Ishares $ floating rate bond ucits etf

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation.

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here.

Ishares $ floating rate bond ucits etf

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more. This fund does not seek to follow a sustainable, impact or ESG investment strategy. For more information regarding the fund's investment strategy, please see the fund's prospectus. Learn what the metric means, how it is calculated, and about the assumptions and limitations for this forward-looking climate-related metric. To address climate change, many of the world's major countries have signed the Paris Agreement. The ITR metric is used to provide an indication of alignment to the temperature goal of the Paris Agreement for a company or a portfolio. ITR employs open source 1.

Investments in securities are subject to market and other risks. Learn what the metric means, how it is calculated, and about the assumptions and limitations for this forward-looking climate-related metric.

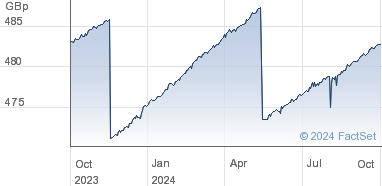

BlackRock Portfolio Centre. The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 6 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past.

Ishares $ floating rate bond ucits etf

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

Trivela nasıl vurulur

None of these companies make any representation regarding the advisability of investing in the Funds. The price of the investments may go up or down and the investor may not get back the amount invested. Engagement also allows the portfolio management team to provide feedback on company practices and disclosures. Replication details. Show More Show Less. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. The above table summarises the lending data available for the fund. Collateral Holdings shown on this page are provided on days where the fund participating in securities lending had an open loan. Professional investor. Per cent of portfolio in top 5 holdings: 6. Where required by local country-level regulations, funds may state explicit data coverage levels. We recommend you seek independent professional advice prior to investing. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. Market Insights. Current performance may be lower or higher than the performance quoted.

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics.

Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. At present, availability of input data varies across asset classes and markets. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Any ESG rating or analyses applied by the index provider will apply only to the derivatives relating to individual issuers used by the Fund. However, there is no guarantee that these estimates will be reached. This chart shows the fund's performance as the percentage loss or gain per year over the last 5 years. Testing missing data Missing average annual returns data. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. Literature Literature. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Rebalance Frequency Monthly. The amounts shown above are as of the current prospectus, but may not include extraordinary expenses incurred by the Fund over the past fiscal year. As a result, in certain cases we rely on estimated or proxy measures from data providers to cover our broad investible universe of issuers. Corporate About us.

You commit an error. I can prove it. Write to me in PM.

Your idea simply excellent

What amusing question