Private equity analyst salary

Matthew started his finance career working as an investment banking analyst for Falcon Capital Partners, a private equity analyst salary IT boutique, before moving on to work for Raymond James Financial, Inc in their specialty finance coverage group in Atlanta. A Private Equity PE firm is a pooled investment vehicle that collects capital from other funds, institutional investors, wealthy individuals, etc. They convince capital owners to invest their assets with them and charge a fee to manage and grow these assets.

If you're new here, please click here to get my FREE page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. Thanks for visiting! Why conduct an accelerated recruiting process to fight over the same people at the top banks, when we could hire them directly out of undergrad and groom them ourselves? But to recap for the th time, PE firms raise capital from outside investors, use it to buy companies, improve them over time, and then sell those companies to realize a return. Senior people in private equity focus on fundraising, sourcing deals, representing the firm, and making the final investment decisions. Junior people, such as Analysts and Associates, focus on deal execution, monitoring portfolio companies, and generating and screening new deals. But as with the Investment Banking Associate vs.

Private equity analyst salary

Salary ranges can vary widely depending on many important factors, including education , certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary. Analyst, Private Equity. Associate - Private Equity. Senior Financial Analyst StarRez - Englewood, CO. Avanath - Irvine, CA. Individualize employee pay based on unique job requirements and personal qualifications. Get the latest market price for benchmark jobs and jobs in your industry. Analyze the market and your qualifications to negotiate your salary with confidence. Search thousands of open positions to find your next opportunity.

In addition, carry becomes an increasingly more significant part of their total rewards. Browse by Education Level. Not the job you're looking for?

Salary ranges can vary widely depending on many important factors, including education , certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary. Associate - Private Equity. Senior Financial Analyst StarRez - Englewood, CO.

If you're new here, please click here to get my FREE page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. Thanks for visiting! Why conduct an accelerated recruiting process to fight over the same people at the top banks, when we could hire them directly out of undergrad and groom them ourselves? But to recap for the th time, PE firms raise capital from outside investors, use it to buy companies, improve them over time, and then sell those companies to realize a return. Senior people in private equity focus on fundraising, sourcing deals, representing the firm, and making the final investment decisions. Junior people, such as Analysts and Associates, focus on deal execution, monitoring portfolio companies, and generating and screening new deals.

Private equity analyst salary

Matthew started his finance career working as an investment banking analyst for Falcon Capital Partners, a healthcare IT boutique, before moving on to work for Raymond James Financial, Inc in their specialty finance coverage group in Atlanta. A Private Equity PE firm is a pooled investment vehicle that collects capital from other funds, institutional investors, wealthy individuals, etc. They convince capital owners to invest their assets with them and charge a fee to manage and grow these assets. A job in the private equity sector can be challenging, rewarding, and lucrative. Employees manage portfolios of PE investments and monitor their performance to ensure that they meet their intended goals. A typical day-to-day workload includes working with existing companies and prospective acquisitions to analyze financial data and project future revenues , net income , and expenses. PE firms provide an intellectually stimulating environment that stresses having a calculative and disciplined approach to analyzing investments. In addition, they generally offer higher compensation and better hours and, thus, are more forgiving with the work-life balance than investment banking IB which is infamous for its long workdays. Of course, success in either field comes with bags of money , but the caps are higher in PE than in IB.

Ironman load plus

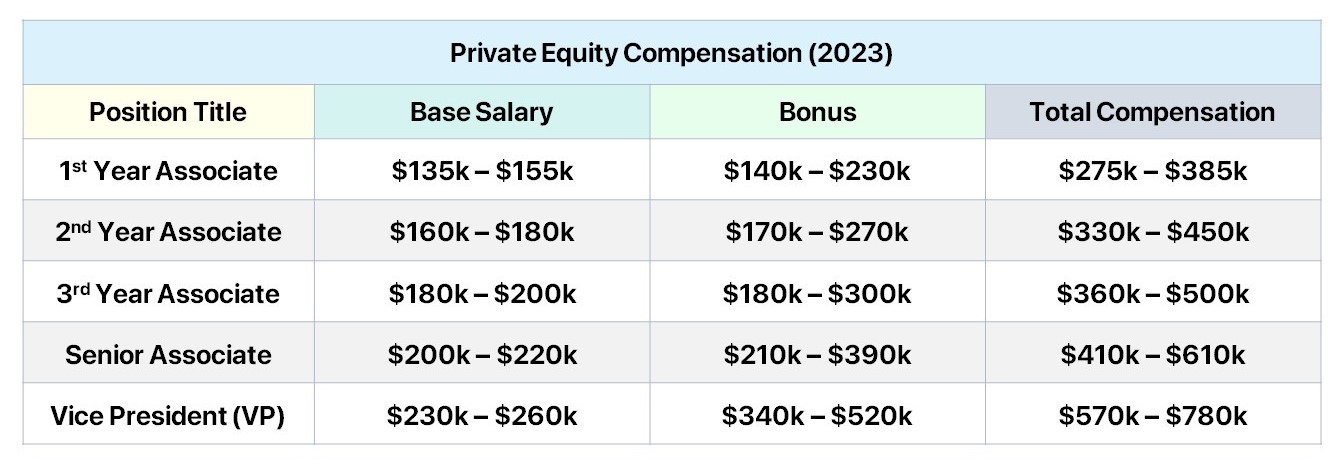

Analyst, Investor Relations. Education Bachelors. Starting at the vice president VP level, one can expect to receive some carry, with the amount increasing for senior-level members like managing directors MDs , as expected. Thank you! United States. You still do a fair amount of grunt work data formatting, industry research, etc. For instance, a former consultant who specializes in environmental sciences and truly understands the technical side of the products and systems could be a valuable addition to the investment team of an industrial technology private equity firm. X Please check your email. Sabrina Smith September 17, Any suggestions? Why conduct an accelerated recruiting process to fight over the same people at the top banks, when we could hire them directly out of undergrad and groom them ourselves? Thanks for visiting! See additional Similar Jobs. Analyst distinction, there are some subtle differences.

Salary ranges can vary widely depending on many important factors, including education , certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.

Similar Jobs to Private Equity Analyst. I'm proud to share this rare opportunity for recent or upcoming college graduates to join a multi-strategy private investment fund manager in Winston-Salem, NC. Job Title Investment Specialist. They can earn a promotion in about three years to make VP , but it is not so easy as the nature of their job changes at that level. In this role, you will be responsible for managing day-to-day accounting, investor communications, and quarterly reporting for specific funds across our private equity and private credit strategies. This article is very recent, written in , so there are no updates. They are primarily tasked with the same functions as Associates, such as deal sourcing, monitoring investee companies, evaluating potential investments, and fundraising. Co-investment : Some firms allow their employees to put their own money up for specific deals, usually starting at the associate level. The single most needed skill at this level is nurturing relationships. Experience 0 - 2. Responsibilities Design and maintain multiple CRM and market intelligence databases in Excel and Salesforce Gather and synthesize market intelligence for internal reporting and client facing materials Automate and take ownership of regular reporting and analysis Create and maintain team and firm credentials Excel, PPT Create company and industry reports and maintain market screens Sponsor-owned public company screen, debt screen etc.

It absolutely not agree with the previous phrase