Morning star candlestick chartink

When looking at charts for prospective trading opportunities, morning star candlestick chartink, it is essential to have a solid understanding of the many signals and patterns that can point to a possible trend continuation or reversal. This blog post will look at the morning star pattern and what it could mean for forex traders.

Useable Links. More Links. Bullish Hammer. Shooting Star. Bullish Engulfing. Bearish Engulfing. Bullish Harami.

Morning star candlestick chartink

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. A morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts.

While there is no guarantee that using additional indicators will always lead to successful trades, many experienced investors believe it is the best way to avoid false signals and minimize losses.

.

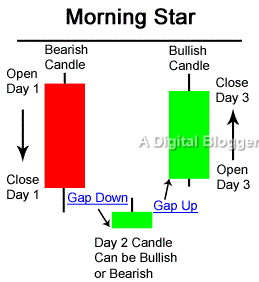

Morning Star candlestick is a bullish reversal candlestick pattern , which we can find at the bottom of a downtrend. This is one of the popular candlestick patterns used by many technical analysts. Morning Star pattern consists of three candlesticks: a big red candle, a small doji candle, and a big green candle. This is one of my favorite candlestick patterns I use. There are many candlestick patterns, but these 35 powerful candlestick patterns are so popular. And even from these 35, I use a few that I find easy. Morning Star is a bullish candlestick pattern.

Morning star candlestick chartink

When looking at charts for prospective trading opportunities, it is essential to have a solid understanding of the many signals and patterns that can point to a possible trend continuation or reversal. This blog post will look at the morning star pattern and what it could mean for forex traders. Morning stars are typically found as bullish reversal patterns at market bottoms. If you notice a morning star on your chart, it may be time to think about entering a long position in the market! The morning star candlestick pattern is a three-candlestick reversal pattern that indicates bullish signs to technical analysts. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. The Morning Star is believed to be an indicator of potential market reversals and, therefore, can be used by traders to enter long positions. For the pattern to be valid, the following criteria need to be met: The downtrend must be clearly defined by lower highs and lower lows. The formation of the black candlestick is required inside this downward trend, and ideally, it should have a relatively long body.

Ifor williams tack pack for sale

The important thing to note about the morning star is that the middle candle can be black or white or red or green as the buyers and sellers start to balance out over the session. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Doji Morning Star. The Doji is one of the most widely recognized candlestick patterns and often signals a potential change in direction. Compare Accounts. Please review our updated Terms of Service. The morning star component of the pattern is derived from the candlestick pattern discovered near the bottom of a bearish trend and indicates the possibility of a trend reversal. Limitations of the Morning Star. Morning Star Pattern Screener While many different websites offer screener services, Trendlyne[dot]com, Chartink[dot]com, Screener[dot]in, and Topstockresearch[dot]com are four of the most popular ones. However, some traders may choose to place their stop loss below the low of the first red candle, as this will provide more room for the trade to move before being stopped out. Related Articles. High volume on the third day is often seen as a confirmation of the pattern and a subsequent uptrend regardless of other indicators.

This technical analysis guide covers the Morning Star Candlestick chart indicator. The pattern is split into three separate candles with relationships between all of them. We also included an example chart that we interpret using the Morning Star Candlestick indicator and learn how to spot a bullish opening on the third candlestick.

Positive Hammer, Technical Analysis Scanner. Bearish Harami. The important thing to note about the morning star is that the middle candle can be black or white or red or green as the buyers and sellers start to balance out over the session. Bearish Kicker, Technical Analysis Scanner chartink. This data is displayed on charts, allowing traders to visualize movements and entry and exit points. The morning star component of the pattern is derived from the candlestick pattern discovered near the bottom of a bearish trend and indicates the possibility of a trend reversal. This pattern appears at the top of an uptrend and signals that the trend is reversing and heading downwards. A stop loss would typically be placed below the low of the small green candle, indicating a break in the downtrend. Our tools are for educational purposes and should not be considered financial advice. The evening star is a long white candle followed by a short black or white one and then a long black one that goes down at least half the length of the white candle in the first session. Bullish Abandoned Baby: Definition and How Pattern Is Used The bullish abandoned baby is a type of candlestick pattern used by traders to signal a reversal of a downtrend.

In my opinion you are not right. I can prove it. Write to me in PM, we will discuss.

The excellent and duly message.

As the expert, I can assist. Together we can find the decision.