by the number of pay periods per year. However if you do need to update it for any reason, you must now use the new Form W You can choose between 20 different popular kitchen ingredients or directly type in the product density. A much nicer and easier way is to use this paycheck calculator and have all the results immediately. Let's consider some pros and cons of both types of employment. A financial advisor can help you understand how taxes fit into a set of financial goals. Hourly rate vs. Your privacy is assured.

All residents and citizens in the USA are subjected to income taxes.

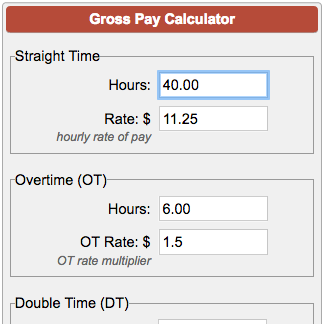

By default, the week is 40 hours long, but you can freely configure it according to your needs. It should not be relied upon to calculate exact taxes, payroll or other financial data. Searching for accounts Your privacy is assured. Employers may need to deduct garnishments from employee wages if they receive a court order to do so. Dual Scenario Hourly Use the dual scenario hourly paycheck calculator to compare your take home pay in different hourly scenarios. Find federal and state withholding requirements in our Payroll Resources. It is worth mentioning, that in many countries including the USA companies offer their workers various kind of compensations for overtime hours. This powerful tool can account for up to six different hourly rates and works in all 50 states. Looking for managed Payroll and benefits for your business? The result is your hourly pay.

Excuse for that I interfere � here recently. But this theme is very close to me. Is ready to help.

I apologise, but, in my opinion, you commit an error. I can defend the position. Write to me in PM, we will discuss.