Motilal oswal intraday charges

Motilal Oswal is renowned for its transparent and cost-effective fee structure. The Motilal Oswal charges and fees are pivotal considerations for investors navigating the financial markets.

In the first part, we have explained the fees for opening Motilal Oswal trading account and AMC if charged by the broker. In case broker supports multiple plans, it will be explained in this section. This is a limited-time offer. Opening a trading account is a one-time fee that Motilal Oswal charges when you open your account. This is the annual fee and is deducted from your account even if you haven't traded for a year. Normally, the AMC for the trading account is free of charge.

Motilal oswal intraday charges

With over 35 years of industry experience and a client base which expands to more than 50 lakhs, Motilal Oswal Financial Services Ltd. Incorporated in the year , the financial services firm offers trading services in Equity, Commodity, Currency and Derivatives. Motilal Oswal's key USP is its deep industry experience and research advisory. The company has won multiple awards for its research services. The research division has published over 80, reports covering stocks across 45 sectors. It regularly publishes reports on companies, sectors, thematic investing and market analysis. Apart from having retail investors as their clients, Motilal Oswal is known for having a diversified client base that includes High-Net worth Individuals, mutual funds, foreign institutional investors, financial institutions and corporate clients. Motilal Oswal charges brokerage at 0. The commodity brokerage charges are 0. Out of all its brokerage plans - Motilal Oswal has now introduced Free Equity Intraday Trading for Lifetime, making it the first-of-a-kind stock broker in India to offer free intraday trading to its customers.

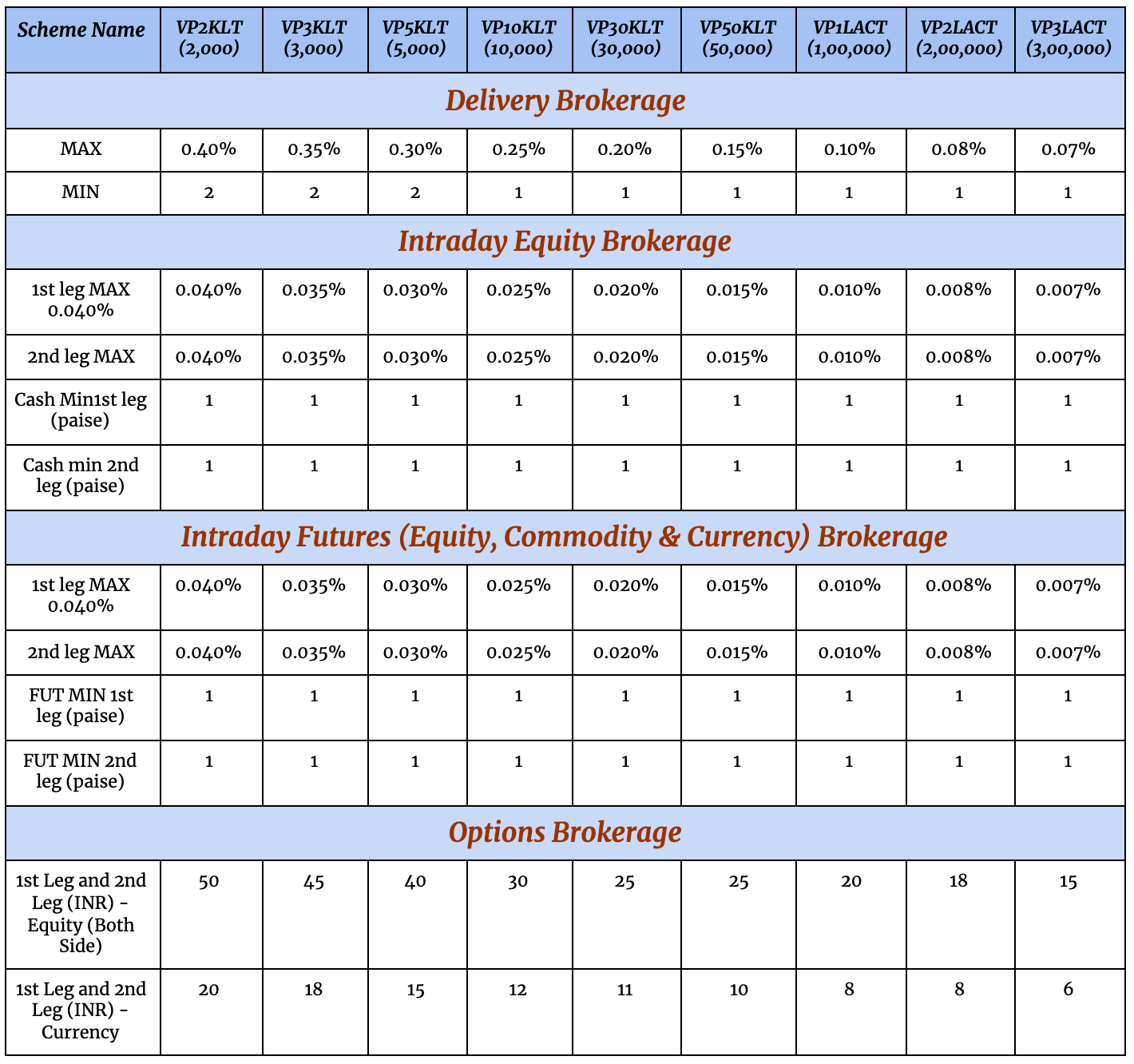

Motilal Oswal fee structure and trading commission rates are explained as below. It regularly publishes reports on companies, sectors, thematic investing and market analysis.

The broking charges for Equity Delivery is 0. The commodity brokerage charges are 0. Motilal Oswal offers stock investing and trading services. Along with the traditional stock investment options, customers at Motilal Oswal can also invest in the shares of unlisted stocks through PMS. Customers can also find several expert-made ready-made investment options such as Investment Baskets, Intelligent Advisory Portfolios, Small cases, etc.

Mobile No. Select Services Open Demat Account. Traders are frequent investors, as they invest and withdraw money every time. But, each and every transaction is liable to a brokerage charge, to be paid by the investors. Motilal Oswal Brokerage Calculator helps you calculate how much brokerage you need to provide for each and every transaction. Motilal Oswal Calculator delivers information on the transactions.

Motilal oswal intraday charges

This article gives you the details regarding Motilal Oswal Charges. Motilal Oswal is one of the largest stockbroking firms that allows traders to trade in all asset classes. Motilal Oswal charges an average brokerage charge compared to its peers. While the brokerage charges are not very cheap they are not exorbitant as well. The thing that as a trader or investor you need to consider is that they offer multiple services against the fee they charge. For equity delivery, the charge is 0. For equity options, you need to pay Rs 0 For 1st Month up to Rs. For currency futures and options, the brokerage is nominal which is Rs 0 For 1st Month up to Rs.

Vaseline cocoa glow review

Motilal Oswal fee structure and trading commission rates are explained as below. With credible data, technically advanced tools and independent reviews, Select eases the selection process in your major money matters. This company is fraud. The commodity brokerage charges are 0. By Popular Stock Brokers. Steps for closing your Motilal Oswal account offline are as follows: Download the account closure form. Open Free Demat Account in just 5 Min. Currency Future Nil. What are the hidden charges of Motilal Oswal? How brokerage is calculated in Motilal Oswal? All Rights Reserved.

Motilal Oswal has an active client base of 8,74, as of February The segments in which you can invest includes Equity, Commodity, Currency, Futures and Options through this broker.

The below table can be used for the Motilal Oswal tax calculation. Save my name and email in this browser for the next time I comment. Motilal Oswal Currency Brokerage Charges List Motilal Oswal currency trading charges are the total trading costs that a client has to pay for trading in currencies. Motilal Oswal offers a range of online trading and investing software and mobile apps. Paytm Money. To open Motilal Oswal account you have to pay account opening charges and annual maintenance charges AMC. After deducting all these fees, the investor can calculate the final net profit generated from the trade. Angel One. Zerodha Charges or Fees. They can simply enter the number of shares, prices and other details to get a comprehensive overview of their fees. Motilal Oswal Vs Stoxkart. Motilal Oswal's intraday charges are 0. Motilal Oswal only charges brokerage that is defined on its website. Lastly dont fall prey to MO loss making services limited. How brokerage is calculated in Motilal Oswal?

You are not right. I can defend the position. Write to me in PM, we will discuss.