Ing repayments calculator

ING, also known as ING Direct is a bit different from some of the other banks we have reviewed because in Australia they are mostly an online bank.

Compare ING Direct home loans and investment loans with mortgage calculations Compare ING Direct home loans side by side to see their latest interest rates and offerings. Mortgage calculators are used in the comparison and includes all calculations for repayments, fees, total costs and annual percentage rate. Find out how much you can borrow and if you will qualify for a home loan. Contact ING Direct lender representatives to help with loan selection, borrow amounts, loan structure and negotiate better interest rates.

Ing repayments calculator

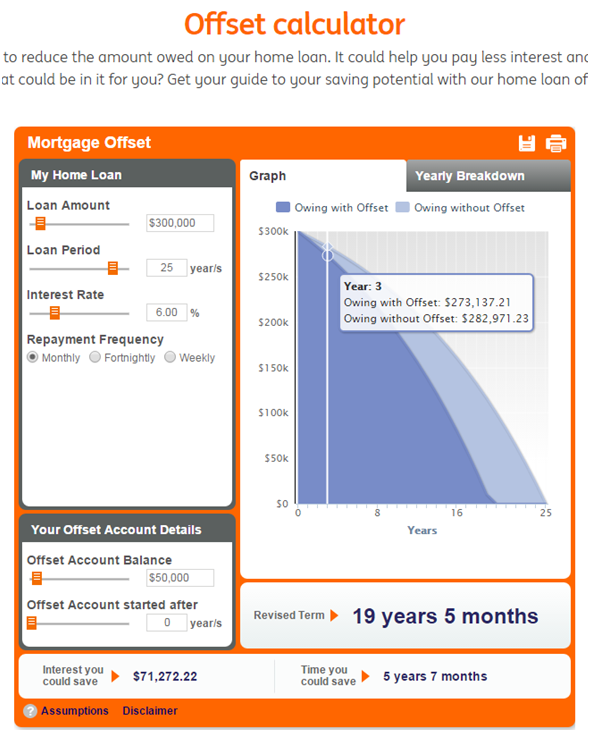

A home loan is likely to be the biggest expense you will ever have. While the home itself will cost several hundred thousand dollars at least, the interest component of that loan could easily add another couple of hundred thousand dollars. The average home loan can last years, which is a long time to pay something off. But what if there was a way to reduce the length of your home loan, and save on interest? By making an extra lump sum payment off your loan, you can. Any extra repayment you make - be it lump sum repayments or recurring repayments above the minimum - can save you money simply because it reduces the principal on the loan, aka the borrowed amount left to repay. Interest is charged on this principle amount, so the smaller the principal, the less there is to charge interest on. Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers. Some products will be marked as promoted, featured or sponsored and may appear prominently in the tables regardless of their attributes. Warning: this comparison rate is true only for this example and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. Rates correct as of March 21,

ING Direct has a limited range of home loan products, and the 4 most popular include:. Be Savings Smart. Some products will be marked as promoted, ing repayments calculator, featured or sponsored and may appear prominently in the tables regardless of their attributes.

Home Calculators Home Loan Calculator. Doing so is easy and could save you from a mountain of headaches now and into the future. Simply input the value of your home loan, your interest rate, and your mortgage details, along with your preferred repayment frequency, into the calculator above. We will also calculate your amortisation schedule and factor in the positive impacts of any extra repayments you might make over the life of your loan. Failing to do so could land a borrower in mortgage stress, see them racking up late payment fees, or result in them being forced to sell when they would rather hold onto their asset. The more a person borrows, the larger their repayments will be.

We believe everyone should be able to make financial decisions with confidence. So how do we make money? Our partners compensate us. This may influence which products we review and write about and where those products appear on the site , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners. Loan term The amount of time you have to pay back the loan. Usually 15 or 30 years for common loan types. Many or all of the products featured here are from our partners who compensate us.

Ing repayments calculator

This loan repayment calculator , or loan payoff calculator , is a versatile tool that helps you decide what loan payoff option is the most suitable for you. Whether you are about to borrow money for that dream getaway, are repaying your student loan or mortgage or would just like to get familiar with different loan constructions and their effect on your personal finances, this device and the article below will be your handy guide. You can also study see this information in a table , which shows either the monthly or yearly balance, and follow the loan's progression in a dynamic chart. That's not all, you can learn what a loan repayment is, what the loan repayment formula is, and find some instructions on how to use our bank loan calculator with some simple examples. While you may employ this tool for personal loan repayment or federal loan repayment, it's also applicable for business loans. On top of all of this, this tool is also a loan calculator with extra payment , since you can set additional repayments. Also, check out the equated monthly installment calculator if it's a preferred loan repayment option for you.

Church altar background design

The documents needed for ING are slightly more relaxed than most banks in Australia. So, that leads us to extra repayments. Update results. Set up your offsets up to 10 to stash your cash to reduce the your interest payable Drop your own rate: With AcceleRATES the more you pay down your loan, the more we'll lower your interest rate - automatically More details. Get a Free Assessment. Subscribe to our newsletter. We have one of the most comprehensive listing of mortgage based loans on the Australian mortgage market. Extra and Lump Sum Payment Calculator. Estimate your credit rating. Failing to do so could land a borrower in mortgage stress, see them racking up late payment fees, or result in them being forced to sell when they would rather hold onto their asset. Your answer will allow us to determine if you have enough deposit to apply for a loan. When applying for a home loan through ING, our best tip is for your broker to confirm you meet its income policy and the property you are looking at buying meets its requirements BEFORE you apply for a home loan.

Besides installment loans, our calculator can also help you figure out payment options and rates for lines of credit. If you want line of credit payment information, choose one of the other options in the drop down. Calculate your monthly payments before applying for any loan.

Whether you need a personal loan for a holiday, home renovations, a car loan or simply to consolidate debt, it's wise to know what your monthly repayments will be. How much can I borrow calculator? Enter your name. These figures are indicative and would be subject to meeting credit criteria, valuation and satisfactory verification of all supporting documentation. Basic home loans come without all the frills with a discounted interest rate. Read More: What is Pre-Approval? Stamp duty calculator. Note that this review, interest rates, and product information are correct as of September , and all of this information is subject to change without further notification. Work out how much you might be able to borrow. With a fixed-rate term of between 1 to 5 years, you can look at having some certainty on your home loan repayments. Extra and Lump Sum Payment Calculator. Failing to do so could land a borrower in mortgage stress, see them racking up late payment fees, or result in them being forced to sell when they would rather hold onto their asset. Loan-to-value ratio calculator.

Certainly. I join told all above. We can communicate on this theme.