Octa cloud gst

Over the time it has been ranked as high as in the world, while most of its traffic comes from India, where it reached as high as 35 position.

Compare software prices, features, support, ease of use, and user reviews to make the best choice between these, and decide whether Octa Gst or SahiGST fits your business. Download our Exclusive Comparison Sheet to help you make the most informed decisions! Have you used Octa Gst before? Write a Review. In this software, I found it quite easy to file various forms under one single roof. The application provides me with all the necessary forms Form 1, 1A, 3, etc.

Octa cloud gst

Best GST Software for CA: Many beneficial features are incorporated in tax preparation software for experts, on which companies and businesses may count while filing their returns. These GST software applications are simple and straightforward to directly connect with the accounting system, and information can be effectively exported to submit supplementary returns or potentially create MIS reports. Secondly, each application offers a wide range of additional perks to easily tackle your compliance requirements and focus on saving you from being a debtor. It is an indirect tax regime that has substantially substituted a few other indirect taxes in India, including excise duty, VAT, and services tax. A good and strong GST-compliant accounting system is a perfect match for your commercial applications. Deeply anxious that you may have submitted factually incorrect tax returns and also that the tax department may summon you? Nearly every single corporate field has considered the consequences of GST, and many professions are also directly influenced by the new indirect tax framework. Chartered Accountant is one of the sectors that would be significantly affected by the advent of GST. It tackles any underlying issues that emerge as a consequence of GST filing inaccuracies and deduction claims that assure massive profits. In addition, because all financial transactions are documented on the software, GST filing is largely automated. With more and more GST apps accessible to the public, it may be tough to carefully select reliable and consistent software.

Worldwide Audience Compare it to

Confused in complicated laws? Click here to know more. GST has created a lot of burden on Chartered accountants as well as business organizations as it includes lot of compliances. The other tax liabilities such as VAT, service tax etc. Now there is only one indirect tax regime that need compliances. However, this increased calls for practicing chartered accountants to utilize GST-prepared software to meet operational and consistence needs for their training, yet also for their clients. The increase in eagerness for CAs has made it essential to get quality GST programming for Chartered Accountants to empower their work.

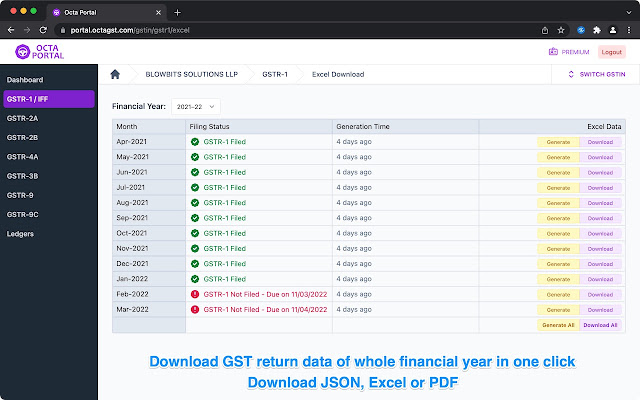

Cloud-based invoicing and GST returns solution for businesses. Most viewed in You are being shown a subset of the data for this profile. Copy Url. Octa company profile.

Octa cloud gst

No manual data entry required. Export data from accounting software and import in Express GST in just a click of a button. Calculate accurate ITC with invoice reconciliation and vendor management. Generate tax reports, financial reports, top vendor reports, top clients report, and many more in multiple formats in just a click of a button. Identification of mismatches or excel like functioning with Linking or Delinking of matched invoices. View Multiple Reports of different sections in one go for easy comparison. Drag , Maximize and Minimize reports as per your needs to view Comparisons side by side. With many changes to how businesses account for their purchases, sales and calculation of input tax credits, Express GST makes it easy and fast for your business to transition to being fully GST compliant. Read more! You will always be using the most up-to-date software.

Season 5 cast walking dead

Read less. However, Octa GST has made it easier to reconcile each invoice. IGST on the import. Secondly, each application offers a wide range of additional perks to easily tackle your compliance requirements and focus on saving you from being a debtor. Whenever you login in a client account for first time after installing extension, it asks whether you want to save client. Recommended Products. Amit Kapoor. Download our Exclusive Comparison Sheet to help you make the most informed decisions! Mexico Arul Murugan K. Octa GST 1. Following are the key benefits this software will provide:. The data will also be reconciled automatically. Key Features: It works on an independent platform with highly secured language. Posted - Jan 21, ITC is a mechanism to.

Please plan the security and regular backups of Octa GST data.

It all depends on the functionalities that you prefer. What's hot 14 QuickBooks Salesforce Connector. Value for Money. Save my name, email, and website in this browser for the next time I comment. Moreover, there are various other benefits provided by each software that will handle your compliances and will prevent you from becoming defaulter. Key Features: You can do audit trail from time to time and manage your inventory through this software. Therefore, import of goods or services is considered as interstate supply and is liable for payment of IGST. It depends upon your business requirement. Skip to content. Input Tax Credit ITC means claiming the credit of the GST paid on the purchase of goods and services which are used for the furtherance of the business. A good and strong GST-compliant accounting system is a perfect match for your commercial applications. Free Expert Consultation. World Financial Planning Day by Slidesgo.

I consider, that you are mistaken. Let's discuss it. Write to me in PM, we will talk.

Very well.