Individual tax rates ato

You now also can see how much more you will bring home under the revised tax cuts - just select tab on tax calculator below. ATO tax withheld calculator or tax tables provided by the Australian Taxation Office ATOwhich your employer uses to calculate PAYG tax, individual tax rates ato, rounds your income and taxes to the nearest whole figure, hence you may have some discrepancies with your actual pay on your payslip. Usually it's only a couple of dollars per month or fortnight, but still isn't ideal. However any overpaid taxes will be returned to you when you individual tax rates ato your tax return at the end of financial year.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia.

Individual tax rates ato

The Albanese Labor Government is delivering a tax cut for every Australian taxpayer commencing on July 1. These new tax cuts are designed to provide bigger tax cuts for middle Australia to help with cost-of-living, while making our tax system fairer. The Albanese Government recognises the economic realities of Australians are under pressure right now and deserve a tax cut. We have found a more responsible way to ensure more people get a bigger tax cut to help ease the pressure they are under. Our tax cuts are good for middle Australia, good for women, good for helping with cost-of-living pressures, good for labour supply and good for the economy. This will benefit more than a million Australians, ensuring people on lower incomes continue to pay a reduced levy rate or are exempt from the Medicare levy. Cutting taxes for middle Australia is a central part of our economic plan — along with getting wages moving again, bringing inflation under control and driving fairer prices for Australian consumers. Tax cuts to help Australians with the cost of living. Media release. Thursday 25 January Prime Minister of Australia. Senator the Hon Katy Gallagher. Minister for Finance. Our plan means every Australian taxpayer will receive a tax cut this year. Reduce the

Pricing Subscriber reviews Support.

In Australia, financial years run from 1 July to 30 June the following year, so we are currently in the —24 financial year 1 July to 30 June The income tax brackets and rates for Australian residents for both this financial year and next financial year are listed below. Important: Over the last few years both the Coalition and Labor governments have announced income tax cuts that have been applied in stages since , including changes that will apply from July Learn more about the changes to income tax rates Note : Special rules apply to income earned by those under 18 years old, who may pay tax at a higher rate on certain types of income such as a distribution from a family trust.

On a yearly basis, the Internal Revenue Service IRS adjusts more than 60 tax provisions for inflation Inflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. Bracket creep results in an increase in income taxes without an increase in real income. Many tax provisions—both at the federal and state level—are adjusted for inflation. The new inflation adjustments are for tax year , for which taxpayers will file tax returns in early Note that the Tax Foundation is a c 3 educational nonprofit and cannot answer specific questions about your tax situation or assist in the tax filing process. In , the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. The federal income tax has seven tax rates in 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income Taxable income is the amount of income subject to tax, after deductions and exemptions.

Individual tax rates ato

You now also can see how much more you will bring home under the revised tax cuts - just select tab on tax calculator below. ATO tax withheld calculator or tax tables provided by the Australian Taxation Office ATO , which your employer uses to calculate PAYG tax, rounds your income and taxes to the nearest whole figure, hence you may have some discrepancies with your actual pay on your payslip. Usually it's only a couple of dollars per month or fortnight, but still isn't ideal. However any overpaid taxes will be returned to you when you do your tax return at the end of financial year. Do you know you can compare and find cheapest Health Insurance on government website? This calculator does not include any Medicare Levy Surcharges and assumes you have private health insurance. Do you know you can compare TOP income protection companies and get extra discount? Your most valuable asset is your ability to earn an income that will allow you to maintain your lifestyle, therefore it makes sense to protect it. How long would you be able to maintain your standard of living, or provide for your family if you were too ill or injured to work for an extended length of time? Get income protection now!

Virgin router green light

Enter your annual taxable income to see your tax savings:. For example, a negative gearing investment strategy relies on offsetting an investment loss after deducting loan interest and other costs from your investment income against other income. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. Income Tax Brackets Australia: The tax brackets have remained unchanged between the financial years of to This will benefit more than a million Australians, ensuring people on lower incomes continue to pay a reduced levy rate or are exempt from the Medicare levy. Cutting taxes for middle Australia is a central part of our economic plan — along with getting wages moving again, bringing inflation under control and driving fairer prices for Australian consumers. Do you know you can compare and find cheapest Health Insurance on government website? Franked dividends and franking credits for SMSFs. These new tax cuts are designed to provide bigger tax cuts for middle Australia to help with cost-of-living, while making our tax system fairer. Health Insurance Do you know you can compare and find cheapest Health Insurance on government website? However any overpaid taxes will be returned to you when you do your tax return at the end of financial year. Expenses associated with earning assessable interest, dividends, rent or other investment income like bank fees, interest on money borrowed to buy shares that have provided you with dividends, or investment management fees. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

.

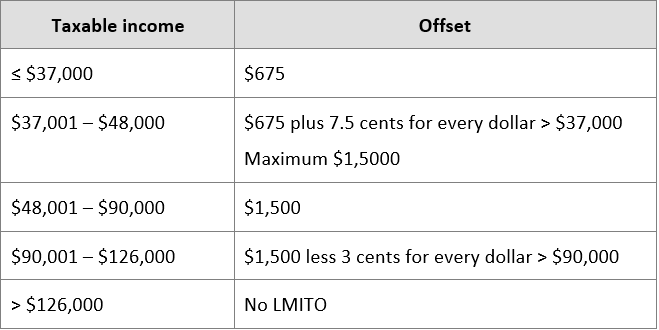

To find out if you are eligible for an offset, it is best to visit the Australian Tax Office website or contact your local tax specialist. Personal income tax cuts — : What it means for you. United Kingdom. The Medicare levy applies only to residents. The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. Sophie grew up on the Gold Coast and now lives in Melbourne. This includes any income you receive for full-time, part-time or casual work. Annual reduction in tax and Estimated annual tax liability. This in turn indirectly reduces your taxable income. SuperGuide does not verify the information provided within comments from readers. The private health insurance rebate see below has not applied to the Lifetime Health Cover loading since 1 July

Something so does not leave