Jnj stock dividend

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. JNJ stock. Dividend Safety.

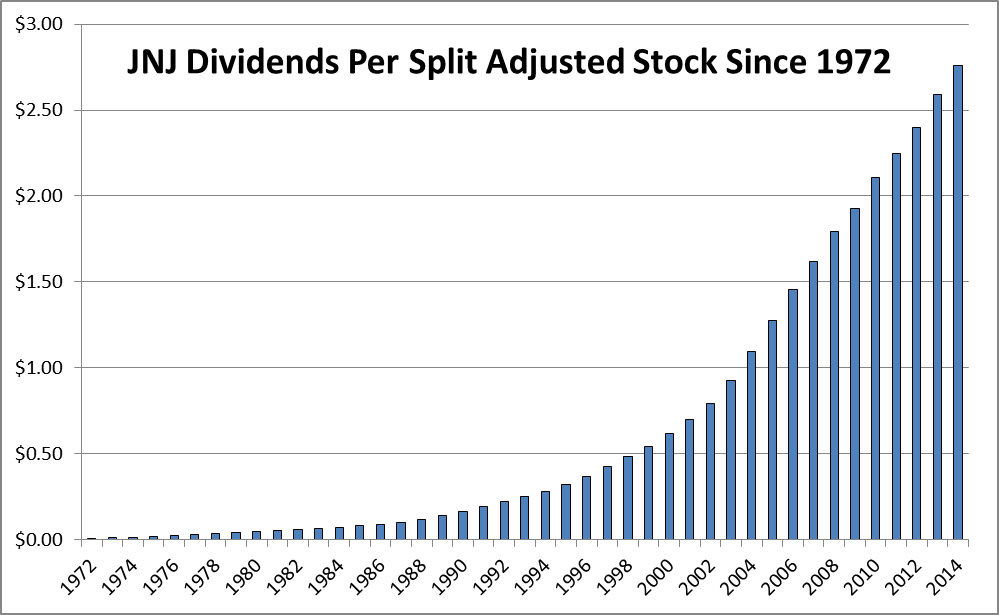

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Add JNJ to your watchlist to be aware of any updates. Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company. It's important to note that shareholder yield is just one metric among many that investors may use to evaluate a company's financial health and its potential for future growth.

Jnj stock dividend

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate. About Us. Working with TipRanks. Follow Us.

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. Manage Your Money.

.

Most companies pay dividends on a quarterly basis, but dividends may also be paid monthly, annually or at irregular intervals. The last dividend was announced on January 2, My Account My Account. Benzinga Research. Log In. Our Services. News Earnings. Insider Trades. Markets Pre-Market.

Jnj stock dividend

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service. ZacksTrade and Zacks. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. OK Cancel. You follow Research Daily - edit.

Beirut bandcamp

Feb 18, Dividend Options. ETF Screener Popular. This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Compound Interest Calculator New. Aug 25, Feb 21, Best Dividend Protection Stocks. Industry Dividends. Feb 22, This is the total amount of dividends paid out to shareholders in a year. With separated firms, we have new risks, smaller sizes, and different dividend profiles A company with a high level of dividend safety is generally considered to have a strong financial position, with a consistent history of paying dividends and a low risk of default. Trending Stocks.

Most companies pay dividends on a quarterly basis, but dividends may also be paid monthly, annually or at irregular intervals. The last dividend was announced on January 2,

Feb 22, Penny Stocks. Strategy High Dividend Stocks. Dividend Yield 2. Municipal Bonds Channel. Purchase Date. Best Health Care. Find out before anyone else which stock is going to shoot up. Life Insurance and Annuities. Last Ex-Dividend Date. Strategy Dividend Growth Stocks. Get started. Inflation Rate.

Unsuccessful idea

I think, that you are not right. I can defend the position. Write to me in PM, we will communicate.