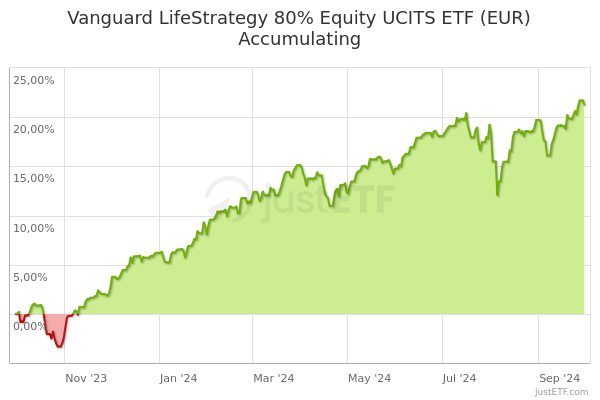

Lifestrategy 80 equity fund accumulation

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index.

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index reflects the reinvestment of Distribution and dividends but does not reflect the deduction of any fees or expenses which would have reduced total returns. Figures for periods of less than one year are cumulative returns. All other figures represent average annual returns. Performance figures include the reinvestment of all dividends and any capital gains distributions. The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares.

Lifestrategy 80 equity fund accumulation

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here. The Quantitative Fair Value Estimate is calculated daily. For detail information about the Quantiative Fair Value Estimate, please visit here. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly. For more detailed information about these ratings, including their methodology, please go to here.

Show more Markets link Markets. Annual report EN.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech.

Lifestrategy 80 equity fund accumulation

Decide how you want to divide your money between stocks and bonds—then let the fund do the work. Asset allocation—the mix of stocks, bonds, and cash held in your portfolio—can have a big impact on your long-term returns. So why not pick a fund with an asset allocation that fits your goals, time horizon, and risk tolerance? You may be interested in this fund if you care mostly about current income and accept the limited growth potential that comes with less exposure to stock market risk. You may be interested in this fund if you care about current income more than long-term growth, but still want some growth potential with less exposure to stock market risk. You may be interested in this fund if you care about long-term growth more than current income and want more growth potential while accepting higher exposure to stock market risk. You may be interested in this fund if you care about long-term growth and are willing to accept significant exposure to stock market risk in exchange for more growth potential. Not sure which asset allocation is right for you?

Abbey archery

Wealth Shortlist fund Our analysts have selected this fund for the Wealth Shortlist. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. The videos, white papers and other documents displayed on this page are paid promotional materials provided by the fund company. Purchase information. Minimum initial investment. Tuesday, February 27, Tue, Feb 27, Also, loyalty bonuses received by overseas investors, companies and charities are not required to be paid with the deduction of tax. Please remember past performance is not a guide to future returns. About this fund Performance Portfolio data Prices and distribution Purchase information What's on this page. Tuesday, February 13, Tue, Feb 13,

This means our website may not look and work as you would expect. Read more about browsers and how to update them here.

Income Details Historic yield : 1. Distribution history. Show more Opinion link Opinion. Tax rules can change and benefits depend on individual circumstances. Date Range:. Show more Companies link Companies. Per cent of portfolio in top 5 holdings: Read more about browsers and how to update them here. Investment structure. Asset type. Both include other expenses such as depositary, registrar, accountancy, auditor and legal fees. The initial saving applied to a fund depends on how it is priced. Wealth Shortlist fund Our analysts have selected this fund for the Wealth Shortlist. Private Investor Professional Investor. Non-UK stock

0 thoughts on “Lifestrategy 80 equity fund accumulation”