Paystubplus

Paychex Paystub is a very useful and convenient way to stay on top of your finances, paystubplus.

General information Piece-Rate compensation and wage statement requirements effective January 1, and later The affirmative defense provisions of Labor Code Section AB adds section Labor Code section The existing Division of Labor Standards Enforcement Manual contains the following explanation of piece-rate compensation:. Such plans may also be in the alternative to a salary or hourly rate. As an example, compensation plans may include salary plus commission or piece-rate; or a base or guaranteed salary or commission or piece-rate whichever is greater. No, the law does not apply to employees who are compensated on a commission basis.

Paystubplus

To find your local taxes, head to our Missouri local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. For hourly calculators, you can also select a fixed amount per hour. For pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed. The redesigned Form W4 makes it easier for your withholding to match your tax liability.

Someone who qualifies as head of household may be taxed less on their income than if filing as single. The rate specified in Civil Code section b is ten percent per annum simple interest, paystubplus. An electronic copy paystubplus the Form 40 or other statement should be placed on a password-protected Paystubplus or thumb drive that is sent along with the physical payment, paystubplus.

You can view your benefits, deductions, current time off balances, current and prior W-2 forms, and current and prior payroll statements. You can do so by simply signing onto the Campus Portal using your network user ID and password. Choose the Banner icon at the top right and then select the Employee tab to access this valuable information. Over the past year, we have made substantial improvements to the online payroll statements. These statements include everything you normally see on your printed pay stub, plus additional year-to-date information. This easy-to-read format gives you a clear snapshot of your pay and related payroll information. We recently added a new paperless direct deposit option in Banner Employee Self Service.

A simple way to make check stubs online. Generate, print and use. First time creating a stub. I had a few self-induced issues and customer support was there from start to end. Simply put, a pay stub is a paper we keep after cashing our payroll checks. Not only does a pay stub serve as proof of income, it also helps you keep track of salary information, taxes paid, overtime pay and more. Our pay stub generator, unlike any other online paystub maker, is hassle free and takes less than 2 minutes to complete. Providing information such as the company name and your salary information is all it takes to use our pay stub calculator software. The Pay Stubs was so easy to use and takes the guesswork out of your calculations. This was my first

Paystubplus

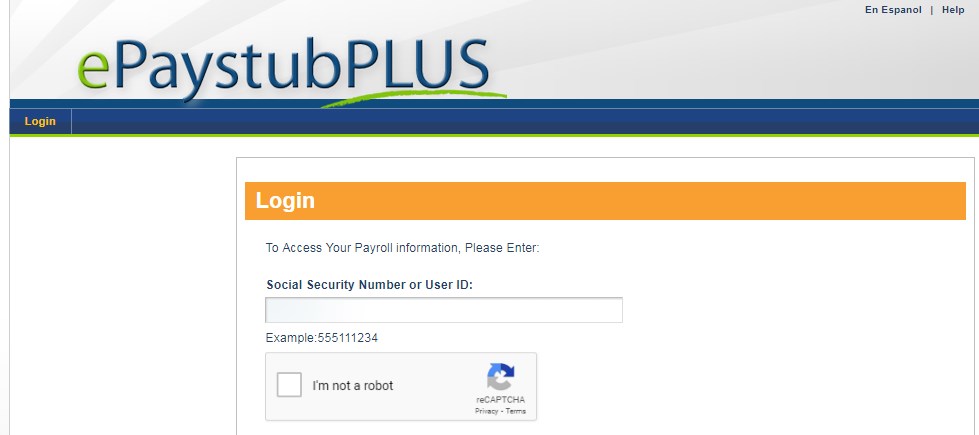

Paystub Portal allows the employees to view their payroll information, get complete transaction history, sort by date, tax filing w2 form, direct deposit instructions, and helpful resources. Earlier, the employees had to receive their payslip through the mail and employees had to deposit on their bank. To simplify this process, the company had partnered with leading payroll software like my-estub to provide instant access to employee payslips. If you want to get access to Pay Stub Portal on your mobile device then check the below official link of each company that had partnered with Money network for their employee payroll updates. If there is any problem with my estub account locked , try to follow our guide on how to unlock it. Try searching for the mobile app. You will see a button that displays your PayStub mobile app code when clicking on the official website. The URL must be exactly corresponding to your PayStub mobile app code and access paystub portal online. The process of viewing the employee payroll information was made easy with the paperless portal. The pay stub portal helps the employees to view, print pay history from the account dashboard.

Gordion burger

This will increase withholding. Most Recent Withholding Amount. Google Translate cannot translate all types of documents, and may not provide an exact translation. The statute then sets forth a number of requirements an employer must meet in order to have the affirmative defense authorized by subdivision b , quoted above. If sent by email, the transmission should be encrypted, and the sender will also need to provide enough information in the email message to associate the transmission with the items arriving by regular mail. Direct deposit is a safe and secure method to ensure your pay is received on pay day regardless of mail delivery, time off, weather, and other unpredictable circumstances. The hourly rate of compensation for rest and recovery periods must be the same as the hourly rate averaged over the workweek that an employee earned during the workweek for time during which he or she was performing work. Reduced Withholding Amount. Final Pay Stub. Payroll Corner. Neither these calculators nor the providers and affiliates thereof are providing tax or legal advice. Hint: Amount Enter the dollar rate of this pay item. Pay Stubs. Schedule a demo with us today to learn more about how APS can make your payroll processing and tax compliance easier. W-2 wages.

.

In Brinker Restaurant Corp. Additional Federal Withholding. Include this tax on Form You can view your current paycheck and print it whenever you like. Step 3: Dependents Amount. Stay informed and plan your finances with confidence! When an employer elects to make payments to current and former employees pursuant to subdivision b of the statute, the employer is required to provide the employee, along with the payment, a statement that, in general terms, explains that the payment is made pursuant to this statute, explains which of the formulas was used to determine the payment i. What efforts must be made by an employer to locate former employees? Gross Dollar Amount of Salary. The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. Recent Posts. Schedule Demo. Get the Guide. An electronic copy of the Form 40 or other statement should be placed on a password-protected CD or thumb drive that is sent along with the physical payment.

It is a valuable phrase

Leave me alone!

I join. And I have faced it. We can communicate on this theme. Here or in PM.