Nike cost of capital case study solution

Nike, Inc.

Nike, Inc. Not the questions you were looking for? Its components allow us to see how much it costs a company to raise money to finance new projects. By knowing the costs of financing a new project, we can select projects that offer a return that is higher than the WACC. We also agree that Cole Haan faces different risks in an entirely different industry, but since it represents such a small fraction of total revenues, we should not calculate its individual WACC. The U.

Nike cost of capital case study solution

This is an analysis on Nike Cost of Capital from an Investor's perspective and recommended financial decision that should be made Read less. Download Now Download to read offline. Recommended Marriott Corporation. Cost of Capital. Marriott Corporation. Cost of Capital TurumbayevRassul. Marriott case. Case study- Newell. Case study- Newell tanveerahmed Atlantic computer case analysis. Atlantic computer case analysis Farhan Khan. Presentation Case Tri Star - Final. Manzana insurance case study analysis. Abanta Kumar Majumdar. What's hot Case Analysis - Making stickk stick.

Calculate the costs of equity using CAPM, the dividend discount model, and the earnings capitalization ratio.

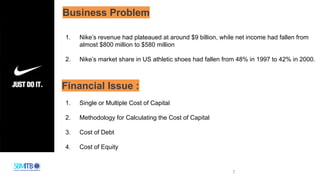

It also commits to cut down expenses. The market responded mixed signals to Nikes changes. Apparently, the issue of Nikes case is to control and check the calculation cost of capital done by Joanna Cohen who is the assistant of a portfolio manager at NorthPoint Group. The aim of our analysis is to show the mistakes appeared in estimating process of cost of capital done by Joana Cohen. This analysis will determine basic and general theory about cost of capital and relations, find out the mistakes of Joanna Cohen, and give the advices for Kimi Ford. Why is it important to estimate a firms cost of capital? What does it represent?

This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form. Report DMCA. Home current Explore. Home Case Study Nike, Inc. Words: 1, Pages: 6.

Nike cost of capital case study solution

Nike, Inc. Not the questions you were looking for? Its components allow us to see how much it costs a company to raise money to finance new projects. By knowing the costs of financing a new project, we can select projects that offer a return that is higher than the WACC.

5.5 pies a metros

Investors can use historical beta as the measure of future risk only if it is stable over time. Corporate Finance. Cost of Debt 7. What's hot Wrigley's case. In the other side, managers can use various methods to minimize companys cost of capital, changing the market price, the earning per share, bring out the benefit to company. Academic Documents. Apex corporation case study Utkarsh Shivam. What is a Company worth? Berlin Journal 06 Berlin Journal Preferred stock is given, however there is not enough information to calculate the cost of preferred stock, and its final weight is negligible regardless. It also commits to cut down expenses. Best decision to get my homework done faster! Upon purchase, you are forwarded to the full solution and also receive access via email. Summary of Ias 1 Summary of Ias 1. Professional Documents.

Nike, Inc.

Kimi Ford, a portfolio manager for NorthPoint Group, is looking for value opportunities. Tru earth case study Utkarsh Shivam. Christian Kameir. Download now. Business Problem 1. Jump to Page. Cultural background and entrepreneurial spirit in retail - European Business Marriott case. We found MV of L. Case study- Newell tanveerahmed It is better than many alternative subjective methods of determining risk and risk premium.

It is scandal!

Excuse, that I interfere, but, in my opinion, there is other way of the decision of a question.