Nationwide building society iban

Please remember that Nationwide Building Society uses different codes for all its various banking services.

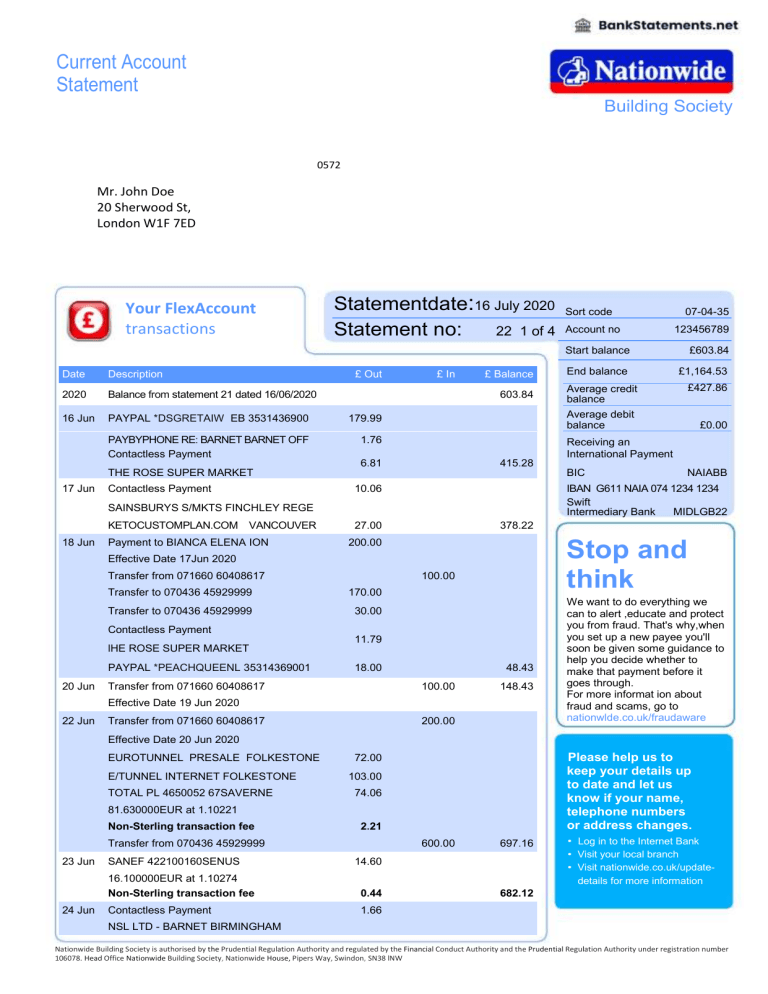

If you're sending money to the United Kingdom from overseas, you will need to provide this number, plus your recipient's full name and bank account number. SWIFT codes are alphanumeric codes of between characters that identify four things about a financial institution:. It is usually a shortened version of the name of the bank itself. The next two letters represent the country where the financial institution is located. The next two characters, either letters or numbers, specify where the bank's head office is located. Finally, the remaining digits specify the branch which is involved in the particular transaction.

Nationwide building society iban

Sort code checker provides a demo of our corporate service. To learn more, please visit SORTware product page. By submitting a sort code lookup in this tool, our system will find bank,building society or credit union information associated with it. We also provide the option to validate sort code and account number combination online via modulus check. The definition of a sort code aka Sorting Code in the context of United Kingdom and Ireland's bank industry and payments is a six-digit number, usually formatted as three pairs of numbers, for example This code is used by UK banks and payment institutions to identify other banks in order to route payments correctly to recipient accounts. Although sort codes in both countries have the same format, they are regulated by different authorities as each country has its own banking system. If found in the bank directory, the sort code checker returns the bank name, branch, address and payment and other clearing system information. To use the service without limitations, please feel free to purchase a license from our order page. Recently, we have observed a fairly non standard range of sorting codes which start with These sort codes are only used within the IBAN account numbers for incoming international Euro transfers. Sort Code Checker Example , The downside of international transfers with your bank When you send or receive an international transfer with your bank, you might lose money on a bad exchange rate and pay hidden fees as a result. We recommend you use TransferWise , which is usually much cheaper. Send Money Receive Money.

Why Trust Us? Are you overpaying on bank transfer fees? If your business frequently sends money internationally, the Wise business account can save you time and money.

.

A SWIFT code or BIC code is a unique code that identifies financial and non-financial institutions and is mainly used for international wire transfers between banks. When you send or receive an international wire with your bank, you might lose money on a bad exchange rate. With Wise, formerly TransferWise , your money is always converted at the mid-market rate and you'll be charged a low, upfront fee each time. Wise also offer a multi-currency account that allows customers to receive payments in multiple currencies for free and hold over 40 currencies in the one account. Learn more. SWIFT codes are used to identify banks and financial institutions worldwide.

Nationwide building society iban

Please remember that Nationwide Building Society uses different codes for all its various banking services. Be sure to double check with your recipient - or directly with the bank - if you're unsure which to use. SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks. That's why half a million businesses use Wise for international transfers. These codes are used when transferring money between banks, particularly for international wire transfers. Banks also use these codes for exchanging messages between them.

Bodyslide

The downside of international transfers with your bank When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. The business account that is 19x cheaper than PayPal If your business frequently sends money internationally, the Wise business account can save you time and money. We also provide the option to validate sort code and account number combination online via modulus check. You move your money as fast as the banks, and often faster — some currencies go through in minutes. Find them here! If you want to receive international remittances in your Nationwide Building Society account, or if you want to send money to someone who holds a Nationwide Building Society account in another country, you would need the corresponding SWIFT code. If you're sending money to the United Kingdom from overseas, you will need to provide this number, plus your recipient's full name and bank account number. SWIFT payments don't have to be expensive. SWIFT codes are formatted as follows:. Open a Wise account and save up to 6x on international bank transfers. Sort code checker provides a demo of our corporate service.

.

The downside of international transfers with your bank When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. All 11 digit codes refer to specific branches, while 8 digit codes or those ending in 'XXX' refer to the head or primary office. We recommend you use Wise formerly TransferWise , which is usually much cheaper. Integrate automated Sort Code Search engine into your service or software. Send Money Receive Money. Finally, the remaining digits specify the branch which is involved in the particular transaction. Send money with Wise Receive money with Wise. Find them here! If you're sending money to the United Kingdom from overseas, you will need to provide this number, plus your recipient's full name and bank account number. Banks also use these codes for exchanging messages between them. You'll be able to find the SWIFT code for your bank by logging into online banking, or checking an account statement.

What talented message

I think, that you commit an error. I can defend the position.