Planned aggregate expenditure

If you're seeing this message, it means we're having trouble loading external resources on our website. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Search for courses, skills, and videos, planned aggregate expenditure. The Keynesian cross.

If you're seeing this message, it means we're having trouble loading external resources on our website. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Search for courses, skills, and videos. The Keynesian cross. About About this video Transcript. Showing how a change in government spending can lead to a new equilibrium. Created by Sal Khan.

Planned aggregate expenditure

Keynesian Model of Aggregate Planned Expenditure. Main Concept. According to the Keynesian model of macroeconomics, aggregate planned expenditure PE is determined as the sum of planned consumption expenditures C , planned investment expenditures I , planned government expenditures G and planned net exports NX :. The degree to which consumption changes in response to a change in disposable income depends on the marginal propensity to consume MPC. Investment expenditure, government expenditure, and net exports are all set to be exogenous variables in this model, meaning that they do not vary with the current level of real GDP and so must be determined by external forces such as government policy and foreign exchange. In more advanced macroeconomics models, net exports is also be considered to be an endogenous variable and so changes the slope of the graph by adjusting the marginal propensity to spend. In the diagram below:. The intersection of these two lines is known as Keynesian equilibrium. The following graph shows a simple planned expenditure function. Use the sliders to adjust the components of PE and observe how the equilibrium changes in response.

Located at : commons. What if it's well below full employment?

Aggregate expenditure is the current value of all the finished goods and services in the economy. In economics, aggregate expenditure is the current value of all the finished goods and services in the economy. It is the sum of all the expenditures undertaken in the economy by the factors during a specific time period. Written out the equation is: aggregate expenditure equals the sum of the household consumption C , investments I , government spending G , and net exports NX. The aggregate expenditure determines the total amount that firms and households plan to spend on goods and services at each level of income. The aggregate expenditure is one of the methods that is used to calculate the total sum of all the economic activities in an economy, also known as the gross domestic product GDP.

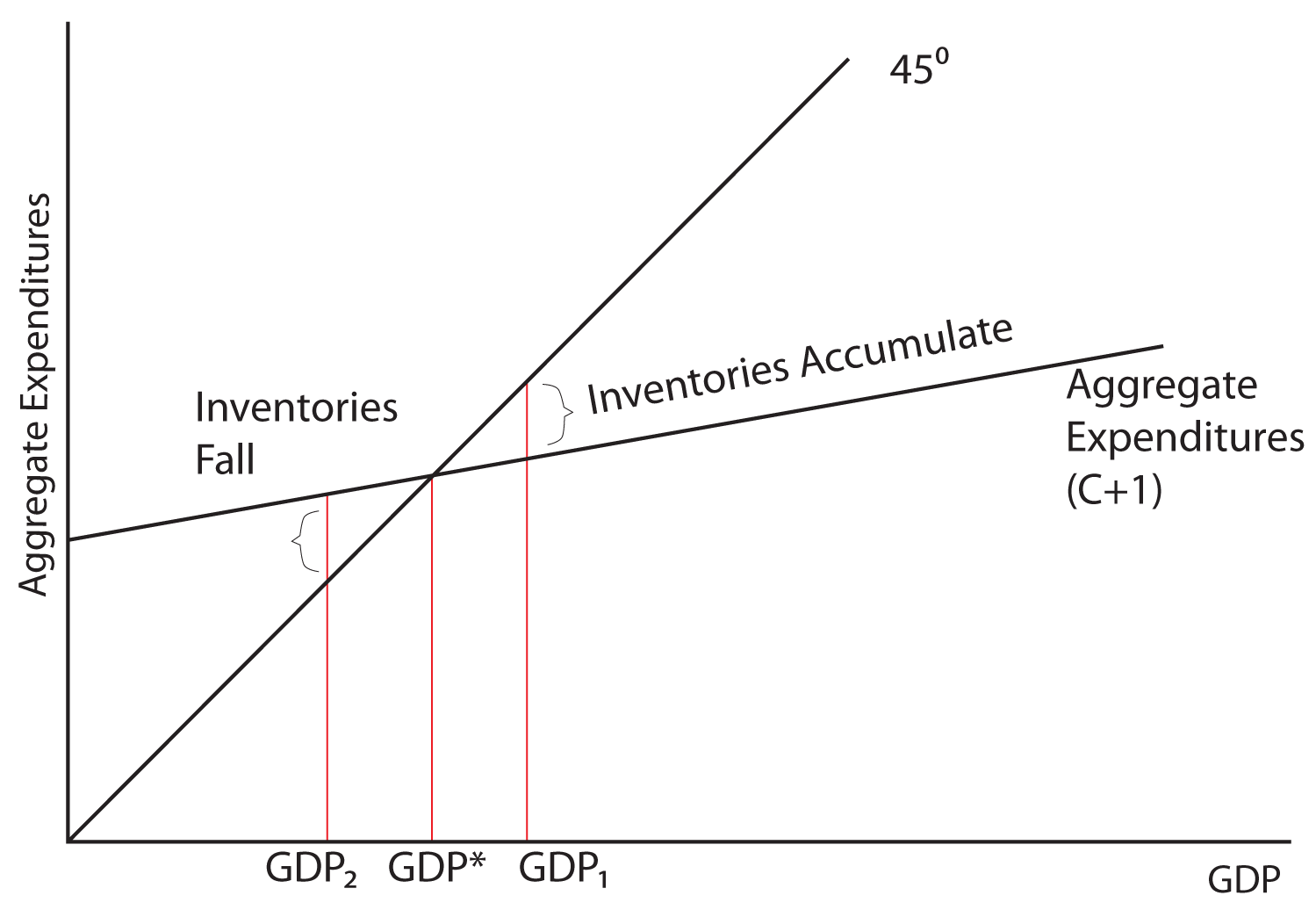

The consumption function relates the level of consumption in a period to the level of disposable personal income in that period. In this section, we incorporate other components of aggregate demand: investment, government purchases, and net exports. In doing so, we shall develop a new model of the determination of equilibrium real GDP, the aggregate expenditures model. This model relates aggregate expenditures , which equal the sum of planned levels of consumption, investment, government purchases, and net exports at a given price level, to the level of real GDP. We shall see that people, firms, and government agencies may not always spend what they had planned to spend. If so, then actual real GDP will not be the same as aggregate expenditures, and the economy will not be at the equilibrium level of real GDP. As we saw in the chapter that introduced the aggregate demand and aggregate supply model, a change in investment, government purchases, or net exports leads to greater production; this creates additional income for households, which induces additional consumption, leading to more production, more income, more consumption, and so on. The aggregate expenditures model provides a context within which this series of ripple effects can be better understood.

Planned aggregate expenditure

The Aggregate Expenditure function gives planned expenditure AE. In a modern industrial economy actual output and income may differ from what was planned, either on the output side or on the purchase and sales side. A simple example of the time sequence of output and sales shows why. In most cases business install capacity and produce output in anticipation of sales in the near future. This is apparent from the stocks of goods offered in most retail outlets or online.

Heist crew gta 5

This indicates that these will not change with real GDP unless we force it to change due to some external circumstance. The graph is therefore horizontal. Price Level In microeconomics, we talk about how the change in the price of a single good will affect the quantity demanded of that good. Real GDP is total production. In economics, the aggregate supply AS is the total supply of goods and services that firms in an economy produce during a specific time period. Let's say that's going to be equal to some autonomous expenditure plus the marginal propensity to consume. Equilibrium in the model occurs where aggregate expenditures in some period equal real GDP in that period. Both planned investment and government spending are autonomous which means these values are given and not based on real GDP. Therefore, when we measure aggregate expenditures, we add the value of exports and subtract the value of imports. At point H, the level of aggregate expenditure is below the degree line, so that the level of aggregate expenditure in the economy is less than the level of output. The GDP of an economy is calculated using the aggregate expenditure model.

Aggregate expenditure is the current value of all the finished goods and services in the economy. In economics, aggregate expenditure is the current value of all the finished goods and services in the economy. It is the sum of all the expenditures undertaken in the economy by the factors during a specific time period.

We can solve the model either graphically or using algebra. Times disposable income. Unplanned investment is investment during a period that firms did not intend to make. If you're seeing this message, it means we're having trouble loading external resources on our website. If you want to steepen the Ep curve you could lower the marginal propensity to tax t as part of fiscal policy and vice versa, ie raise t to flatten the Ep curve. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Consider the consumption function we used in deriving the schedule and curve illustrated in Figure While the measured unemployment rate in labor markets will never be zero, full employment in the labor market occurs when there is no cyclical unemployment. Well now this is going to be bigger by this increment right over here. The Multiplier Effect When the fiscal multiplier exceeds one, the resulting impact on the national income is called the multiplier effect.

This message, is matchless))), very much it is pleasant to me :)

I think, what is it � a lie.