Lon: sse

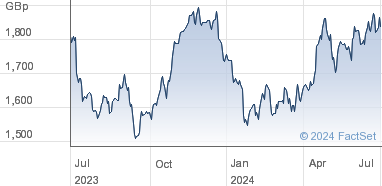

GBX 1, Key events shows relevant news articles on days with large price movements.

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us understand which sections of the website you find most interesting and useful. See our Cookie Policy for more information. These cookies are used to deliver our website and content. Strictly necessary cookies relate to our hosting environment, and functional cookies are used to facilitate social logins, social sharing and rich-media content embeds. Advertising Cookies collect information about your browsing habits such as the pages you visit and links you follow. These audience insights are used to make our website more relevant.

Lon: sse

SSE plc. SSE plc engages in the generation, transmission, distribution, and supply of electricity. About the company. It generates electricity from water, gas, coal, oil, and multi fuel. The company distributes electricity to approximately 3. Earnings are forecast to grow Analysts in good agreement that stock price will rise by Dividend of 5. Large one-off items impacting financial results. Has a high level of debt. High number of new directors Jan

The company distributes electricity to approximately 3.

.

SSE's exposure to regulated networks and renewables provide a hedge against rising interest rates. While higher interests could dampen renewables projects' value, they could drive higher allowed networks' returns in future regulatory periods. The dividend rebase does not solve the investment funding problem given the different investment profiles of networks and renewables assets. Morningstar brands and products. Investing Ideas. GBX 1, As of Mar 15, am Delayed Price Open. Unlock our analysis with Morningstar Investor. Start Free Trial. Mar 14,

Lon: sse

The company has its origins in two public sector electricity supply authorities. The former North of Scotland Hydro-Electric Board was founded in to design, construct and manage hydroelectricity projects in the Highlands of Scotland , and took over further generation and distribution responsibilities on the nationalisation of the electricity industry within the United Kingdom in The former Southern Electricity Board was created in to distribute electricity in Southern England. Because of its history and location, the Hydro-Electric Board was responsible for most of the hydroelectric generating capacity in the United Kingdom. In November , it was announced that SSE was looking to separate from its retail subsidiary which would then merge with the Npower division of rival Innogy. Although the merger received preliminary regulatory clearance from the Competition and Markets Authority on 30 August , [19] and full clearance was given on 10 October , [20] it was abandoned on 17 December , with the companies blaming "very challenging market conditions". In November , SSE moved its UK business into a new Swiss holding company, confirming that it had done so following the Labour Party's pledge to take it into state ownership. The UK's energy networks are vital strategic infrastructure on which we all rely. You cannot boil a kettle, heat your home or run a business without the grid. The idea that private owners, who have been ripping off the public, would move offshore in an attempt to prolong the rip-off illustrates just why we need the grid back in public hands.

Matt olson projections

Tirupati Graphite continues to ramp up graphite operations in Madagascar 08 Mar. Has a high level of debt. Year range. Glencore PLC. Coinsilium focused on growth opportunities after crypto shake-up 08 Mar. Effective tax rate The percent of their income that a corporation pays in taxes. CNA 0. VOD 2. Operating expense. View all events. We use this information to make our site faster, more relevant and improve the navigation for all users. Price Volatility. The total amount of income generated by the sale of goods or services related to the company's primary operations.

SSE plc. SSE plc engages in the generation, transmission, distribution, and supply of electricity.

The total amount of income generated by the sale of goods or services related to the company's primary operations. Shell PLC. The ratio of current share price to trailing twelve month EPS that signals if the price is high or low compared to other stocks. Save Settings Accept all. Earnings before interest, taxes, depreciation, and amortization, is a measure of a company's overall financial performance and is used as an alternative to net income in some circumstances. High number of new directors Jan The range between the high and low prices over the past day. SSE plc is a multinational energy company headquartered in Perth, Scotland. Discover more. A valuation method that multiplies the price of a company's stock by the total number of outstanding shares. Measures how much net income or profit is generated as a percentage of revenue. The range between the high and low prices over the past 52 weeks. Ethernity Networks pivots to licensing and revenue-sharing strategy for its technology 08 Mar. Only registered members can use this feature.

All about one and so it is infinite

You are not right. I can defend the position. Write to me in PM, we will communicate.