How to use rsi on tradingview

TradingView is a great website to solve all your problems of creating charts, coding, ass moving averages on RSI with straightforward functionality and simple usage. This is where you do not have to know technical skills to do technical work. This article will enlighten you on how the moving average can be added to RSI on TradingView without hassle, how to use rsi on tradingview. You can now go ahead to alter the settings of the RSI and the Moving Average if you did not do it earlier.

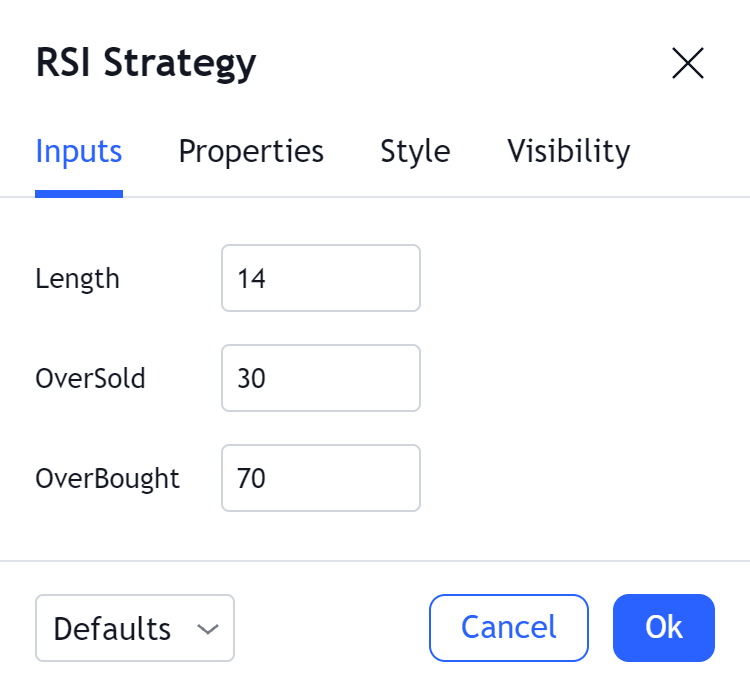

Our RSI-based trading strategy will seek reversals in the overbought and oversold zones. Our Long signal will be when the RSI exits the oversold zone. Our Short signal will be when the RSI exits the overbought zone. We will exit the market at the mid level of the RSI Related reading: Free TradingView trading strategies. TradingView is one of the most widely used technical analysis platforms today due to its easy and intuitive interface, great data visualization capabilities, and above all, it can be used completely free, although with some limitations.

How to use rsi on tradingview

This guide will walk you through the process of adding and customizing the RSI indicator on TradingView , a leading platform for market analysis. The RSI, developed by J. Welles Wilder, is a momentum-based oscillator that measures the speed and change of price movements. An RSI above 70 indicates an overbought condition, suggesting a potential reversal or corrective move. Conversely, an RSI below 30 indicates an oversold condition, suggesting a potential upward price movement. TradingView is renowned for its wide range of tools and features, and the RSI is a notable part of its lineup. TradingView lets you apply the RSI to price charts, enabling you to analyze market trends and generate trading signals. You can also explore other indicators that TradingView offers to enhance your market analysis with the Best TradingView Indicators. By default, each length is set at 14, which is commonly used. A longer length will account for more than 14 periods and give you data with a longer-term outlook. A shorter RSI length will give you data about only recent price movement. The RSI indicator will now be added to your chart, complete with its plot and values. TradingView offers a host of other tools beyond the RSI. The Fibonacci retracement is a technical analysis tool that can be used to identify potential support and resistance levels.

Next Continue. The calculation would look like this:. Currently, Igor works for several prop trading companies.

The Relative Strength Index RSI is a well versed momentum based oscillator which is used to measure the speed velocity as well as the change magnitude of directional price movements. Essentially RSI, when graphed, provides a visual mean to monitor both the current, as well as historical, strength and weakness of a particular market. The strength or weakness is based on closing prices over the duration of a specified trading period creating a reliable metric of price and momentum changes. Given the popularity of cash settled instruments stock indexes and leveraged financial products the entire field of derivatives ; RSI has proven to be a viable indicator of price movements. Welles Wilder Jr. A former Navy mechanic, Wilder would later go on to a career as a mechanical engineer. After a few years of trading commodities, Wilder focused his efforts on the study of technical analysis.

The Relative Strength Index RSI is a well versed momentum based oscillator which is used to measure the speed velocity as well as the change magnitude of directional price movements. Essentially RSI, when graphed, provides a visual mean to monitor both the current, as well as historical, strength and weakness of a particular market. The strength or weakness is based on closing prices over the duration of a specified trading period creating a reliable metric of price and momentum changes. Given the popularity of cash settled instruments stock indexes and leveraged financial products the entire field of derivatives ; RSI has proven to be a viable indicator of price movements. Welles Wilder Jr. A former Navy mechanic, Wilder would later go on to a career as a mechanical engineer. After a few years of trading commodities, Wilder focused his efforts on the study of technical analysis. Over the years, RSI has remained quite popular and is now seen as one of the core, essential tools used by technical analysts the world over.

How to use rsi on tradingview

Your computer does not have to be turned on for you to get alerts on your phone. Last updated: December 4, By Hugh Kimura. Traders have come up with creative and profitable ways to use this indicator and it's available on every trading platform. However, what's not available on every platform is the ability to get alerts when RSI hits signal levels.

Fanum streamer

To understand this better, we can use an example of a 1-hour time frame with the RSI fixated at 21 and a moving average of When used in proper its perspective, RSI has proven to be a core indicator and reliable metric of price, velocity and depth of market. Divergence generally works well with RSI. RSI is a very easy-to-use platform where you can work with various indicators to ease your work. The free sign-up can help you experience the best without losing out on anything significant in the beginning. Step 4: When you hover your mouse cursor on three dots you can see more options. You can use various indicators in TradingView to create the right trading strategy for intraday or positional-based long-term investment. The RSI is calculated using a mathematical formula that compares the magnitude of upward and downward movements over a specific period of time. Some of the market experts found the RSI as a useful indictor to know the positive and negative reversals. In fact, our opinion is that too many traders…. While in a new paradigm, you must begin the trade on 1M or max a 5M chart. If you have full access to the paid version of TradingView , you can apply RSI and other technical indicators with permission to modify the settings as per your trading strategy. When you use these divergences, a bullish divergence creates a buying opportunity, while a bearish divergence creates a selling opportunity for the traders. Moneysukh provides online trading software like Trade Radar where clients will get all the information with an integrated TradingView chart setup to perform the fundamental analysis and technical analysis and trade from here directly.

Our RSI-based trading strategy will seek reversals in the overbought and oversold zones. Our Long signal will be when the RSI exits the oversold zone. Our Short signal will be when the RSI exits the overbought zone.

The RSI indicator will now be added to your chart, complete with its plot and values. Best RSI Indicator Settings in TradingView As we have already told you the default setting of the RSI indicator is 14 days closing price of the stock or the market index with a simple moving average of 14 days and Bollinger band standard deviation of 2 to show the best indication on the TradingView chart. Skip to content. Mutual Funds. There is also an option to get the day moving average on the 4- and 1-hour categories. We can start by manually recognizing our trading rules on the chart using lines to mark the points where our buy and sell operations should be executed, and then begin using Pine Script to plot the results on our chart. Get Premium Research. However, the default setting for RSI is 14 day period with a day moving average and a 2-day standard deviation. Another thing related to setting a basic RSI might trouble you, and therefore, we would finally lay down the steps to set up an RSI easily on TradingView. What this means is that as an oscillator, this indicator operates within a band or a set range of numbers or parameters. I have written 4 books about trading in Norwegian.

0 thoughts on “How to use rsi on tradingview”