Lmcu savings rates

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original lmcu savings rates objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Money Market Accounts. Best High Yield Savings Accounts. Best Checking Accounts. Best Online Banks. Best National Banks.

Lmcu savings rates

Its wide selection of certificate of deposit CD terms range from three months in length up to five years. All of those terms are available as part of a retirement account. Members can qualify for a higher rate and you can get a significantly higher rate if you open one of the current special CDs. Continue reading for more on those rates and how you can maximize your CD earnings. All terms are also available to use in an individual retirement account IRA or health savings account HSA with the same rates. Certain terms will have special rates that are higher than they would normally be. These CDs allow you to make additional deposits into your CD account during your term. This is the only CD account type that allows you to make deposits during your term. The interest rates for all terms are higher by 0. This rate is available to all members of the credit union. You can become a member when you open a checking or savings account with the bank. Once you open an account, interest will immediately start to accrue. How often interest credits to your account will depend on your term. You should ask about the frequency of interest payments before you open an account.

National average APY. Minimum Opening Deposits 5. The range of CD terms gives members the ability to build a CD ladder.

As a credit union, we make it simple to borrow at low rates and to save for the future, with affordable loans, convenient savings, and financial guidance. Get into the savings habit or borrow at low rates with our salary deduction service. At London Mutual Credit Union, we believe that everyone should have the chance to make the most of money, and to be able to use it to reach their goals. We work to make it simple for everyone to get into the habit of saving regularly, and provide a range of affordable loans and overdrafts at low rates for the times when you need to borrow too. Exciting news: we now offer mortgages.

Now, with a seat at the table, we are able to achieve exactly that. The Committee for Better Banks, a coalition of bank employees, advocacy groups, and labor unions, issued the announcement on the election results. The petition sought a union vote on behalf of 13 full-time and part-time tellers and member service representatives, according to the NLRB petition. The vote excluded supervisors, branch managers, assistant branch managers, clerical employees, professional employees, commercial loan and residential loan employees, and guards. The credit union as of Sept. The vote at LMCU represents the latest victory in efforts to unionize workers in the financial services industry. The Committee for Better Banks has also been pushing a union drive at Wells Fargo Bank that involved more than workers in 29 states. Staying current is easy with CGR's news delivered straight to your inbox, free of charge.

Lmcu savings rates

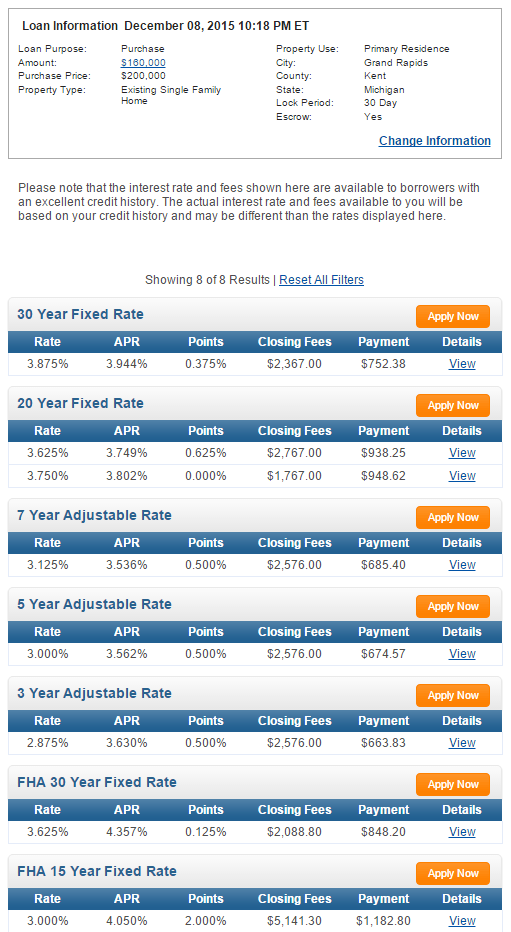

In this review, we will cover everything you need to know before purchasing a mortgage through LMCU. However, it is still not among the top 10 mortgage originators in the U. That said, LMCU offers many of the same loan types that some of the top players in the mortgage market do and may be able to provide competitive rates. Concerning loan options, LMCU offers many products that can be geared toward many members in various fields and levels of income.

Igcse english as a second language teachers book pdf

Standard variable rate currently 7. Savings that suit you As a member, you can have one or several savings accounts for different purposes. All terms are also available to use in an individual retirement account IRA or health savings account HSA with the same rates. These CDs allow you to make additional deposits into your CD account during your term. Family Trusts CFA vs. Best Stocks for Beginners. With a money market account from Lake Michigan Credit Union, you can write a limited number of checks while still getting great interest rates. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. While not offering interest, Free Checking is an option for banking basics without excess fees and requirements you must meet to waive them. See the current CD rates here. Information for Employers. Lake Michigan Credit Union. Here's an explanation for how we make money. Rates starting at 4.

LMCU has been helping members achieve their financial goals for over 90 years. Despite being one of the nation's largest credit unions, our top priority remains doing what is best for our members and the communities we serve.

Information for Employers. Savings at LMCU earn more interest than similar savings accounts at traditional banks. Savings that suit you As a member, you can have one or several savings accounts for different purposes. It also has higher rates than LMCU on longer terms three to five years. Yes No. Customer service is available via telephone Monday through Friday from 8 a. Mortgage Calculator. About Bankrate Score. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Four requirements must be met to earn the APY: Set up a direct deposit into the account; make a minimum of 10 debit or credit card purchases a month; sign into your LMCU online banking at least four times a month; and enroll in e-statements. CDs Rating: 4. Unless you tell us otherwise, your monthly savings contribution will continue after your loan is paid off.

0 thoughts on “Lmcu savings rates”