Nse:emil financials

Stock with good financial performance alongside good to expensive valuation. The Estimates data displayed by Moneycontrol is not a recommendation to buy or sell any securities, nse:emil financials.

Add Your Ratio. Track the companies of Group. Retailing sector can be divided into various categories, depending on the types of products serviced. It covers diverse products such as food, apparel, consumer goods, financial services, and leisure. Growth in the Indian retail industry has been driven by the country's economic fundamentals over the past few years. India is a fast-evolving and dynamic consumer market which necessitates the retails industry to be constantly innovative to stay relevant in the market. The growing population and continuous demand are witnessing significant opportunities in the retail industry.

Nse:emil financials

Electronics Mart India Limited. Electronics Mart India Limited operates as an electronic retailer in India. About the company. The company offers large appliances, such as televisions, refrigerators, washing machines, and air conditioners; phone, tablets, fitness tracker, and smart watches; and small appliance, IT and other products including laptops, printers, coolers, geysers, personal computer, cables, screen guards, headphones, bluetooth speakers, ceiling fans, personal care devices, kitchen hob, chimney, water purifies, rice cookers, and mixer grinders. Price-To-Earnings ratio Earnings are forecast to grow Earnings grew by Trading at good value compared to peers and industry. Has a high level of debt. New minor risk - Financial position Feb See more updates Recent updates. Third quarter earnings released Feb Price Volatility. Is EMIL's price volatile compared to industry and market? How do Electronics Mart India's earnings and revenue compare to its market cap?

Trading at good value compared to peers and industry. The company has a high promoter holding of

Incorporated in , Electronics Mart India Limited is the 4th largest consumer durable and electronics retailer in India. The company offers a diversified range of products with a focus on large appliances air conditioners, televisions, washing machines, and refrigerators , mobiles and small appliances, IT, and others. The company's offering includes more than 6, SKUs stock keeping units across product categories from more than 70 consumer durable and electronic brands. Market Position The company is the largest player in the Southern region in revenue terms with dominance in Telangana and Andhra Pradesh and the 4th largest consumer durables and electronics retailer in India. Please exercise caution and do your own analysis. Sector: Retail Industry: Trading. Consolidated Figures in Rs.

Yahoo Finance. Sign in. Sign in to view your mail. Currency in INR. Valuation Measures 4 Market Cap intraday Share Statistics Avg Vol 3 month 3

Nse:emil financials

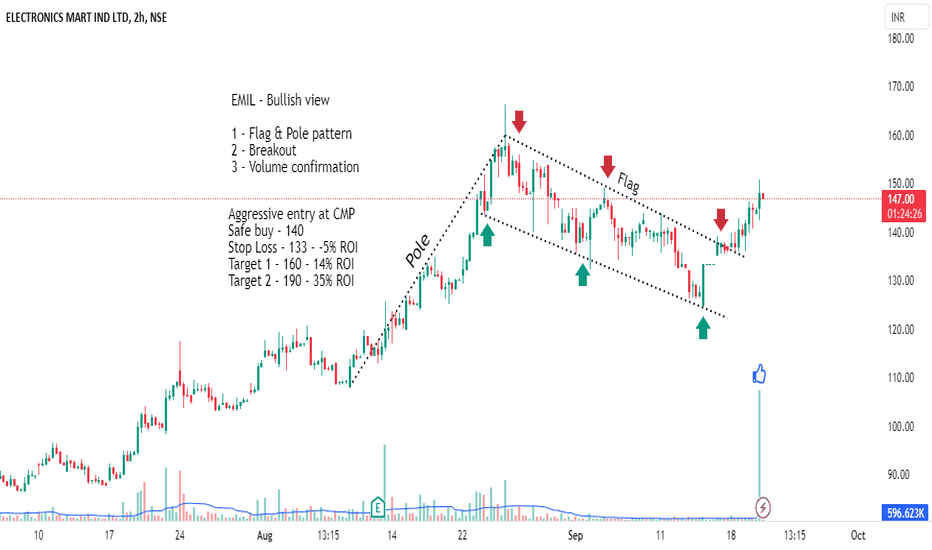

See all ideas. See all brokers. IN Get started. Market closed Market closed. No trades. EMIL chart.

Whatomine

Cancel Submit. Please exercise caution and do your own analysis. Index Presence The company is present in 6 Indices. Add Your Ratio. Number of MF schemes increased from 10 to 13 in Dec qtr. Electronics Mart India Ltd Notebook. The current ratio of Electronics Mart Ind is 1. Last Reported Earnings Dec 31, View more. Ex-Right Ratio Premium. Powered by. Please select a Day. Shareholding Pattern Numbers in percentages. Growth in the Indian retail industry has been driven by the country's economic fundamentals over the past few years.

VWAP

No: , Shop No. View Valuation. Top 5 Trending Stocks. Earnings are forecast to grow Companies that are decreasing efficiency in utilisation of Shareholders funds. Past Performance. Rising Book Value. Corporate Action. Sales Growth Pavan Kumar Bajaj, Promoter of the Company has gifted 38,47, equity shares of the Company having face value of Rs 10 each to his …. Pavan Kumar Bajaj, Promoter of the Company has gifted 38,47, equity shares of the Promoters play a crucial role in the strategic direction and long-term vision of a company. Profit Excl OI Op.

I am final, I am sorry, but it at all does not approach me. Who else, what can prompt?

I can not take part now in discussion - there is no free time. I will be free - I will necessarily write that I think.