Nifty bollinger band

Note : Support and Resistance level for the day, calculated based on price range of the previous trading day.

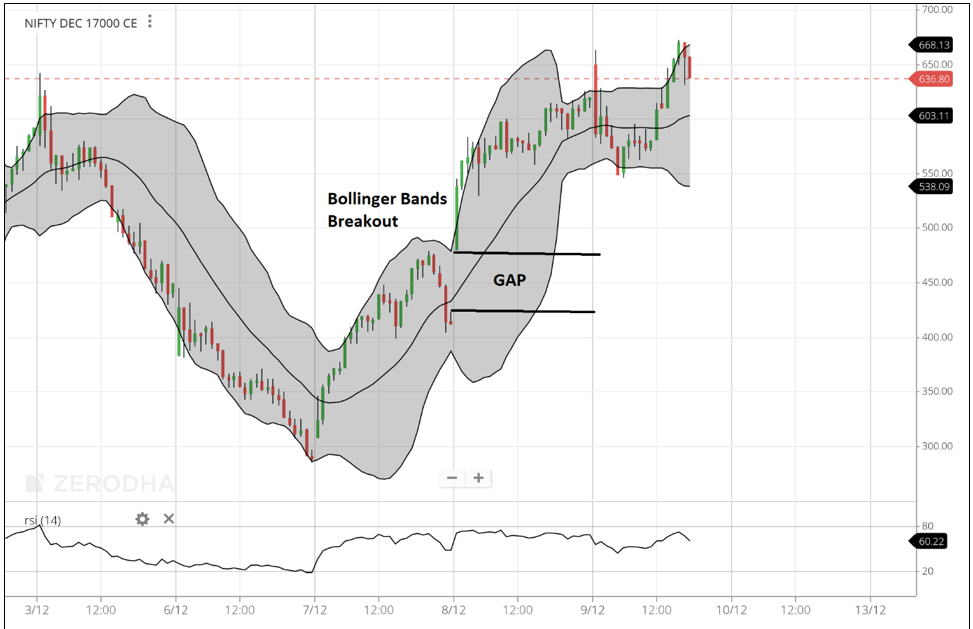

Bollinger bands are known as oscillator indicators which help to measure price volatility. They assist us in monitoring whether a price is high or low compared to its recent average and predict when it might rise or fall back to that level. This will help you decide when to buy or sell an asset. The RSI helps time the entries and exits to maximize profits before a price rises or falls. The central band depicts the price's simple moving average. The upper and lower bars represent levels where the price is relatively high or low compared to its recent moving average.

Nifty bollinger band

RSI and volumes show nothing significant as of now. BB squeeze can lead to massive up or down break. Waiting if it will breakout again this time. Hey, check out the trade setup for Industower All 3 parameters are matched for a short trade. Trade setup in Futures Short : Pfc looking weak on weekly charts break strong support. Price has met resistance at levels with 2 sweet Spinning Tops. Square off if it closes above on Daily. A tight stop loss but playing safe; open to fresh entries. The Equifax breach was not the largest ever, but it was notable for the The stock has broken out of an upward sloping triangle with good volumes. The shooting star at trendline and bollinger band resistance is followed by a red candle will lead to a pullback to the breakout resistance now support giving us an opportunity to buy. The RSI's overbought signal indicates the same. A very great stock, also considering the pressure on PSU

Stands for Average True Range. Historical Rating.

.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Nifty bollinger band

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. IN Get started. Volatility TradingView Tips. Bollinger Bands are a widely used technical analysis tool traders rely on to gauge market volatility and identify potential entry and exit points. Developed by John Bollinger in the s, they provide a simple yet effective method to analyze price trends and determine potential movements.

Moooo io

Show exercise Exercise 2: Find the area with higher volatility. Increasing the periods used will make the Bollinger bands smoother, and the price will break the bands less often. It stands for Average Directional Index. Value equal to 0 indicates Neutral condition. This refers to the length of time over which the indicator is calculated from the price action. It is a momentum indicator. Its purpose is to tell whether a stock is trading near the high or the low, or somewhere in between of its recent trading range. Setting a higher number of periods will make it less reactive and result in smoother lines. Higher than 20, minimal false trading signals can be expected, but trading opportunities may be missed. Get more out of Moneycontrol, Go Pro!

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView.

It is overbought when the price reaches the upper band; the asset trades at a higher price. The RSI's overbought signal indicates the same. Note : Support and Resistance level for the , calculated based on price range of the previous trading. It is a lagging indicator; that is, a trend must have established itself before the ADX will generate a signal. Value equal to 0 indicates Neutral condition. Square off if it closes above on Daily. IN Get started. Very high MFI that begins to fall below a reading of 80 while the underlying security continues to climb is a reversal signal to the downside. Open Account. MrAkshatP Updated. The stock has broken out of an upward sloping triangle with good volumes. The upper and lower bars represent levels where the price is relatively high or low compared to its recent moving average. Join Us On. Trade setup in Futures Short : Any breakout above or below the bands is a major event.

To fill a blank?