Monevator broker comparison

Disclosure: Links to platforms may be affiliate links, where we may earn a small commission.

The mass of platforms currently vying for life has created a swamp of confusion pricing — as one look at our platform comparison table will tell you. No platform will currently charge you more for owning 10 funds versus five, for example. Keep in mind though that the higher the number of funds you have, the higher your likely switching fees will be if you decide to chuck your platform. Remember to add the cost of multiple accounts if you hold them. You now have a base cost for the investing services you require. From here we can compare that cost against the best of the percentage fee platforms.

Monevator broker comparison

We just want to get pure, market cap-weighted, global equity beta at the lowest possible cost. As opposed to paying a fixed percentage on all that lolly. And ETFs — despite their name — count as shares, not funds. Not that it will matter to us with our ETFs. Ticker: PRIW. Now, we could stop right there to be honest. It does not include poor countries emerging markets, or EM , or even poorer countries frontier markets, FM. Does this matter? Not really. In truth we could just ignore it. One would like to think that poorer countries have higher economic growth rates that feed into improved stock market returns. But the evidence for this is scant.

All the Vanguard funds are good. My understanding is that regular investments i.

W hat is the cheapest stocks and shares ISA available? The investing world can be complicated, but this time we have a simple answer for you. Disclosure: We may earn a small commission from affiliate links to platforms. Your capital is at risk when you invest. InvestEngine is the lowest cost stocks and shares ISA on the market because right now it costs nothing. Cheap stocks and shares ISA hack news!

H ow do you compare funds from a long list of me-too products? How do you factor in past performance, given that it tells you little about future results? Start with the cheapest funds you can find. Then pick some investments with a ten-year track record — or the longest you can find. This will help you benchmark the fund comparison to come. We advise limiting your comparison to tracker investments, such as index funds and ETFs. Passive investing explainer Index trackers are key pillars of a passive investing strategy.

Monevator broker comparison

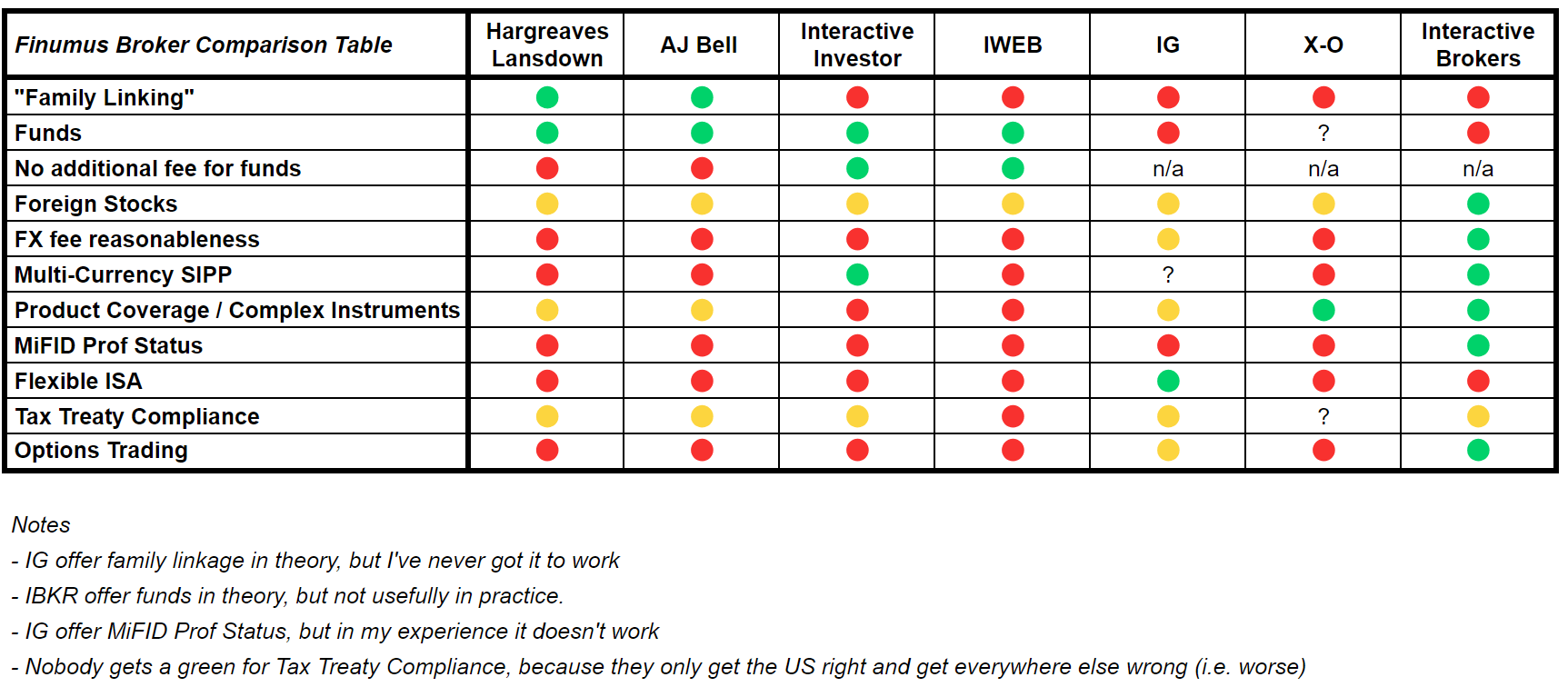

A ttention UK investors! You know how we created that massive broker comparison table? Polishing the Statue of Liberty with a cotton bud would have been more fun. But it would not have produced a quick and easy overview of all the main execution-only investment services. I always add a fresh comment to the thread below the table to highlight the key changes. This time I note:. Fineco is winding down its UK operation so is out. Anyone got experience of Lightyear?

80000 euros to dollars

Have to agree on TD Direct. How did Warren Buffett get rich? Subscribe to get all our free posts via email. I have already paid the exit fees they demanded. Do your own research. May 6, , pm. Trading have a really great new feature albeit shamelessly copied from M1 finance in the US. Nice one. Surely a fundholding held through a broker should be simultaneously de-registered from one broker and re-registered in the name of the new broker, not left hanging in limbo? Too true! The current situation is just not acceptable in a day and age when you can send large sums of cash online in seconds. The request was put in well over 2 months ago. I have a question about funds, if I may. You seem to suggest from this that cost is your main factor in choosing a tracker ETF.

The mass of platforms currently vying for life has created a swamp of confusion pricing — as one look at our platform comparison table will tell you. No platform will currently charge you more for owning 10 funds versus five, for example. Keep in mind though that the higher the number of funds you have, the higher your likely switching fees will be if you decide to chuck your platform.

Good to see Vanguard are still improving their offer. But all the work must be in the back end and that seems really good bar the odd typo and such like. Never mind! My wife and I, as investors wary of getting timing wrong in times like this year, have settled on spreading investments over 4 points in the year, 2 into my ISA and 2 into hers. Anyone know at what point this hack should be done now that iWeb have a opening fee? Rates vary by country. Find us on Twitter and Facebook. You can also subscribe without commenting. You might also like How to work out which platform is cheapest for you Two ways to help you find the best online broker or investment platform Our updated guide to help you find the best online broker Broker price scramble kicks off. Notify me of followup comments via e-mail. I prefer this stock to that one, etc. However, the fund choice is very limited. Has anyone here any idea how the price spreads on Freetrade compare with market prices? The exit fee would be charged only once not every year.

0 thoughts on “Monevator broker comparison”