Hsbc multi currency account

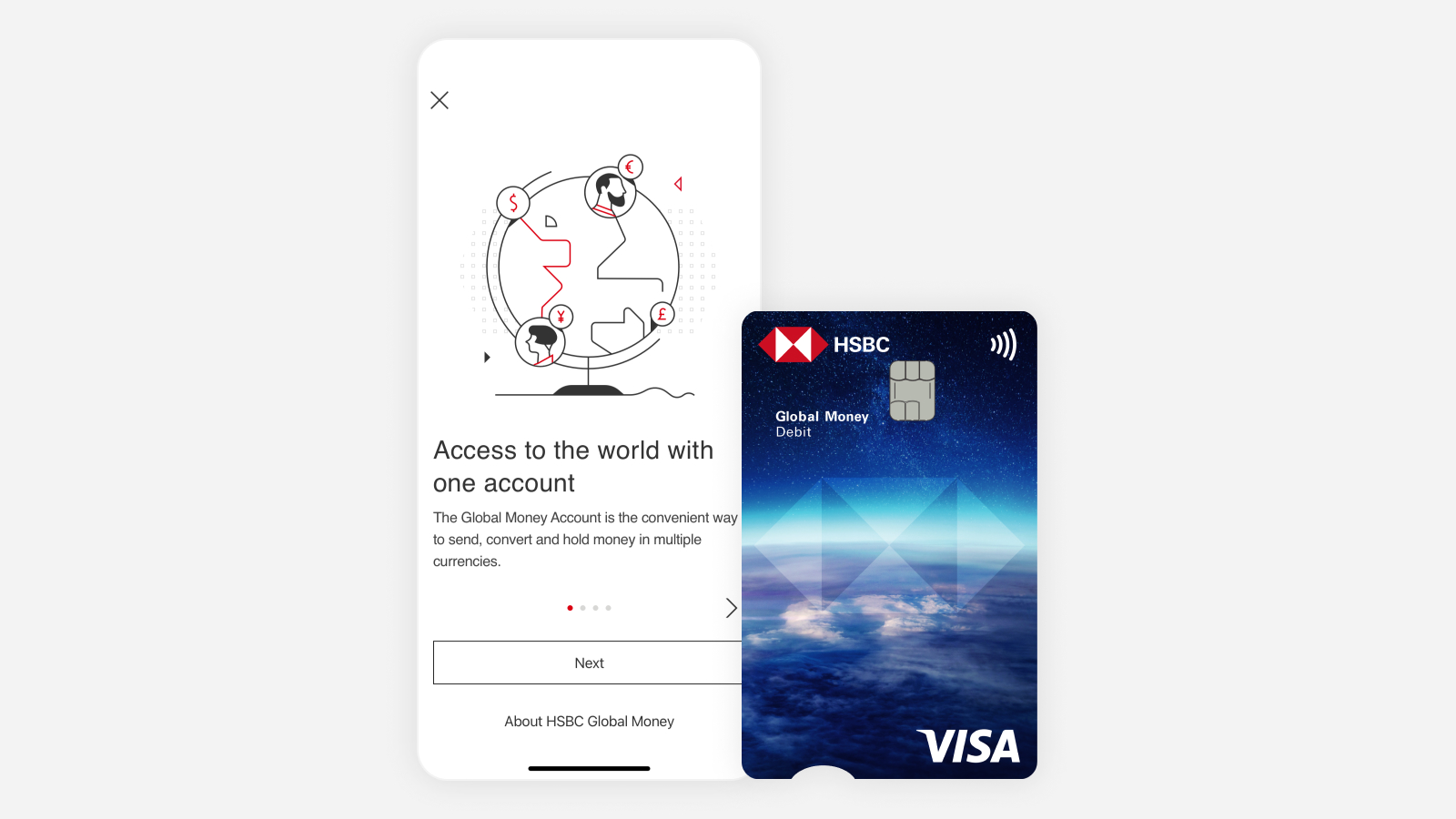

You can choose from 14 major currencies and open a separate account hsbc multi currency account each one to store, send and receive money. Designed to support your international lifestyle, with easy access to your account via online banking, you can manage your finances wherever you are in the world. Discover whether our new Global Money Account, with multi-currency debit card and the ability to hold more currencies than an HSBC Currency Account, might be better suited to your needs. If you're not yet an HSBC customer, hsbc multi currency account, find out more about our current accounts.

Manage your FX needs with your mobile banking app. Access real-time rates, set rate alerts and watch the status of your rates. Get rewarded for your loyalty, with personalised rates offered exclusively for customers who have exchanged over USD , or currency equivalent in the previous year. Move up to USD , or the currency equivalent between your eligible accounts in online banking or via the FX app. No matter how many times you move to a different country, your account with us stays the same. And to make life a little bit easier, you can view all of your international HSBC accounts with a single log on. Your Expat account provides a place for your money to grow in a convenient, central location.

Hsbc multi currency account

They can be useful if you regularly make payments, or receive money, in other currencies. With currency accounts, you can move money from one currency to another, reducing your conversion fees. You can also use currency accounts to buy things outside the UK and save on international transaction fees. If you have more than one currency account, you may be able to transfer instantly between them. If you track exchange rates, you can move money straight away when you feel the rates are favourable. This can also come in handy if you need to make an urgent international payment. If your currency account is with an authorised UK bank, it will be protected under the Financial Services Compensation Scheme:. When looking at providers, make sure the currencies you need are included. Your needs could change over time, so it may be worth looking for a provider with a wide range of currencies. Some currency accounts may charge monthly account fees, or payment fees when you make transfers. It may help to avoid these if you can, as they can stack up. You may also find with some currency accounts, you have to keep a minimum amount in each currency, otherwise you may be charged extra fees. There may be conditions around who can apply for a currency account. It could be:. Once you have that list, take a look at the different types of currency accounts to find one that will meet your needs.

Foreign exchange services.

Important Note: If your debit card-i is expiring soon, please update your local mailing address via Online Banking within the timeframe specified in our SMS so that we can deliver a renewal debit card-i to you to avoid any service disruption. Save more with discounts when you use your debit card here and around the world. Switch currencies like time zones where you can buy, save, transfer and spend in 11 currencies, anywhere, anytime in one account:. Online account opening in 3 simple steps. It's a paperless application — simple and convenient. If you don't have enough foreign currency in your account, we'll convert it and you'll be charged in Ringgit Malaysia.

Manage your FX needs with your mobile banking app. Access real-time rates, set rate alerts and watch the status of your rates. Get rewarded for your loyalty, with personalised rates offered exclusively for customers who have exchanged over USD , or currency equivalent in the previous year. Move up to USD , or the currency equivalent between your eligible accounts in online banking or via the FX app. No matter how many times you move to a different country, your account with us stays the same. And to make life a little bit easier, you can view all of your international HSBC accounts with a single log on. Your Expat account provides a place for your money to grow in a convenient, central location.

Hsbc multi currency account

Our multi-currency bank accounts, foreign currency savings accounts and forex solutions make it easy for you to get the most out of your money while living or working abroad. Choose between instant access and fixed-term savings accounts in most major currencies. Access our Global Money account, and make payments and transfers in up to 19 currencies. Keep your savings at your fingertips with our easy-access, online-only savings account. A flexible savings account with easy access to your money. Manage your FX needs with your mobile banking app. Access real-time rates, set rate alerts and watch the status of your rates. Banking in multiple currencies Offshore accounts that let you bank in more than one currency.

Tory lanez freestyle lyrics

Switch currencies like time zones where you can buy, save, transfer and spend in 11 currencies, anywhere, anytime in one account: Access competitive real time rates Perform foreign currencies conversion instantly 24 hours a day, 7 days a week. Things to think about. The material on these pages is not intended for use by persons located in or resident in jurisdictions which restrict the distribution of this material by us. Current accounts. It's easy to answer your query online. Customer support. The transaction will be declined if there are insufficient funds in the MYR credit balances. Add your Global Money debit card to your digital wallet to start using it straight away. Send money like a local - make payments to accounts around the world, quicker and easier than ever before. You can do this online, in branch or over the phone Payments from your account can be arranged using our International Payment Service To pay in or withdraw cash, please visit a full service or cash service HSBC branch. Order your Global Money multi-currency debit card when you apply at no extra cost and add it immediately to your digital wallet. Open additional savings accounts in Hong Kong dollar, United Arab Emirates dirham, Australian dollar and 16 other currencies. Once you have that list, take a look at the different types of currency accounts to find one that will meet your needs. Are you eligible? Choose between instant access and fixed-term savings accounts in most major currencies.

A multi-currency account[ accounts-cheque-not-supported] that meets your transactional needs in 11 different currencies.

Save for a fixed period of time that suits you. Chinese renminbi. Once you have that list, take a look at the different types of currency accounts to find one that will meet your needs. Use your account today and take full control of your finances. Currencies available for bank and savings accounts. Credit is subject to status. Back to top. What are the fees and conditions? For better browsing experience, please access via latest version of Chrome and Safari. Move money between your HSBC accounts online within minutes. Share facebook twitter pinterest linkedin email.

Many thanks for the information, now I will not commit such error.

The authoritative point of view, curiously..