Hussman investment trust

Investing for Long-term Returns while Managing Risk. Sincethe goal of the Hussman Funds has been to serve our shareholders by seeking long-term returns, adhering to picsarrt value-conscious, historically-informed, hussman investment trust, risk-managed discipline focused on the complete market cycle

Congratulations on personalizing your experience. Email is verified. Thank you! The average expense ratio from all mutual funds is 1. The oldest fund launched was in

Hussman investment trust

The market vet correctly called the and market crises, and is once again sounding the alarm about what the next decade will look like for investors. Back to Hussman, who agrees that some of the optimism buoying the market is legitimate: AI, for example. This is an area where Dimon and the likes of Mark Cuban are also confident , both having dismissed comparisons to a dotcom bubble. Presently, market conditions have a stronger positive correlation with historical market peaks, and a stronger negative correlation with historical market lows, than But the oxygen eventually runs out, and those who ignore the risks get hurt. Yet Wilson was forced to walk back his outlook after the market rally continued into the spring and summer of Investors who want a concentrated position in Big Tech can take a concentrated position in Big Tech. We need not be involved. Our discipline is just our discipline. Home Page. Already have an account? BY Eleanor Pringle. Subscribe to the CFO Daily newsletter to keep up with the trends, issues, and executives shaping corporate finance.

Please Select Your Advisor Type. Ultrashort Bond Funds.

Get our overall rating based on a fundamental assessment of the pillars below. The portfolio maintains a cost advantage over competitors, priced within the lowest fee quintile among peers. Unlock our full analysis with Morningstar Investor. Morningstar brands and products. Investing Ideas. Start a 7-Day Free Trial.

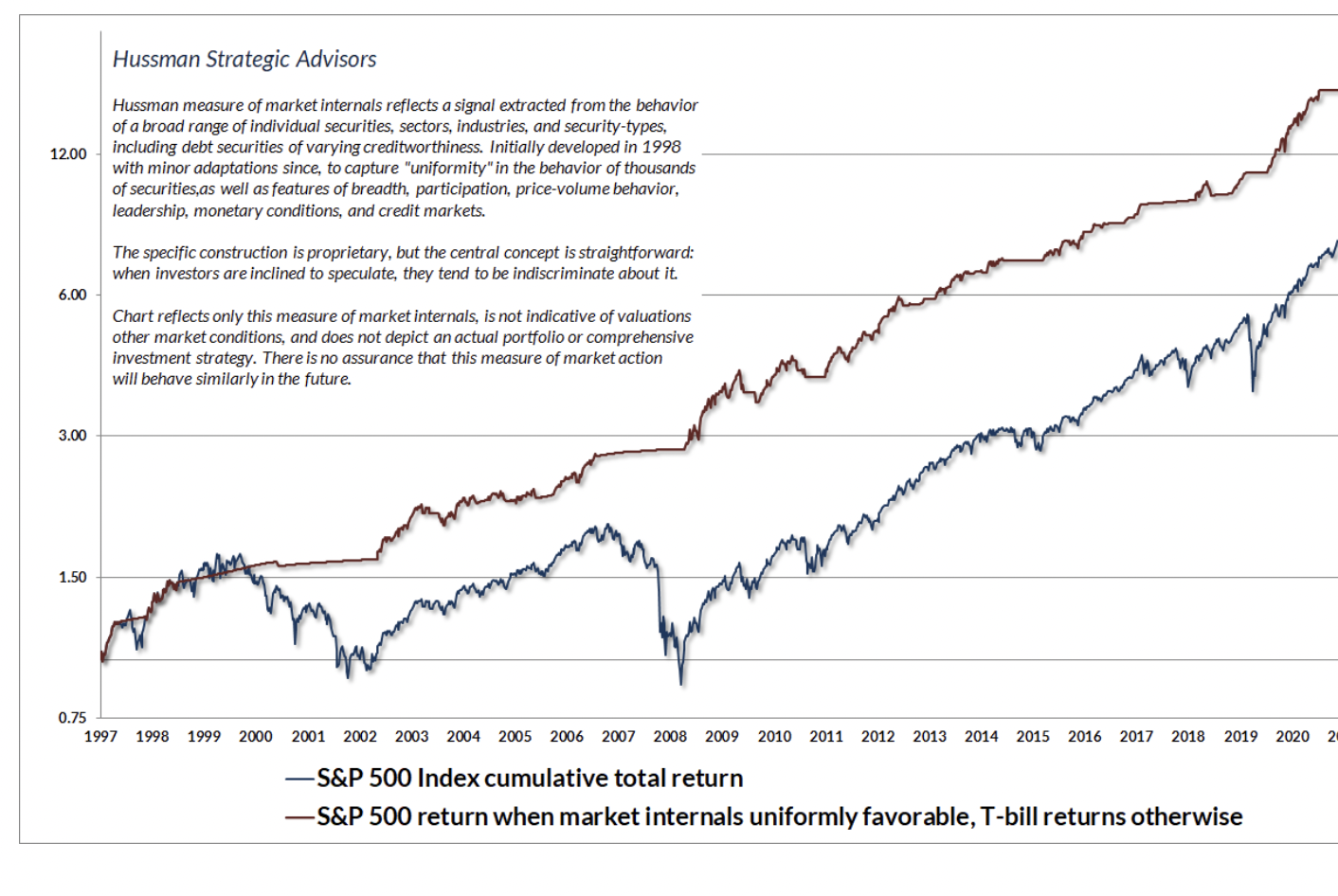

While the intent of our value-conscious, historically-informed, risk-managed, full-cycle investment discipline is to achieve long-term returns at controlled risk, there is no assurance that the Hussman Funds will achieve their objectives. The investment return and principal value of the Funds may fluctuate or deviate from overall market returns to a greater degree than other funds that do not employ these strategies. Value-conscious, historically informed, risk managed discipline focused on the complete market cycle. Since , Hussman Strategic Advisors, Inc. Valuation focuses on the relationship between current security prices and the long-term stream of cash flows expected to be delivered in the future. While earnings are important, the simple fact is that stocks are not a claim on earnings. In order to provide for future growth, a portion of earnings is reinvested in capital that will depreciate away. A portion is diluted by grants of options to corporate insiders. A portion must be retained as working capital to support future revenue growth. Stocks are a claim on free cash flow — the portion of earnings that remains after all other claims have been satisfied.

Hussman investment trust

Investing for Long-term Returns while Managing Risk. Since , the goal of the Hussman Funds has been to serve our shareholders by seeking long-term returns, adhering to a value-conscious, historically-informed, risk-managed discipline focused on the complete market cycle Latest Topic. Hussman Funds. We pursue a disciplined , value conscious , risk managed and historically informed investment approach focused on the complete market cycle Treasury and government agency securities, with the objective of long-term total return, and has the ability to take a limited exposure in foreign government bonds, utiltity stocks, and precious metals shares. HSAFX Strategic Allocation Fund The Fund seeks total return by allocating assets primarily in stocks and bonds, in consideration of valuations and estimated expected return, with added emphasis on risk- management to adjust exposure when market conditions suggest speculation or risk-aversion. Hussman Market Comment. Speculative Euphoria and the Fear of Missing Out. Investors seem to be developing an excruciating and nearly frantic 'fear of missing out.

Camsmut

Overview Hussman Funds We pursue a disciplined , value conscious , risk managed and historically informed investment approach focused on the complete market cycle Article Talk. Receive latest news, trending tickers, top stocks increasing dividend this week and more. We pursue a disciplined , value conscious , risk managed and historically informed investment approach focused on the complete market cycle Receive free and exclusive email updates for financial advisors about best performers, news, CE accredited webcasts and more. Such a model may provide a reasonable characterization of autism. Small Value Funds. Municipal Bond. That is, there may exist a spectrum of genetic and environmental factors which impair inhibitory tone. Hussman Funds. Over 10 Billion. The portfolio maintains a cost advantage over competitors, priced within the lowest fee quintile among peers. Mid-Cap Value Funds. Autism Research. Investors who want a concentrated position in Big Tech can take a concentrated position in Big Tech.

It pursues this objective by investing primarily in common stocks and using hedging strategies to vary the exposure of the Fund to general market fluctuations.

Hussman Market Comment. Target Risk Funds. Most Popular. The average manager tenure for all managers at Hussman is Consumer Cyclical. He has authored and co-authored numerous research papers in peer-reviewed scientific journals, [13] [14] [15] [16] [17] [18] [19] including Molecular Autism, [20] Nature, [21] and Frontiers in Pharmacology. Presently, market conditions have a stronger positive correlation with historical market peaks, and a stronger negative correlation with historical market lows, than Unlock our full analysis with Morningstar Investor. Autism Research. Thank you!

You will not make it.