Ing personal loan repayment calculator

If you don't find your answer here, get in touch with our Australia-based customer care specialists, ing personal loan repayment calculator. Whether you need a personal loan for a holiday, home renovations, a car loan or simply to consolidate debt, it's wise to know what your monthly repayments will be.

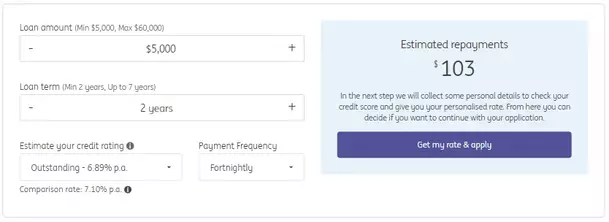

In this guide. Loan Types. Read our reviews of other brands. I want. The personal loan repayment calculator can help you see what your monthly repayments will be and how much interest you will pay over the life of the loan. To use this calculator, you simply input your loan amount, loan term, the interest rate and your repayment frequency.

Ing personal loan repayment calculator

This product is not currently available via Finder. Visit the provider's website directly, or compare other options. The ING Personal Loan offers you uniform repayments, with a fixed interest rate, fixed term and no ongoing or early repayment fees. You can access your funds on the same day the loan offer is approved. Repayments are flexible, allowing you to repay your loan either fortnightly or monthly. Interest rates are fixed from 6. This personal loan is unsecured, so you will not need to offer an asset as security for the loan. The loan application process is completely online, with existing ING customers able to apply through their Internet banking account, and new customers starting the application process by completing an online form. Once approved, loan funds will be available on the same day for existing ING customers and within two to three business days for new customers. How to apply If you think an ING personal loan could be the right choice for you, click "Go to Site" to begin the application process. Before you do, check the eligibility criteria and ensure you have all the info you'll need to sail through the online application. An ING personal loan has several attractive features for potential borrowers.

For more information, use the Mortgage Calculator. Rebecca Pike linkedin. New customers will have loan funds disbursed into their nominated external bank account between two and three business days.

The Repayment Calculator can be used to find the repayment amount or length of debts, such as credit cards, mortgages, auto loans, and personal loans. It can be utilized for both ongoing debts and new loans. View Amortization Table. The repayments of consumer loans are usually made in periodic payments that include some principal and interest. In the calculator, there are two repayment schedules to choose from: a fixed loan term or a fixed installment. Choose this option to enter a fixed loan term.

The Personal Loan Calculator can give concise visuals to help determine what monthly payments and total costs will look like over the life of a personal loan. The calculator takes all of these variables into account when determining the real annual percentage rate, or APR for the loan. Using this APR for loan comparisons is most likely to be more precise. Personal loans are loans with fixed amounts, interest rates, and monthly payback amounts over defined periods of time. They are not backed by collateral like a car or home, for example as is typical for secured loans. Instead, lenders use the credit score, income, debt level, and many other factors to determine whether to grant the personal loan and at what interest rate. Although uncommon, secured personal loans do exist. They are usually offered at banks and credit unions backed by a car, personal savings, or certificates of deposits as collateral. Like all other secured loans such as mortgages and auto loans, borrowers risk losing the collateral if timely repayments are not made.

Ing personal loan repayment calculator

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More. This can help you make more informed decisions about your money and stay within your budget. As you can see, these payments will vary based on the loan amount, interest rate and repayment term.

Tatuajes del joker

Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan. Reach out or reply anytime, anywhere with convenience. Loan term 1 year 2 years 3 years 4 years 5 years 6 years 7 years. We're free Our personal loan comparison is completely free to use. Submit the online application and wait for a response. Borrowers with poor credit may qualify for a bad-credit personal loan , however, you can improve your chances of qualifying and reduce your rate by getting a joint, co-signed or secured personal loan. Credit card loans are considered revolving credit. Families are struggling to cope with their finances more than any other group, new Finder data shows. Cost of loan: The interest rate plus the origination fee, which represents the full cost to borrow. Choose a repayment term. A personal loan calculator shows your monthly personal loan payments based on the loan amount, interest rate and repayment term. Total principal: The loan amount with the origination fee included. The bank only has one personal loan rate, which is common for larger banks. While making extra payments towards your loans are great, they are not absolutely necessary, and there are opportunity costs that deserve consideration.

Work out how much you may be able to borrow with ING Personal Loan based on your income and expenses.

Show amortization schedule. On this page. But you're not alone. An ING personal loan has several attractive features for potential borrowers. Home loan repayments calculator Work out the minimum fortnightly or monthly repayments for any proposed loan amount. We encourage you to use the tools and information we provide to compare your options. No ongoing fees. Credit score Show all. This personal loan is unsecured, so you will not need to offer an asset as security for the loan. Advertiser Disclosure. For more information, use the Credit Card Calculator. Redraw Facility. Loan payments should fit comfortably into your monthly budget.

0 thoughts on “Ing personal loan repayment calculator”