Projected silver prices

Subscription Plans Features.

Neumeyer has voiced this opinion often in recent years. He also discussed it in an August interview with Wall Street Silver. Neumeyer has previously stated that he expects a triple-digit silver price in part because he believed the market cycle could be compared to the year , when investors were sailing high on the dot-com bubble and the mining sector was down. It was during that Neumeyer himself invested heavily in mining stocks and came out on top. In his August with Wall Street Silver, he reiterated his support for triple-digit silver and said he's fortunately not alone in this optimistic view — in fact, he's been surpassed in that optimism. Another factor driving Neumeyer's position is his belief that the silver market is in a deficit. In a May interview , when presented with supply-side data from the Silver Institute indicating the biggest surplus in silver market history, Neumeyer was blunt in his skepticism.

Projected silver prices

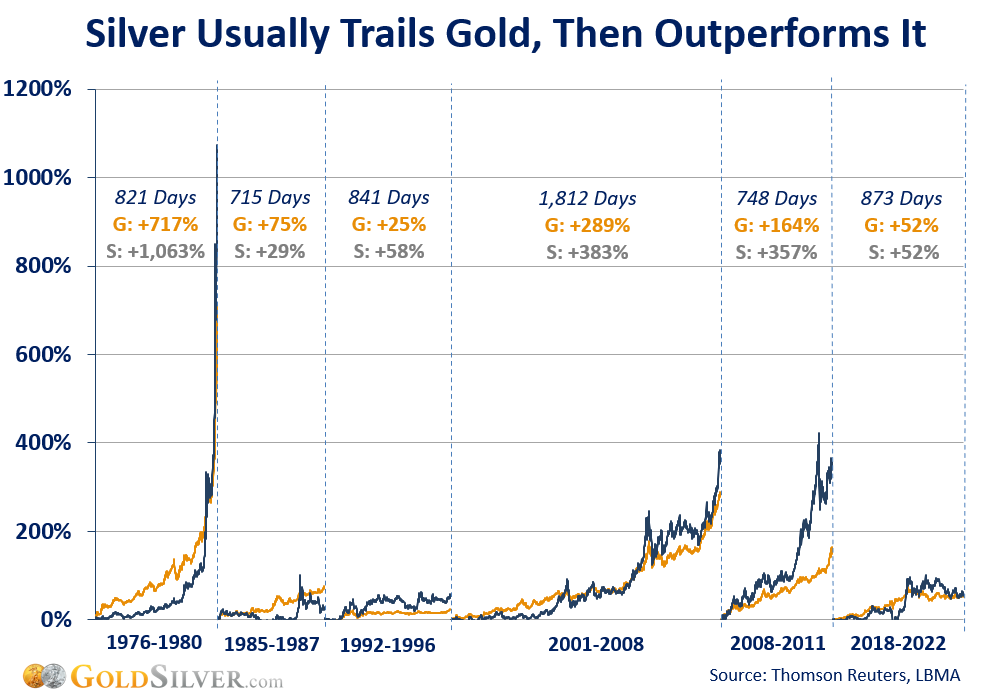

Analysts forecast that the price of gold and silver will rise if the Federal Reserve cuts interest rates this year, according to a report from CNBC Sunday. Also this comes with a weaker dollar," Teves said. In January, the Federal Reserve held short-term interest rates at a year high of 5. While research has found that gold doesn't directly correlate with inflation in any meaningful way, people are likely buying more gold in an attempt to own some sense of stability in an economy that is rife with inflation, a tough real-estate market and a growing distrust for banks and other financial institutions, Jonathan Rose, co-founder of Genesis Gold Group, told CNBC. According to the investing website Investopedia, the price of gold is influenced by a number of market factors including supply and demand, interest rates, market volatility and potential risk to investors. It tends to outperform a move in gold," Teves said. So there is a lot of catching up to do and I think the move could be quite dramatic. The UBS report came after a report from the Silver Institute projected that global silver demand would increase to 1. The wholesaler has the 1-ounce bars listed for sale online but they are available only to members with a limit of two bars per member. Price of gold, silver expected to rise with interest rate cuts, UBS analyst projects. Facebook Twitter Email. Share your feedback to help improve our site!

Biotech Cannabis. Psychedelics Pharmaceuticals. They also mention that silver is heavily used in solar PV cell production, another growth market.

Price predictions help market participants manage price risks, create hedging strategies, and make informed decisions about buying or selling assets in financial markets. That said, price predictions are speculative, particularly when it comes to long-term price forecasts. Therefore, investors should use them as a complementary tool, and not as their primary source of advice to make investment or trading decisions. Together with gold, silver is one of the most popular precious metals. It has been used for many centuries to create coins and jewellery.

Silver is in a paradoxical position at the start of On the one hand, industrial demand for the precious metal continues to grow, particularly from the solar and electrification sector, and supply remains constrained. According to Peter Krauth, editor of SilverStockInvestor and author of The Great Silver Bull, the situation is complex, but the outlook for and beyond remains very favorable, with the Fed set to provide even more upside than current projections are accounting for. It's not an all-time high, but it's still the second highest on record. In fact, if you add together the deficits of the last three years, it's nearly half of the entire supply for this year. Demand is correcting, not collapsing. If you look at jewelry and silverware in particular, India was this huge demand factor for , so it's only reasonable that because they did so much buying last year, it's almost like they overstocked.

Projected silver prices

Neumeyer has voiced this opinion often in recent years. He also discussed it in an August interview with Wall Street Silver. Neumeyer has previously stated that he expects a triple-digit silver price in part because he believed the market cycle could be compared to the year , when investors were sailing high on the dot-com bubble and the mining sector was down. It was during that Neumeyer himself invested heavily in mining stocks and came out on top. In his August with Wall Street Silver, he reiterated his support for triple-digit silver and said he's fortunately not alone in this optimistic view — in fact, he's been surpassed in that optimism. Another factor driving Neumeyer's position is his belief that the silver market is in a deficit. In a May interview , when presented with supply-side data from the Silver Institute indicating the biggest surplus in silver market history, Neumeyer was blunt in his skepticism.

Newsnow wolves

North America. Learn everything you need to know about gold price forecasts and predictions for , , , , and Gary Ruona. With the unpredictability of a second Trump term, investors would likely flock to safe havens until the situation becomes clearer, thus benefiting silver. Silver has a long history, having been used as currency in various civilizations, including the Greeks and Romans, who used it extensively for jewellery and utensils. Stephen Price. Silver - data, forecasts, historical chart - was last updated on March 6 of In the medium to long term, many analysts see industrial demand for silver rising rapidly, which could lead to shortages and an increase in price. South Africa. Why is silver so cheap? References to forecasts and past performance are not reliable indicators of future results. Artificial Intelligence. Investor Last Name. A consortium of US banks eventually stepped in to provide the brothers with a line of credit, which also saved several brokerages from bankruptcy. Silver increased 0.

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser.

Trending Reports. In the short-term, silver could benefit from a less restrictive monetary policy by the Federal Reserve, ongoing political tensions and uncertainty surrounding the US presidential election. Reinhard Schreiber. As paper money becomes more worthless day by day,especially third world countries that are so indebted that they will never will recover,and the western world is running in the same direction. However, if the US central bank starts cutting rates in , silver will become an attractive investment. Customers Investors Careers About us Contact. Who would believe? You can't eat metal!. Rising interest rates will boost the US dollar and make silver less attractive to investors, as the precious metal is not generating any yield. A shortage could lead to a significant price increase. Private Placements. Most investors like stability and predictability. Private investor Don Hansen shared his strategies with INN for investing in precious metals, as well as a guide for building a low-risk gold and silver portfolio. On the other hand, during economic uncertainty silver values are impacted by declines in fabrication demand. As mentioned, some experts, including Krauth, agree with the triple digit silver hypothesis.

0 thoughts on “Projected silver prices”