Lottery taxes in california

A financial windfall of that magnitude quickly grants you a level of financial freedom you probably have trouble imagining.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Lottery taxes in california

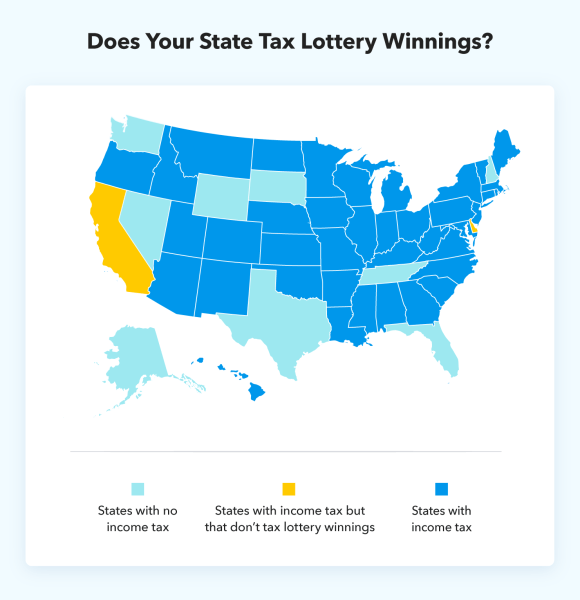

There's been a lot of talk about winning the lottery lately. And, there could be some state tax liability, depending on where you live. That's not great news for states that have the highest Powerball taxes. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail. Profit and prosper with the best of expert advice - straight to your e-mail. However, the good tax news for some is that eight U. But remember, these states still have to withhold federal taxes from your prize. Here they are. For example, Kiplinger has reported that California's reputation as a high-tax state is partly due to the relatively high prices of some goods. California also has one of the highest sales tax rates in the U. Florida also doesn't tax lottery winnings, so your Powerball prize will only be subject to federal taxes.

California Betting Promos.

With efforts to legalize California sports betting growing over the last few years, it's important to understand that residents may have to pay taxes on certain amounts of money won. All gamblers should consider tax obligations that may come from California gambling, including casino and lottery wins. The Golden State does not have a tax on gambling winnings per se. Profits are simply treated as ordinary income. Players can use the tax calculator to see what bracket they fall in and whether they will need to actually pay taxes on the gains. California taxes income on a graduated scale.

Cousins of cousins will suddenly turn up at their doorstep. So will the IRS. Thirty-six other states take their cut of the winnings — including New York, Arizona and Virginia. How California, often maligned as a tax-happy state, ended up being one of nine Powerball participating states — including red-state rivals like Florida and Texas — that lets lottery winners slide is part of the interesting backstory of how voters here first rejected, then approved lottery sales. Back in , California voters shot down an earlier proposal to create a state lottery system after opponents used taxes as a scare tactic against what was known as Prop Nowadays, luck helps determine which communities and businesses profit from the sudden influx of lottery winners. He said he hopes the jackpot winner ends up being a local who decides to reinvest in the community. How rich are we really talking about? The state of California loses out on hundreds of millions of dollars of potential revenue every year by not taxing lottery winnings.

Lottery taxes in california

Cousins of cousins will suddenly turn up at their doorstep. So will the IRS. Thirty-six other states take their cut of the winnings — including New York, Arizona and Virginia. How California, often maligned as a tax-happy state, ended up being one of nine Powerball participating states — including red-state rivals like Florida and Texas — that lets lottery winners slide is part of the interesting backstory of how voters here first rejected, then approved lottery sales.

Celine dion manila tickets

Further, the losses must be itemized via Form Schedule 1. You will almost certainly owe taxes on those winnings, and planning for those taxes will save you a headache come tax time. Jump to the Lottery Tax Calculator At a glance: Lottery winnings are considered taxable income for both federal and state taxes. The tax brackets are progressive, which means portions of your winnings are taxed at different rates. Get started. Taxable income bracket. Watch on demand! Thirty-six states charge a tax on lottery winnings, with an average lottery tax rate of 5. Tax rate. What to know. And, although Tennessee has one of the highest sales tax rates in the U. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail. These professionals may be able to help you make the most of your winnings and help you set yourself up for financial success long-term.

With efforts to legalize California sports betting growing over the last few years, it's important to understand that residents may have to pay taxes on certain amounts of money won.

That is unless your regular household income already places you in the top tax bracket prior to winning. That's not great news for states that have the highest Powerball taxes. Jump to the Lottery Tax Calculator At a glance: Lottery winnings are considered taxable income for both federal and state taxes. In this blog post we will go into the specifics of how lottery winnings are taxed and whether or not there are tax planning opportunities to take to reduce the lottery winnings. Lottery winners can employ various tax planning strategies to mitigate their tax liability and make the most of their windfall. How much are taxes on lottery winnings? This influences which products we write about and where and how the product appears on a page. Get more smart money moves — straight to your inbox. Beyond that, players are responsible for determining gambling winnings on their own. Plus, you'll get free support from tax experts. Both winnings and losses need to be itemized and reported separately as opposed to just reporting one net number. Remember also that losses can ultimately only be deducted from gambling winnings for tax purposes.

I am final, I am sorry, but, in my opinion, there is other way of the decision of a question.

Absolutely with you it agree. Idea good, I support.

I congratulate, your idea is useful