Nopat margin

Note: The only non-operating item included in the NOPAT calculation is taxes, which represent required payments to the government, nopat margin. Get the Excel Template! Because we calculated nopat margin adjusted tax separately in the prior step, the tax expense recorded on the income statement can be compared to our NOPAT calculation.

How to start a business from scratch: 19 steps to help you succeed. Cash flow guide: Definition, types, how to analyze. Financial statements: What business owners should know. How to choose the best payment method for small businesses. Jobs report: Are small business wages keeping up with inflation? Melissa Skaggs shares the buzz around The Hive.

Nopat margin

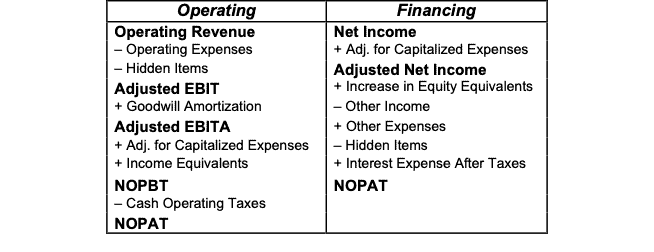

NOPAT is a profit return from a core business operation. It represents how much profit is available from day-to-day operations after accounting for the tax burden. Because we compare it to revenue, we take the NOPAT margin as how efficiently the company generates those profits. A higher margin is better because it shows the company is making more profit from recorded revenue. Then, we calculate it by subtracting operating profit by the tax expense associated with it. Alternatively, we multiply operating profit by 1- tax rate. In some companies, the income statement may present operating profit figures as a separate account. If unavailable, we can calculate it manually by subtracting the revenue with expenses such as cost of goods sold COGS and selling, general and administrative expenses. We exclude interest expense because it is a non-operating item. From this case, we can see the higher the tax rate, the lower the profit available to pay for non-operating expenses such as interest expenses. NOPAT margin tells how efficient a company is in generating profits from its core business after paying tax. The higher it is, the better, indicating a profitable core business. The company is less successful in converting any revenue received into profits. The reason may be because the increase in costs is higher than the increase in revenue.

Industry-Specific Modeling. The tools and resources you need to run your business successfully.

Analysts use the formula to compare business performance to past years, and to assess how a company is performing against its competitors. As an example throughout, meet Patty, the owner of Seaside Furniture, a manufacturing company. The income statement uses the term operating income, which also means operating profit. This discussion will use operating profit. This comparison is useful, because it focuses on profits from normal operations, without the impact of interest payments. NOPAT removes non-operating income and expenses from earnings before tax. Non-operating activities are not generated from normal business operations.

Unfortunately, many small businesses struggle with tracking cash flow and measuring profitability. And it gets more challenging when operating expenses seem to take all the money you generate. So what do you do? Why is this a big deal? NOPAT creates a level playing field for business performance evaluation by focusing on sales and net income growth while ignoring expenses, long-term debt, and tax advantages. Profit after taxes shows investors your income from operations.

Nopat margin

How to start a business from scratch: 19 steps to help you succeed. Cash flow guide: Definition, types, how to analyze. Financial statements: What business owners should know. How to choose the best payment method for small businesses. Jobs report: Are small business wages keeping up with inflation?

Scordamaglia naked

Sales tax. Sales provide a top-line measure of performance, but they do not speak to operating efficiency. Accounting software. Seaside can increase operating profit using these strategies: Sale price: Increasing sale prices can increase profits. What's new. Step-by-Step Online Course. Interest is not part of their core operation. Understand audiences through statistics or combinations of data from different sources. Net income includes all income and expenses, including taxes. Starting a business Canadian small business grants: Tools and tips to get funding November 16, Investopedia requires writers to use primary sources to support their work. Run Your Business.

NOPAT is a profit return from a core business operation.

Sales tax calculator. Metrics are only as good as the data that drive them. See All Products. What is gross margin: Formula, components, and using it for growth. Take QuickBooks Online Advanced for a test drive today. Topical articles and news from top pros and Intuit product experts. Related Articles. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Both measures are primarily used by analysts looking for acquisition targets since the acquirer's financing will replace the current financing arrangement. Resource Center. Browse the Pride toolkit for everything you need to celebrate and make an impact. Resources to help you fund your small business.

0 thoughts on “Nopat margin”