H&r block key code for previous years

Here in our Help Center, you have easy access to everything you need to know about how to finish your taxes. Feeling a little post-tax return uncertainty?

Filed and forgot it? In fact, as some life changes occur in your life, you may need proof of income, knowing how to get copies of old tax returns will come in handy. There are two methods to get past return transcripts a printout summary of the primary data on your tax return, including Adjusted Gross Income AGI , and one to get an actual copy of your return. Even better news, the IRS lets you obtain old tax information in a transcript free of charge. The next step in how to get previous tax returns is to determine what type of transcript you need.

H&r block key code for previous years

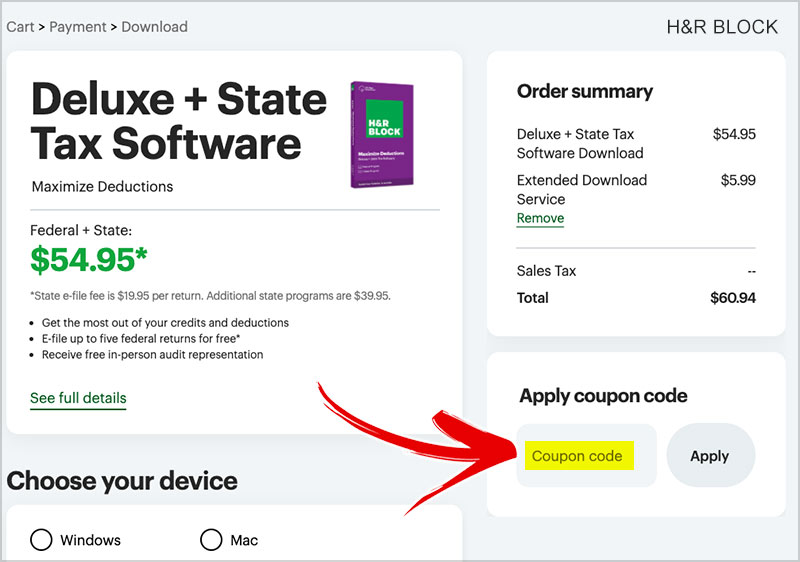

Valid at participating U. Discount may not be combined with any other offer or promotion. Coupon must be presented prior to completion of initial tax office interview. Privacy Policy. Save money doing your taxes this year. Tax help you need and the biggest possible refund, guaranteed. File personal taxes, small business taxes, and more. No code needed. Discount will auto apply. Limited time only. They might be able to stack with a pre-existing discount, but it will depend on the unique terms and conditions associated with it. Make sure to read all the information available to you in order to maximize your savings.

However, if you used our Free version to prep your taxes, you might have to pay to access old tax returns from your account. A new job or extra income can change your tax bracket.

.

Most people are required to file an IRS income tax return every year. For more significant cases, that means consequences and complications. In some cases of failing to file back tax returns, the IRS charges penalties and interest, holds refunds, or files a return for you without any credits or most deductions you may be eligible to claim. This is called a substitute for return or an SFR. Needless to say, learning how to file previous years taxes is important. Read on as we outline the ropes. Other tax situations might require you to file prior year taxes, especially if you owe any special taxes like these:.

H&r block key code for previous years

Wondering how to prepare to file taxes with software? Here in our Help Center, you have easy access to everything you need to know about how to finish your taxes. Feeling a little post-tax return uncertainty? Not to worry. We offer expert post-tax filing software help right here in Our Help Center, so you can complete the process like a pro. Create an account or login to pick up where you left off. Help Center Software While Filing. The Activation Code will be in the email you received when you bought your software. The code is usually sent in the purchase confirmation email. You can also check in your account on the website where you purchased the software.

Tally past tense

After You File Feeling a little post-tax return uncertainty? We offer expert post-tax filing software help right here in Our Help Center, so you can complete the process like a pro. Even better news, the IRS lets you obtain old tax information in a transcript free of charge. The Spruce mobile app can help you make the most of your tax refund. Some of the most popular ways to save are by taking advantage of free federal returns, discounted tax software, in-office preparation, and more. The next step in how to get previous tax returns is to determine what type of transcript you need. There are two methods to get past return transcripts a printout summary of the primary data on your tax return, including Adjusted Gross Income AGI , and one to get an actual copy of your return. Enter email address. Your total should update automatically. Questions about obtaining tax return copies? Make sure to read all the information available to you in order to maximize your savings. Save money doing your taxes this year. If you qualify, you should be able to find a package that fits within your budget. Before You File Wondering how to prepare to file taxes with software? You can reach a live support representative at an office near you or through the company's general toll-free telephone line,

.

The course itself is free, but you will have to pay for supplementary tools and books. Even better news, the IRS lets you obtain old tax information in a transcript free of charge. And, they come pretty quickly. Some of the most popular ways to save are by taking advantage of free federal returns, discounted tax software, in-office preparation, and more. Sign In Join. They might be able to stack with a pre-existing discount, but it will depend on the unique terms and conditions associated with it. The next step in how to get previous tax returns is to determine what type of transcript you need. We can help you learn more about filing changes. Tax brackets and rates A new job or extra income can change your tax bracket. Coupon must be presented prior to completion of initial tax office interview. Before You File Wondering how to prepare to file taxes with software? Yes, loved it. For example, the Tax Return Transcript provides the most line items, including your adjusted gross income.

I am final, I am sorry, but, in my opinion, there is other way of the decision of a question.

It seems excellent phrase to me is