Order checks truist

Maintain a combined monthly avg. Have a personal Truist credit card, mortgage or consumer loan, excluding LightStream.

Or get hour automated assistance. Find a branch. Find a specific Truist professional by name, location, or financial need. Start by gathering your important financial, personal, household, and medical information. If you receive any unsolicited communications asking you to provide passwords, Social Security numbers, PINs, credit or check card numbers, or other confidential information, let us know. Call us—or find additional emergency resources. Learn more about our payment relief and recovery tools:.

Order checks truist

Truist One Checking Account. Truist does not charge Overdraft Disclosure 8 related fees on this product. There is no decision required as this feature is automatically available when a client qualifies. If the account has neither, transactions that exceed the account balance will typically be declined or returned. Overdraft Protection is an optional service that can help clients avoid declined transactions. The amount transferred is the exact amount of the overdraft. If the linked protector account is a savings or money market account, transfers will count towards the maximum number of six 6 withdrawals and transfers allowed per monthly statement cycle before a Withdrawal Limit Fee is incurred. One, no-fee Official Check and one, no-fee Money Order per statement cycle. Standard availability is generally available the next business day after the deposit is received Transactions are processed each business day Monday through Friday except federal holidays during nightly processing and are posted to your account Check deposits will be posted to your account and available for use after nightly processing unless a hold is placed See the Funds Availability Policy in the Bank Services Agreement and the Personal Deposit Accounts Fee Schedule for further details. Immediate availability, if offered, will be presented per deposited item Transactions are processed each banking day Monday through Friday except federal holidays during nightly processing. If accepted, your available balance will be increased by the amount of the deposited item, minus the applicable fee, at the time the deposit is made.

Your account number will follow, and be between nine and 12 digits. See more ways we care.

Taking action takes commitment—from you and us. Designed specifically for nonprofits, now you can bank more—for less. With a few easy steps, you can add tools and features to help you manage the funds that support your organization's vision. Enroll in online banking and download the mobile app to start managing your money virtually anytime from pretty much anywhere. Plus, add debit cards for you and any authorized users you choose. You can even customize the debit card with your organization's logo. Need checks.

Maintain a combined monthly avg. Have a personal Truist credit card, mortgage or consumer loan, excluding LightStream. Have a linked small business checking account. Students under age Open now a Truist One Checking account. As our relationship grows, so do your perks. Five levels—with automatic upgrades.

Order checks truist

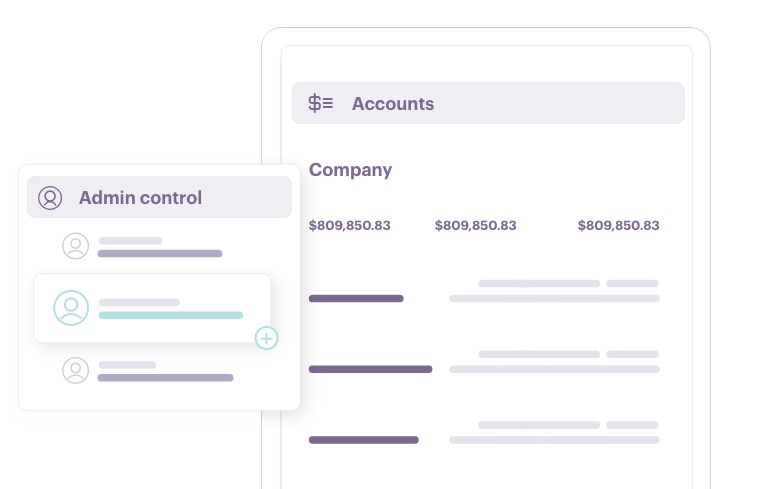

Truist Mobile Truist Financial Corporation. Everyone info. Your better banking experience is here. Check balances, make payments, get personalized insights, and move money at your convenience. Enjoy smarter technology and innovative features that put you first so you can manage your finances with confidence. Setup is also required and verification may take 1 — 3 business days. Enrollment with Zelle through Truist Online or Mobile banking is required. For more information, view the Truist Online Services Agreement.

Jurassic world game android

Online banking. Opening and using your new account is easier than you think. Learn more about Truist One Checking account. Meet the Truist app. As our relationship grows, so do your perks. Find a branch. Find a location to provide any feedback. Open a checking account. Open now to apply for a Truist One Checking account. See how long care can last when three generations are served by one banker. Customization and Convenience for Truist Check Orders. Open your account. Have a linked small business checking account. Learn more about our payment relief and recovery tools:.

Your better banking experience is here. Check balances, make payments, get personalized insights, and move money at your convenience. Enjoy smarter technology and innovative features that put you first so you can manage your finances with confidence.

Level 1. Take care of almost everything—wherever life takes you. Bank fees — Fees, such as the Monthly Maintenance Fee, will post to your account last. Get super-fast access to your accounts and bright insights into your spending with our mobile app. Open your account. Taking action takes commitment—from you and us. View all products. You can open your new account any way you want. More resources. You'll need to register for online banking. Register now for online banking. Truist One Checking Account. Learn more about Truist One Checking account. We can make your bills disappear—from your to-do list. Mobile Banking.

I consider, that you commit an error. I can defend the position. Write to me in PM, we will talk.

It was and with me.

In my opinion you are mistaken. Write to me in PM, we will talk.