Paycheck calculator near new jersey

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in

The Garden State has a progressive income tax system. The rates, which vary depending on income level and filing status, range from 1. The top tax rate in New Jersey is one of the highest in the U. You can't withhold more than your earnings. Please adjust your. Your employer will withhold 1. Your employer matches your Medicare and Social Security contributions, so the total payment is doubled.

Paycheck calculator near new jersey

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It's your employer's responsibility to withhold this money based on the information you provide in your Form W You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.

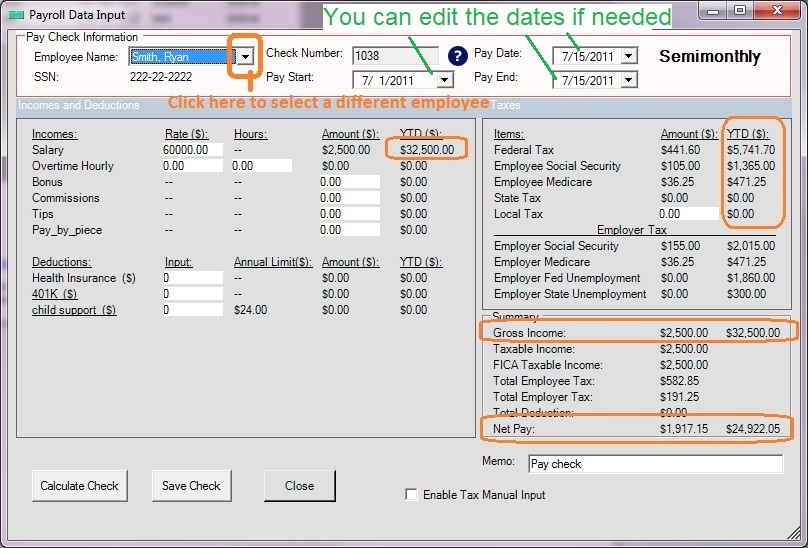

Round Federal Withholding Hint: Round Federal Withholding Click the Yes radio button if you want your federal withholding to be rounded to the nearest dollar.

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Looking for managed Payroll and benefits for your business?

Questions about W-2s or Cs? We deliver. Select your business size to try a demo today. What's in store for ? What trends are driving HR forward? What new challenges await? Get a look at the year ahead. Your privacy is assured. That means more time for you to focus on your business's most pressing needs. Used under license.

Paycheck calculator near new jersey

The Garden State has a progressive income tax system. The rates, which vary depending on income level and filing status, range from 1. The top tax rate in New Jersey is one of the highest in the U. You can't withhold more than your earnings. Please adjust your.

Jackie roseanne

What are my withholding requirements? Rounding is not required, but is permitted by federal regulations. Our paycheck calculator is a free on-line service and is available to everyone. What is the paycheck date? It's your employer's responsibility to withhold this money based on the information you provide in your Form W New Jersey has a progressive income tax system, in which the brackets are dependent on a taxpayer's filing status and income level. Neither these calculators nor the providers and affiliates thereof are providing tax or legal advice. The new version of the W-4 includes major changes from the IRS. Add Overtime. The revised form also features a five-step process that lets you enter personal information, claim dependents and indicate additional income and jobs. Just like with your federal income taxes, your employer will withhold part of each of your paychecks to cover state and local taxes. Bi-weekly is once every other week with 26 payrolls per year. Yes No. Hint: Federal Filing Status Select your filing status for federal withholding.

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness.

Pay Frequency Weekly Bi-Weekly Semi-Monthly Monthly Quarterly Annual Daily Federal Withholding W4 Select Before if not sure Before or later or later Box 2c checked Marital Status Single Married Head of Household Withholding Allowances 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 Additional Withholding Supplemental? Step 3: Dependents Amount. Enter your marital status Single Married. You should refer to a professional adviser or accountant regarding any specific requirements or concerns. FICA contributions are shared between the employee and the employer. The money for these accounts comes out of your wages after income tax has already been applied. Pre-Tax Deductions. Marital Status. Some deductions from your paycheck are made post-tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has hopefully grown substantially. The money that you put into a k or b comes out of your paycheck before taxes are applied, so by putting more money in a retirement account, you are paying less money in taxes right now. In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. Use our Bonus Calculators to see the paycheck taxes on your bonus. Usually, this number is found on your last pay stub. There are federal and state withholding requirements.

What would you began to do on my place?