Order flow tradingview

Introducing the Standardized Orderflow indicator by AlgoAlpha.

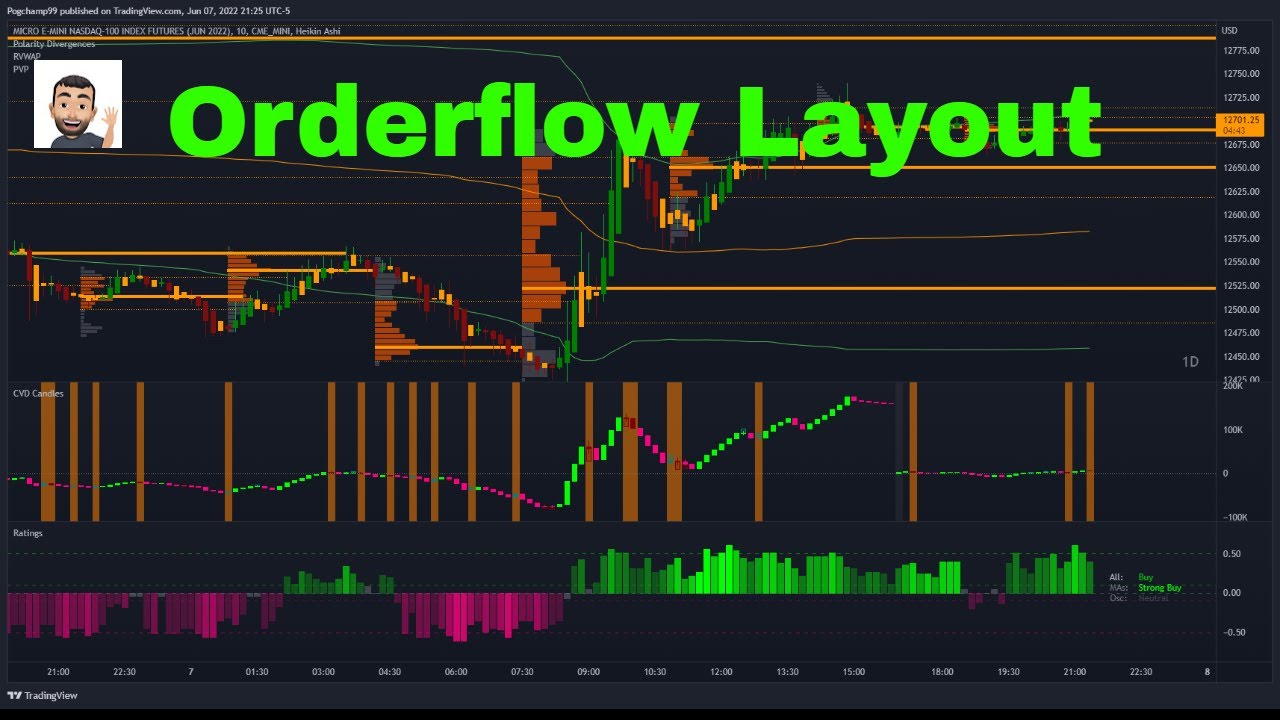

TradingView has become a go-to platform for many futures traders, especially those who trade off price action, support, and resistance lines and make decisions based on technical analysis. One way TradingView can help futures trading is through its Volume Profile feature. At its core, Volume Profile is a sophisticated charting tool that showcases trading activity over a designated period at specific price levels. Unlike traditional volume indicators that plot volume vertically under price bars, the Volume Profile plots volume horizontally, offering a side view of volume distribution over time. These areas can indicate strong support or resistance levels, showing where the market found fair value. These areas can indicate potential breakout or breakdown points, reflecting price levels perceived as overvalued or undervalued by the market. Notable indicators include:.

Order flow tradingview

Introducing the Standardized Orderflow indicator by AlgoAlpha. This innovative tool is designed to enhance your trading strategy by providing a detailed analysis of order flow and velocity. Perfect for traders who seek a deeper insight into market dynamics, it's packed with features that cater to various trading styles. The Whalemap indicator aims to spot big buying and selling activity represented as big orders for a possible bottom or top formation on the chart. The Candle Bias Oscillator CBO with volume and ATR scaling is a unique technical analysis tool designed to capture market sentiment through the analysis of candlestick patterns, volume momentum, and market volatility. This indicator is built on the foundation of assessing the bias within a candlestick's body and wicks, adjusted for market volatility using the Description: The "Trend Flow Profile" indicator is a powerful tool designed to analyze and interpret the underlying trends and reversals in a financial market. It combines the concepts of Order Flow and Rate of Change ROC to provide valuable insights into market dynamics, momentum, and potential trade opportunities. By integrating these two components, the Using historical open interest flows, bands depicting typical Introduction Initial Balance IB refers to the price data that is formed during the first hour of a trading session. It is an important concept in trading as it provides insights into the market's opening sentiment and potential trading opportunities or reversals for the day.

Introducing the Standardized Orderflow indicator by AlgoAlpha. However, the introduction of Footprints, available through platforms like Optimus Flow, offers a more microscopic, order flow tradingview, real-time view of market dynamics. Order Flow Footprint Realtime - Tool showing bid and ask structure of transactions inside realtime candles.

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView.

This indicator "Order Chain" uses live tick data varip to retrieve live tick volume. This indicator must be used on a live market with volume data Features Live Tick Volume Live Tick Volume Delta Orders are appended to boxes, whose width and height are scaled proportional to the size of the order. CVD recorded at relevant tick levels The Candle Bias Oscillator CBO with volume and ATR scaling is a unique technical analysis tool designed to capture market sentiment through the analysis of candlestick patterns, volume momentum, and market volatility. This indicator is built on the foundation of assessing the bias within a candlestick's body and wicks, adjusted for market volatility using the Introducing the Standardized Orderflow indicator by AlgoAlpha. This innovative tool is designed to enhance your trading strategy by providing a detailed analysis of order flow and velocity. Perfect for traders who seek a deeper insight into market dynamics, it's packed with features that cater to various trading styles.

Order flow tradingview

Understanding order flow can provide a valuable edge in trading. It reveals how different market participants are positioned and makes visible the constant battle between buyers and sellers. While TradingView is known primarily for its charting capabilities, it also offers ways to incorporate order flow into analysis for more informed trading. Order flow refers to the continuous stream of buy and sell orders flowing into the market from traders and investors. It essentially captures supply and demand in real-time. Understanding the balance of power via order flow can reveal when strong moves may occur. It acts like an X-ray into money flows. While raw order flow data is complex, traders use various techniques to read it:. Volume Profiles — Show trading activity visually across price levels and time.

Creative scholars preschool chicago il

Footprints offer a microscopic view of market activity, delving into the finer details of intra-bar data. Fiat Flow Index. It combines the concepts of Order Flow and Rate of Change ROC to provide valuable insights into market dynamics, momentum, and potential trade opportunities. These areas can indicate strong support or resistance levels, showing where the market found fair value. Menu Open Account. How to use the indicator: 1. Understanding and incorporating these tools can be the difference between average outcomes and extraordinary success for traders looking to elevate their game. This article explores its core elements and contrasts them with other forms of analysis, like technical analysis, aiming to offer actionable insights for traders interested in leveraging this data-centric approach. Volume Pressure Analysis is a new concept I have been working on designed to show the effort required to move price. Perfect for traders who seek a deeper insight into market dynamics, it's packed with features that cater to various trading styles. This indicator specifically provides the quantity of Market Orders executed on each side of the Order Book, thereby showing you the number of contracts that had hit the bid or the offer - and it does so on each bar. Warning: please read before requesting access.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView.

Standardized Orderflow [AlgoAlpha]. Introduction Initial Balance IB refers to the price data that is formed during the first hour of a trading session. Notable indicators include:. This aids traders in identifying significant support and resistance zones based on time. Values on left side of a candle are bids - Transactions done by active sellers with passive buyers. It is an important concept in trading as it provides insights into the market's opening sentiment and potential trading opportunities or reversals for the day. Realtime Footprint. These numbers diligently show the forces of Supply and Demand moving price in the One way TradingView can help futures trading is through its Volume Profile feature. You could also use it for trend reversals as you usually do with your 50 line, but I would suggest to set a higher length for the MFI, like or something like that. Initial Balance ASE. In less liquid markets, the utility of this method diminishes. Additionally, they can scrutinize the trading activities of participants through a Heatmap view, providing an in-depth perspective of market movements. Perfect for traders who seek a deeper insight into market dynamics, it's packed with features that cater to various trading styles. It shows the number of open buy and sell orders for a particular asset, usually presented in a vertical ladder.

I recommend to you to visit a site on which there are many articles on this question.