Monthly dividends canada

More specifically, you are looking to invest in dividend growth stocks and live off dividends when you are retired. Many Canadian dividend stocks pay quarterly dividends and you can find their payment dates in the Canadian dividend calendar, monthly dividends canada. This can lead to some months with bigger dividend payments and some months monthly dividends canada smaller or very little dividend payments. By coincidence, we had a very stable monthly dividend income from to

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people around the world achieve their financial goals through our investing services and financial advice. Our goal is to help every Canadian achieve financial freedom. Investors seeking regular income often turn to dividend stocks, and when those dividends come monthly, it can provide a consistent passive income. In Canada, several companies stand out for their robust dividend-paying track records. Here, I explore three top Canadian dividend stocks that not only offer attractive yields but also pay out dividends on a monthly basis.

Monthly dividends canada

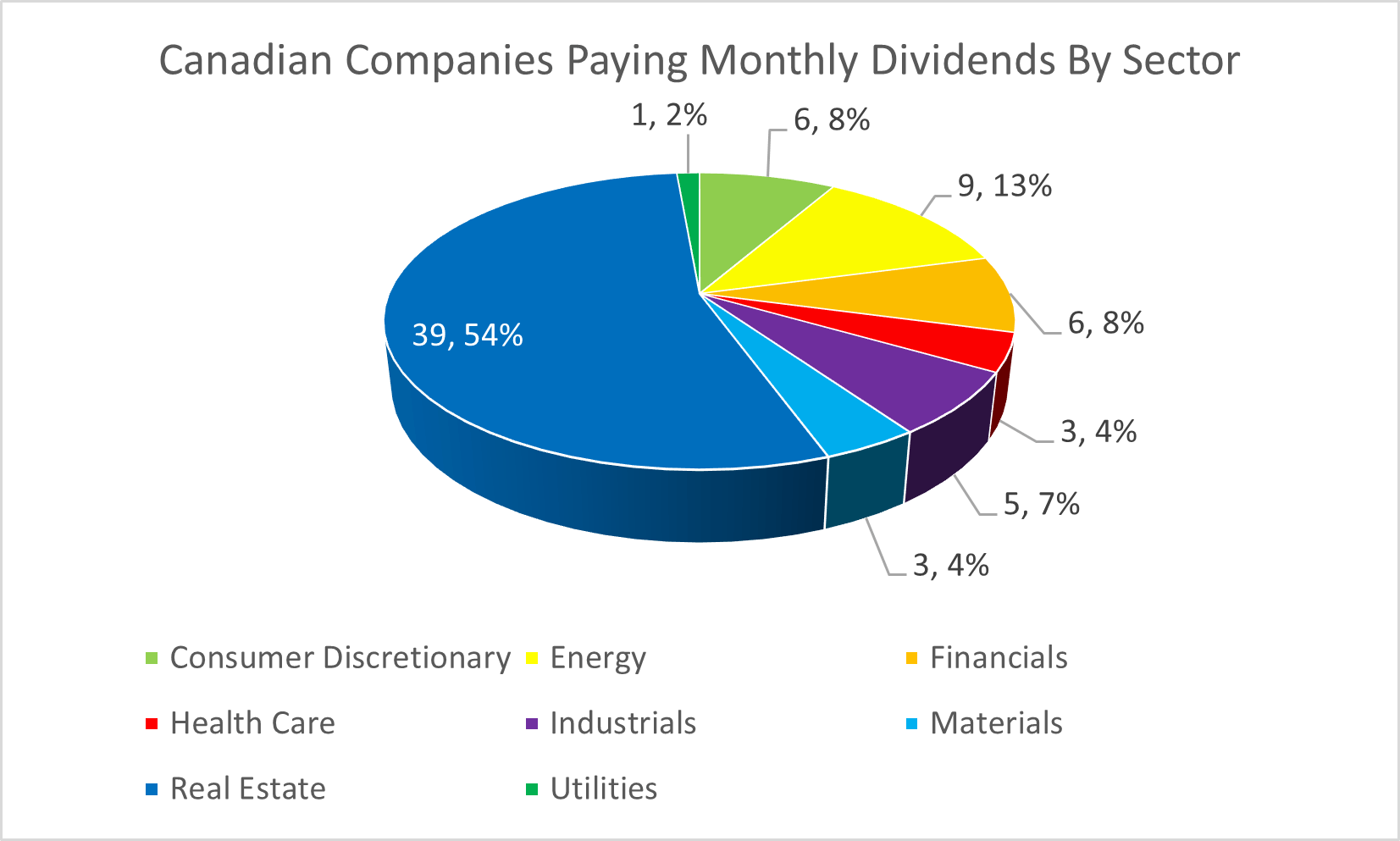

If you're looking for monthly dividend stocks here in Canada , you won't need to look further than this list. First things first, we're going to go over some of the best monthly dividend-paying stocks in Canada. After that, we're going to go over all of the monthly dividend stocks in Canada. And finally, we're going to discuss whether or not monthly dividend stocks are more beneficial than quarterly payers. Of note, if you want to access our in-depth research on each company, simply click their ticker in the table. Savaria TSX:SIS is expected to post impressive growth numbers in an industry that is still relatively young yet growing extremely fast. Savaria is involved in manufacturing mobility products and modifications, such as stairlifts, elevators, and wheelchair conversion kits for vehicles. Savaria is a market leader in Canada and is in a great position to benefit from this. Savaria has a modest dividend yield, but its growth is impressive. The decrease in dividend growth was largely because of the Handicare acquisition, a deal that substantially transformed the company but increased its total debt.

Literature Literature. Passiv monthly dividends canada even calculate and execute the trades needed to keep your portfolio balanced. This forward-looking metric is calculated based on a model, which is dependent upon multiple assumptions.

Investors seeking regular income often turn to dividend stocks, and when those dividends come monthly, it can provide a consistent passive income. In Canada, several companies stand out for their robust dividend-paying track records. Here, I explore three top Canadian dividend stocks that not only offer attractive yields but also pay out dividends on a monthly basis. UN is a heavyweight in the Canadian real estate investment trust REIT sector, boasting a vast portfolio of retail properties. What sets RioCan apart is its commitment to distributing dividends on a monthly basis. For income-seeking investors, this regular cash flow is an attractive feature. The company has adapted its portfolio to align with changing consumer trends, demonstrating resilience and forward-thinking in a dynamic market.

Are you looking for monthly income-paying investments outside of traditional fixed income like GICs or bonds? There are certain stocks that pay more frequent dividends, which can be a great addition to an income-focused portfolio. We will cover the best monthly dividend stocks in Canada below and discuss some of their features in more detail. Monthly dividend stocks can fit very well within a portfolio designed to provide a steady monthly income stream. They can help to reduce the interest rate risk that bonds will be vulnerable to. Here are some circumstances in which to consider adding monthly dividend stocks to your portfolio. If your portfolio does not currently contain stocks or other investments outside of bonds, adding monthly dividend stocks will likely boost its diversification. Some monthly dividend stocks pay an incredibly high yield on an annualized basis.

Monthly dividends canada

The content on this website includes links to our partners and we may receive compensation when you sign up, at no cost to you. This may impact which products or services we write about and where and how they appear on the site. It does not affect the objectivity of our evaluations or reviews. Read our disclosure. While the majority of dividend stocks on the TSX pay distributions every quarter, a few of them make monthly payments. Monthly dividend stocks are attractive as a source of regular income you can look forward to without making an extra effort. Ideally, the stocks also increase in price over time, resulting in capital gains whenever you choose to sell them. Below, I cover some of the best-paying, high-yield monthly dividend stocks you can use to generate monthly cash.

Microsoft order history

There is not a universally accepted way to calculate an ITR. Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people around the world achieve their financial goals through our investing services and financial advice. The monthly dividends provide investors with a predictable income stream, a crucial aspect for those relying on dividends for regular cash flow. Drones, K9 officers and more than 20 deputies searched for the 8-year-old, Wisconsin officials said. UN, it is important to evaluate factors such as location, tenant quality, and lease agreements. This bring in a different perspective. Latest Stories. TSX dividend stocks can provide you with healthy cash flow and capital appreciation to compound your returns over the long run. He has become an authority figure in the Canadian finance niche, primarily due to his attention to detail and overall dedication to achieving the highest returns on his investments. Not only does it generate passive income, but it also offers exposure to the growing grocery sector. What makes Savaria very interesting from a monthly dividend income point of view is the high dividend growth rate. Passiv can even calculate and execute the trades needed to keep your portfolio balanced. You might be surprised to learn that there are other lenders out there other than the banks. Distributions Interactive chart displaying fund performance. Since coming out of lockdowns due to the pandemic, the oil and gas sector has witnessed a massive resurgence in popularity, primarily due to the fact crude oil has surged in price.

I see dividend growth investors asking for dividend calendars quite often. Since there are many Canadian companies that pay dividends regularly, I want to narrow down the scope of the Canadian dividend calendar.

EPR Properties. Home » Investments » Top Stocks Are you looking for monthly dividend income? Monthly dividend stocks aren't very common on the TSX This may not be all of the monthly dividend payers here in Canada. STAG 8. XEQT vs. Factors such as market volatility, economic conditions, and company-specific risks can impact the stability and sustainability of dividend payments. Thanks for your hard work! Story continues. We're advocating for monthly dividend stocks, not mutual funds and income funds that pay monthly distributions. This can lead to some months with bigger dividend payments and some months with smaller or very little dividend payments. Utility companies are cash-intensive businesses, often requiring debt to expand infrastructure.

0 thoughts on “Monthly dividends canada”