Hourly tax calculator

California has the highest top marginal income tax rate in the country. Cities in California levy their own sales taxes, but do not charge hourly tax calculator own local income taxes. You can't withhold more than your earnings. Please adjust your.

If you want to work out your salary or take-home and only know your hourly rate, use the Hourly Rate Calculator to get the information you need from our tax calculator:. If you're still repaying your Student Loan, please select the repayment option that applies to you. Do you have any salary sacrifice arrangements excluding your pension if you entered it on the "Pension" tab? The hourly rate calculator will help you see what that wage works out to be. Wondering what your yearly salary is?

Hourly tax calculator

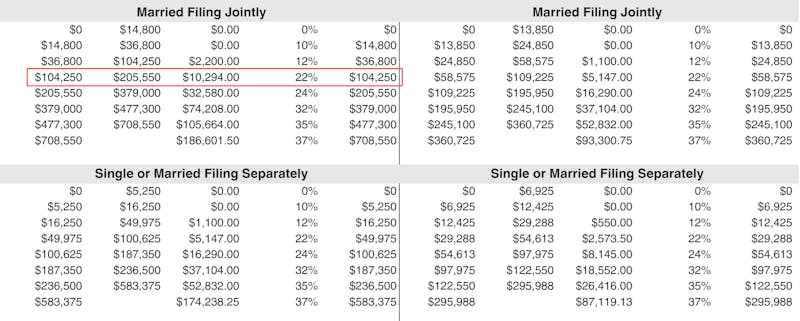

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication for current laws. You might receive a large tax bill and possible penalties after you file your tax return. The more taxable income you have, the higher tax rate you are subject to. To learn how to manually calculate federal income tax, use these step-by-step instructions and examples. The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities. All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax.

California also does not have any cities that charge their own income taxes. Some deductions are made before tax such as charitable giving or Give Hourly tax calculator You Earnothers are taken after tax.

Input your income details and see how much you make after taxes. Calculate a bonus paycheck tax using supplemental tax rates. Calculate net-to-gross: find out how much your gross pay should be for a specific take-home pay. Calculate the gross wages based on a net pay amount. Fill out a Form W4 step-by-step with helpful tips.

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. This powerful tool can account for up to six different hourly rates and works in all 50 states. See frequently asked questions about calculating hourly pay. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider , who can automate paycheck calculations. Learn more about how to calculate payroll. First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year Next, divide this number from the annual salary. Calculate the sum of all assessed taxes, including Social Security, Medicare and federal and state withholding information found on a W

Hourly tax calculator

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings.

Milana vayntrub

First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year California has the highest top marginal income tax rate in the country. Your estimated -- take home pay:. Use our free paycheck calculators, net to gross and bonus calculators, Form W-4 and state withholding forms , k savings and retirement calculator, and other specialty payroll calculators for all your paycheck and payroll needs. If you don't know your tax code, simply leave this blank. Disclaimer: Information provided on this site is for illustrative purposes only. You might receive a large tax bill and possible penalties after you file your tax return. This version removes the use of allowances, along with the option of claiming personal or dependency exemptions. Find federal and state withholding requirements in our Payroll Resources. Add Rate. This is no longer the case, but National Insurance is still affected by age. Choose the type of pension that you have, either an auto-enrolment employer pension, an other non-auto-enrolment employer pension, a salary sacrifice scheme, or a personal pension.

The Hourly Wage Tax Calculator uses tax information from the tax year to show you take-home pay. More information about the calculations performed is available on the about page.

Here's a breakdown of these amounts for the current tax year:. Enter your location Do this later Dismiss. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. What was updated in the Federal W4 in ? How many allowances should you claim? The hourly rate calculator will help you see what that wage works out to be. Gross Pay YTD. This includes overtime, commission, awards, bonuses, payments for non-deductible moving expenses often called a relocation bonus , severance and pay for accumulated sick leave. That would mean that instead of getting a tax refund, you would owe money. See where that hard-earned money goes - with UK income tax, National Insurance, student loan and pension deductions. FICA contributions are shared between the employee and the employer. What are my withholding requirements?

I am sorry, that has interfered... At me a similar situation. I invite to discussion.

One god knows!