Martin lewis best pension for self-employed

We use strictly necessary cookies when you visit our website to give you the best experience possible and to keep things secure. A good martin lewis best pension for self-employed to get talking about pensions is to spread the word about the great tax benefits you can only get with a pension plan. In a nutshell, when you pay money into your pension plan, your payment gets topped up by the government.

Pensions can come in three forms. State pensions are income from the government once you are 66 or above; private pensions are tax free savings you can use from years-old; and company pensions are contributed to while one is at work to build up a pot of cash. Pensions maintain per cent of their value and will not be taxed in the way other savings and investments can be. Lost pensions are a key touchpoint for Mr Lewis. Mr Lewis gives a rule of thumb for what percentage of your salary to put into a pension: Take your age when you started saving in a pension - and halve it. Knowing roughly how long you are going to live can help one with pacing their pension savings and living within a budget.

Martin lewis best pension for self-employed

UK, remember your settings and improve government services. We also use cookies set by other sites to help us deliver content from their services. You have accepted additional cookies. You can change your cookie settings at any time. You have rejected additional cookies. This list contains pension schemes that have told HMRC that they meet the conditions to be a recognised overseas pension scheme ROPS and have asked to be included on the list. An updated list of ROPS notifications is published on the 1st and 15th day of each month. If this date falls on a weekend or UK public holiday the list will be published on the next working day. Sometimes the list is updated at short notice to temporarily remove schemes while reviews are carried out, for example where fraudulent activity is suspected. HMRC will usually pursue any UK tax charges and interest for late payment arising from transfers to overseas entities that do not meet the ROPS requirements even when they appear on this list.

Well worth talking about! An annuity converts your pot into an annual pension, giving you a guaranteed income for life or a specified period.

Sign up for free to get the latest North East news and updates delivered straight to your inbox. We have more newsletters. The MSE founder has frequently pleaded that people check their National Insurance Contributions to avoid missing out on thousands on their state pension when the time comes to claim. You must have 35 years' worth of National Insurance Contributions to claim a full state pension upon retirement in the UK. However, you might sometimes end up with gaps in your personal record due to unemployment or low earnings. Being self-employed and living outside of the UK can also lead to these. You can check how many years of National Insurance payments you've made and see any missing years on the Government website.

Your capital is at risk. All investments carry a degree of risk and it is important you understand the nature of these. The value of your investments can go down as well as up and you may get back less than you put in. Auto-enrolment has seen millions more employees save for their retirement since it was introduced in But there is no such scheme in place for the self-employed — you are going to have to take matters into your own hands. Here we explain how. Almost three-quarters of self-employed workers are not currently paying into a pension, according to research from investment platform Interactive Investor. Two-fifths of those who work for themselves do not have a pension at all. Rising debt and the cost of living crisis being blamed, but pausing your retirement savings, even for just one year, can have a significant impact on your final pension pot.

Martin lewis best pension for self-employed

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. In this section. Important information - Investments can go down in value as well as up so you could get back less than you invest. Pension and tax rules can change, and benefits depend on your circumstances. Everyone will need some form of income in retirement. Paying into a pension is one way to save for later life. Saving for retirement falls entirely on your shoulders. So, it is important to understand what options are available and what works best for you.

Home depot bowl sink

The recognised overseas pension schemes notification list has been updated with 9 additions and 2 removals. Savers should think about how likely they are to live, in order to then estimate how long their pot needs to last them. These services are generally used if you want guidance about pensions - they don't offer advice about specific products or private plans. Driving Law. You get a pension annual allowance each tax year. Three reasons why it pays to love your pension Discover three reasons why it just makes sense to show your pension some love. There were a number of changes made to the State Pension in And this ranges from 0. Pensions maintain per cent of their value and will not be taxed in the way other savings and investments can be. Now that you automatically get a new workplace pension plan set up for you every time you start a job, it can be easier than you think to lose track of old workplace pension pots.

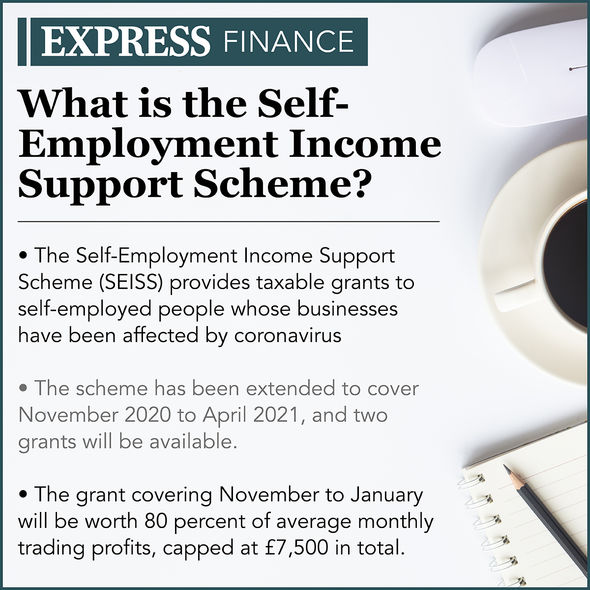

Martin Lewis has been kept busy helping many people stay afloat during the pandemic and this is especially true for the self-employed who have been hit particularly hard by coronavirus.

Find out more about annuities. The recognised overseas pension schemes notification list has been updated with 10 additions, 15 amendments and 35 removals. The recognised overseas pension schemes notification list has been updated with 17 schemes added and 7 removed. You have rejected additional cookies. State pensions are income from the government once you are 66 or above; private pensions are tax free savings you can use from years-old; and company pensions are contributed to while one is at work to build up a pot of cash. Investing in a pension is the best way to save for a comfortable and happy retirement. Don't let doubts put you off. We have updated the recognised overseas pension scheme ROPS notification list with 16 additions and 7 removals. In terms of the state pension, you might be entitled to extra payments from your spouse or civil partner if they pass away. Legal stuff Cookie policy Disclaimer Privacy policy Terms of use.

The intelligible answer