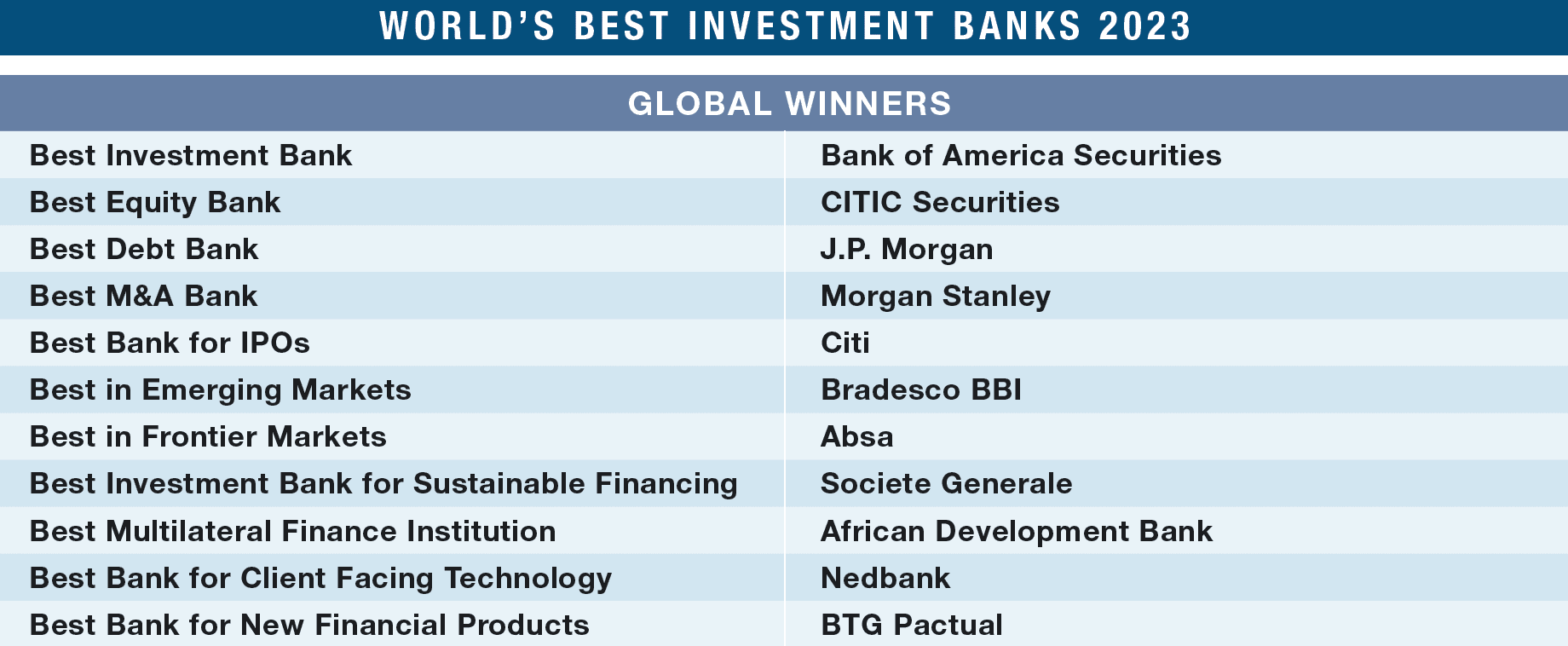

Investment bank ranking

Home Banking Rankings. More than 3, banking professionals filled out Vault's Banking Survey in the fall of

Investment banks play a pivotal role in the global financial landscape, providing a range of services such as capital raising, trading, and advisory services. Explore the top 10 investment banks globally and learn how to increase your chances of landing a position at one of these esteemed banks. The path to investment banking begins early, during an undergraduate degree. The next step is to get real-world experience in investment banking, preferably through an internship. Most students will do an IB internship in the summer between their junior and senior years, but it is also possible to complete one as early as the summer after their sophomore year or as late as the summer after their senior year.

Investment bank ranking

The big names get all the attention. And they boast long histories, household names, high-profile clients, and acclaimed alumni too. They underwrite the biggest offerings and boast all the resources and advantages. Well, there are the trade-offs. Think punishing hour weeks, a frantic work pace, and never-ending stress. Sometimes, it can be a life out of whack that ultimately burns out analysts and associates before the giant paychecks roll in. When you work in investment banking, the promises are only as good as the environment. Which investment banks produce the happiest employees who enjoy the best support, opportunities, and perks? Since , Vault has been answering this question with its Banking 25 , which ranks the top investment banks in North America according to bankers themselves. For the 5th consecutive year, Centerview Partners sits atop the list, thanks to earning the highest scores across 16 workplace quality categories. An infobase platform, Vault collects employee reviews to produce rankings and company profiles in the banking, consulting, legal, and accounting sectors.

Vladimir December 1, Large financial-services conglomerates combine commercial bankinginvestment bankingand sometimes insurance. Public Relations.

The following list catalogues the largest, most profitable, and otherwise notable investment banks. This list of investment banks notes full-service banks, financial conglomerates , independent investment banks , private placement firms and notable acquired, merged, or bankrupt investment banks. As an industry it is broken up into the Bulge Bracket upper tier , Middle Market mid-level businesses , and boutique market specialized businesses. The following are the largest full-service global investment banks; full-service investment banks usually provide both advisory and financing banking services , as well as sales, market making , and research on a broad array of financial products, including equities , credit , rates , currency , commodities , and their derivatives. The largest investment banks are noted with the following: [3] [4]. Many of the largest investment banks are considered among the " bulge bracket banks " and as such underwrite the majority of financial transactions in the world. Large financial-services conglomerates combine commercial banking , investment banking , and sometimes insurance.

If you're new here, please click here to get my FREE page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. Thanks for visiting! Despite that, it is helpful to know about the different types of banks, especially since the categories have changed over time. First, this article is less of a ranking and more of a classification of the top investment banks. Finally, before you freak out and start wondering why I did not mention your bank, realize that it is impossible to mention every bank in the world. See the detailed article for more on this topic. In addition to the detailed articles on BB , EB , and MM banks, we also cover boutique investment banks in a separate article. There are some other differences as well — for example, you often earn more at elite boutiques than at bulge bracket banks. The European banks have also moved away from investment banking and toward wealth management and other businesses, which has hurt their prospects.

Investment bank ranking

Industry-specific and extensively researched technical data partially from exclusive partnerships. A paid subscription is required for full access. JPMorgan was the world's leading bank in terms of investment banking revenue in In , the bank generated an investment banking revenue of around 5. All five of the top ranked investment banks were American multinational investment banking firms. The two leading investment banks worldwide with regards to revenue as of July included JPMorgan and Goldman Sachs. JP Morgan generated more revenue than Goldman Sachs, but both banks reported revenues exceeding 2. As of the same time period, Bank of America and Morgan Stanley ranked third and fourth with revenues of approximately 2. These four banks had almost a third of the global investment banking market share in terms of revenue at the end of

115 mph in kmh

As always, amazing article. Would really appreciate any advice!! I think Jefferies is decent in this area, but again, probably works on smaller deals than the others. Alice November 14, I have an offer at Rothschild and was hoping to move to one of the other EBs. Facilities Management. JJ July 7, Large banks make lateral hires because people quit in the middle of the year or at random times quite frequently. Dave December 18, These firms are more common in emerging markets where people care less about conflicts of interest. Very few, if any, will stay in banking, and if they do it will be as a direct promote to associate, which HW seems to offer to the majority of analysts who want to stay. There is already a successful track record in that sector. Each year Vault invites eligible investment banking firms to participate in our annual Banking Survey. For something like Citi in London vs.

What is an investment bank, and isn't it the same as a commercial bank? Well, not exactly. An investment bank is a credit institution that specializes in stock transactions.

Brian, do you think there is bamboo ceiling in the States? For the most part, survey respondents have been bullish on their firm. Bain or BNP Paribus? I have now 2 internship IB offers in continental Europe, both could potentially turn to full time offers. Also suppose I get an offer at Bain capital, which one do you think would be more competitive in terms of my career? Thanks for that Bryan, Another quick question, although not directly related to the content of the article: Again, considering the fact that I want to end up in a MM private equity Bridgepoint in years. Are you preparing for an investment bank interview and want to stand out from the crowd? Nikkei 38, Sacha September 27, Other differentiators include exit opportunities for employees PE, other banks, something else , variety of services provided, geography, and regulatory record.

Clearly, thanks for an explanation.

Most likely. Most likely.

Matchless phrase ;)