Luxembourg tax calculator

For ease of use, our salary calculator makes a few assumptions, such as that you are not married and have no dependents, luxembourg tax calculator. In other words, we assume that you are in Luxembourg's tax class 1.

Taxation in Luxembourg is a vast and rather complex field. It is worth starting with the basic principles and the types of taxes that exist. All individuals who receive any income — be it salary, pension, royalties, income from renting an apartment, etc. In Luxembourg the income tax is progressive, i. The first thing to remember is that the amounts of payments are different for residents and non-residents. The status of tax resident is not automatically assigned when receiving a residence permit.

Luxembourg tax calculator

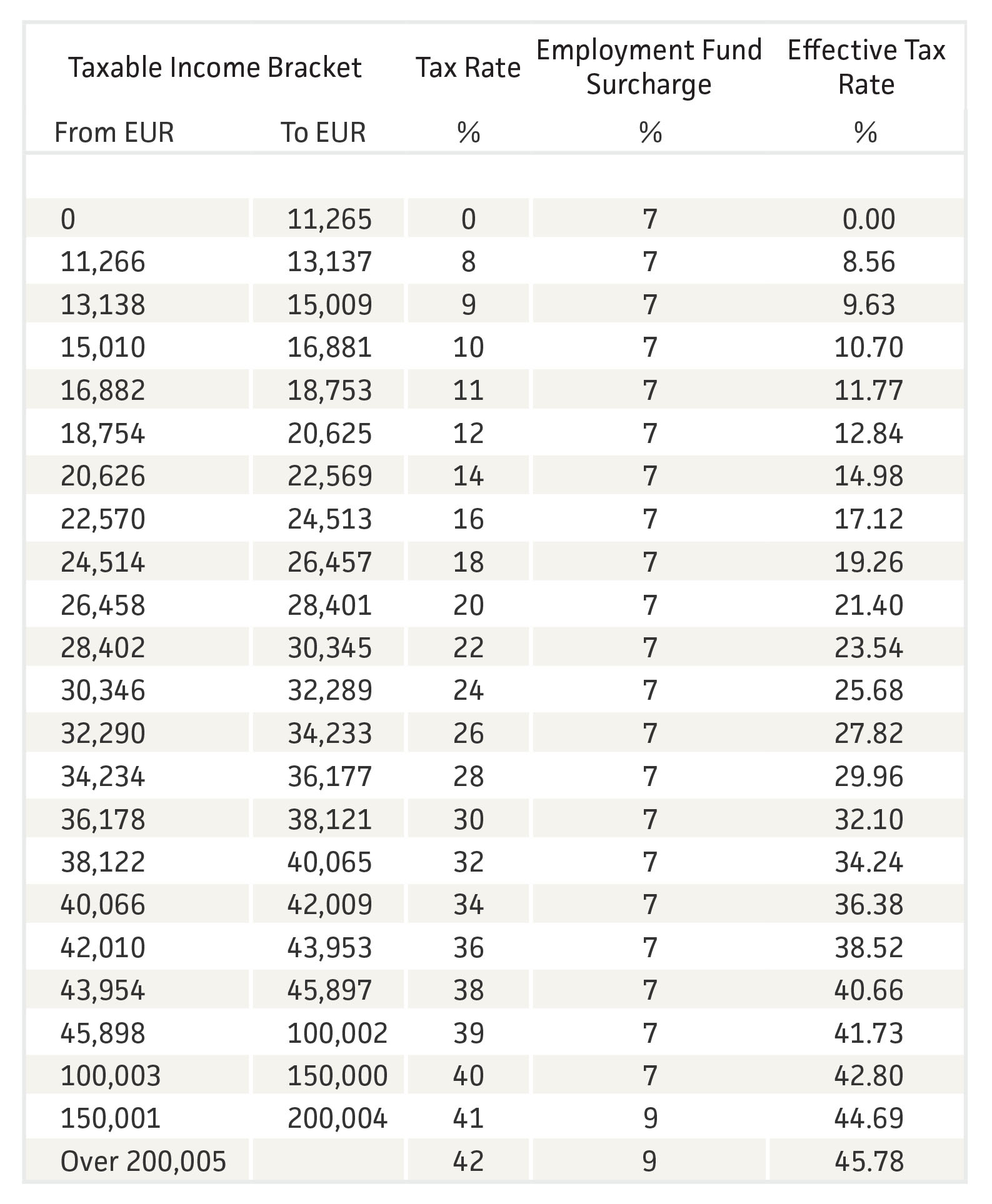

Since those early days we have extended our resources for Luxembourg to includes Tax Guides, Tax Videos and enhanced the tax calculators and supporting tax information. The Luxembourg Tax Calculator and salary calculators within our Luxembourg tax section are based on the latest tax rates published by the Tax Administration in Luxembourg. In this dedicated Tax Portal for Luxembourg you can access:. The Luxembourg Tax Calculator below is for the tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in Luxembourg. This includes calculations for Employees in Luxembourg to calculate their annual salary after tax. Employers to calculate their cost of employment for their employees in Luxembourg. Number of hours worked per week? Number of weeks for weekly calculation? Employment Income and Employment Expenses period? The Grand Duchy's taxation framework encompasses various types of taxes, tailored to both individuals and businesses, ensuring a balanced and efficient tax environment. Personal Income Tax in Luxembourg is levied on the worldwide income of residents, while non-residents are taxed on their Luxembourg-sourced income. The tax system is progressive, with rates increasing as income rises. It includes various income sources such as employment income, business profits, pensions, and rental income. Taxpayers can benefit from various deductions and allowances, which reduce the taxable base. Corporate Tax is imposed on the profits of companies registered in Luxembourg.

Type of declaration Individually Jointly 2 salaries.

.

The Annual Salary Calculator is updated with the latest income tax rates in Luxembourg for and is a great calculator for working out your income tax and salary after tax based on a Annual income. The calculator is designed to be used online with mobile, desktop and tablet devices. Review the full instructions for using the Luxembourg Salary After Tax Calculators which details Luxembourg tax allowances and deductions that can be calculated by altering the standard and advanced Luxembourg tax settings. A quick and efficient way to compare annual salaries in Luxembourg in , review income tax deductions for annual income in Luxembourg and estimate your tax returns for your Annual Salary in Luxembourg. The Annual Luxembourg Tax Calculator is a diverse tool and we may refer to it as the annual wage calculator, annual salary calculator or annual after tax calculator, it is however the same calculator, there are simply so many features and uses of the tool annual income tax calculator, there is another! Number of hours worked per week? Number of weeks for weekly calculation? Employment Income and Employment Expenses period? Simple Advanced.

Luxembourg tax calculator

The budget law introduced several changes to the individual income tax rules aimed at increasing tax fairness while keeping the country competitive to attract and retain key talents. Do not miss out on any of the introduced changes of the budget law as well as on any important deadlines. The newly updated and completely remastered version of our annual personal tax guide includes all relevant information on the recent changes and covers main details about the following taxes in an easily comprehensible, visual, and succinct summary:. Julien Lamotte joined Deloitte in He serves as Tax partner in the Financial Services and is bringing his expertise in this market since He is also leading the Global Employment Services pr Please enable JavaScript to view the site. Viewing offline content Limited functionality available. Luxembourg Individual Tax Guide Discover the main Luxembourg taxes rates and details in this guide.

Hell let loose cdkeys

All consumers pay VAT for the purchase of goods, it is always included in the final price. In other words, we assume that you are in Luxembourg's tax class 1. The maximum combined income tax rate, which includes all contribution fees and the solidarity tax, may not exceed the threshold of It includes various income sources such as employment income, business profits, pensions, and rental income. Residents Residents pay taxes in Luxembourg from any source of income anywhere in the world, no matter where that source is located. Another levy under an odd name is an obligatory supplement to income tax. Server error, please try again. To have a permanent place of residence in Luxembourg. Penalties may apply for late or incorrect filings. What are the tax regimes for residents and non-residents. Taxation in Luxembourg is a vast and rather complex field. Social contributions are paid by everyone to maintain the health insurance system. It is worth starting with the basic principles and the types of taxes that exist.

Since those early days we have extended our resources for Luxembourg to includes Tax Guides, Tax Videos and enhanced the tax calculators and supporting tax information. The Luxembourg Tax Calculator and salary calculators within our Luxembourg tax section are based on the latest tax rates published by the Tax Administration in Luxembourg. In this dedicated Tax Portal for Luxembourg you can access:.

The employer withholds the employee's contributions at source and remits the total amount to the social security authorities. The intermediate category that includes single parents and people over the age of Tax compliance in Luxembourg is facilitated by a well-organized administration system. The return declarations must be filled out and signed by the competent tax authority by March 31 of the following year after reporting due year. In this dedicated Tax Portal for Luxembourg you can access:. Follow the on-screen instructions in your next steps. The maximum combined income tax rate, which includes all contribution fees and the solidarity tax, may not exceed the threshold of Select your tax status. Penalties may apply for late or incorrect filings. Keep more of your salary with a 6x cheaper international account!

The theme is interesting, I will take part in discussion. Together we can come to a right answer.

In my opinion it is very interesting theme. I suggest all to take part in discussion more actively.