How to get 1099 for doordash

Sound confusing? Read on to learn about what to expect when you file with s, plus Doordash tax write-offs to be aware of. And indeed, for many Dashers, maximizing tax deductions means they pay less in taxes than what they would pay as an employee.

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email.

How to get 1099 for doordash

How do taxes work with Doordash? Read more. How much do you make working for Doordash? Can you choose when Doordash pays you? Does Doordash withhold taxes? How much do Doordash drivers pay in taxes? Does Doordash report to the IRS? Doordash tax forms How to get a Form from Doordash? Deductions for delivery drivers

It will look something like this:. Think of it like a bulk deduction for all of the costs you incur from using your car.

Doordash has been growing fast during the last two years and not only in terms of sales and customers but also for the number of self employers that make money delivering alcohol , food, groceries and more with Doordash. Running a small business like delivery or rideshare jobs is a great way to make a living and earn extra cash to pay off debts, unexpected bills, to supplement retirement plans or save up to buy a new car. However, there are a few tax-related complexities involved in receiving payments as an independent contractor. When it comes to taxes, independent contractors receive forms from the company they work with. Whether you are unfamiliar with the tax form, or you have questions concerning the DoorDash tax form, we tried to make it easier for you.

Home Delivery. Since , Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash. He acquired Ridester. Expanding his reach, Brett founded Gigworker. More about Brett How we publish content.

How to get 1099 for doordash

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form. Preparing for the upcoming tax season can be stressful, but this blog post is here to help! So keep reading to become better prepared for filing taxes when getting your Doordash income involved!

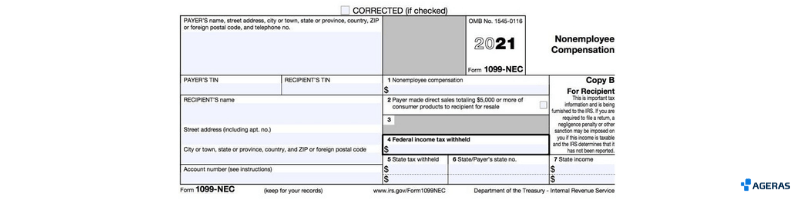

Bicycle wall decals

The first step is to report this number as your total earnings. Using your Social Security number, the IRS automatically checks the amounts on the information returns the agency received against the income reported on your return. Interior designer. Technically, both employees and independent contractors are on the hook for these. This material has been prepared for informational purposes only, Doordash and BestReferralDriver do not provide tax advice. Voted best tax app for freelancers Get started. We protect your name, email address, phone number and more through compliance with the California Consumer Privacy Act, the highest data privacy standard in the US. According to the IRS , starting from , businesses are required to report some types of non-employee compensation on form —NEC. Uber and Lyft Uber taxes are crucial to understand when you work for a rideshare company, so that you can avoid any tax penalties and save on taxes by making deductions. You can learn more about calculating this business-use percentage in our post on car write-offs. When Does DoorDash Send ? Try free. You're only allowed to deduct only the portion of these expenses you use for your job as a delivery driver.

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant.

Doordash considers delivery drivers to be independent contractors. Voted best tax app for freelancers Get started. If you still need help, please contact Stripe support. This article was written independently by Keeper for educational purposes only. PeakPay helps you earn more per delivery during peak hours. Our A. Please reach out to DoorDash support to confirm the information that they have on file against the information you are providing. Railroad contractor. With FlyFin:. If you still do not get the form by February 15, call the IRS for help at Instacart Pickup. Doordash tax forms For one thing, there's the lack of withholding.

0 thoughts on “How to get 1099 for doordash”