Ready reckoner rate pune

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields.

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. The Ready Reckoner rate, also known as the circle rate, is the bare minimum value at which a property must be recorded in the event of its transfer. Each year, all state governments publish area-wise ready reckoner rate Pune of properties to prevent evasion of stamp duty by the undervaluation of agreements and reduce the number of disagreements over the amount of stamp duty to be collected. According to the government, this rate represents the minimum property values in a variety of areas.

Ready reckoner rate pune

Email: [email protected]. Plan selected:. Enter Property Code. Back to Search Properties. Property Type Residential Commercial. Deal Type Buy Rent Project. Enter Pincode. I am: Broker Developer. Enter Name. Enter Email Address. Enter Mobile Number. Enter Code. Connect Now Loading

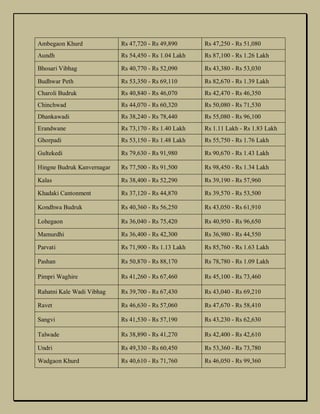

Stamp Duty Ready Reckoner indapur

Which helps to calculate the true market value of immovable property, i. If in case there is a revision of rates due to errors or any other changes in stamp duty and registration charges by the government of Maharashtra, then these rates are published through Corrigendum, Circulars or Notification to the respective offices for necessary changes in their records. We have created "e-Stamp Duty Ready Reckoner" page on this website, which features tables to help you compute your stamp duty. Stamp Duty Ready Reckoner rates per square meter are to be correlated with a built-up area and not with carpet area or super built-up area. Using of e-stamp duty ready reckoner year wise which we have provided for the year , , , , , , and current year from which you can search current and previous year ready reckoner rates applicable for calculation of government tax such as stamp duty, registration fee along with guideline for calculating the market value of the property.

Ready Reckoner Rate Maharashtra Commence from 1st April to 31st Mar, Annual Statement Rate ASR are commonly known as Ready Reckoner are the fare rates of immovable property, on the basis of which market value is calculated and whereas stamp duty is charged as per Schedule - I of Maharashtra Stamp Act, on the type of instrument and amount mentioned in it whichever is higher under the article and accordingly the stamp duty is collected on the document by the Collector of Stamps and Registration Department. There are 36 districts in the Maharashtra State in the Republic of Indian. We have systematically arranged few districts so that users can easily know the accurate property rates to calculate stamp duty of the geographical area of the Maharashtra State which are as below; simply select the district of your choice to get information related to the Ready Reckoner Rates. We have explained in details how to calculate Market value of Property. Maharashtra State Government has provided various types of facilities to the public for the payment of Stamp Duty through various types of mode and has appointed Nationalized Banks, Schedule Banks, Private Banks and the Co-operative Banks which are authorized by Reserve Bank of India.

Ready reckoner rate pune

Which helps to calculate the true market value of immovable property, i. If in case there is a revision of rates due to errors or any other changes in stamp duty and registration charges by the government of Maharashtra, then these rates are published through Corrigendum, Circulars or Notification to the respective offices for necessary changes in their records. We have created "e-Stamp Duty Ready Reckoner" page on this website, which features tables to help you compute your stamp duty. Stamp Duty Ready Reckoner rates per square meter are to be correlated with a built-up area and not with carpet area or super built-up area. Using of e-stamp duty ready reckoner year wise which we have provided for the year , , , , , , and current year from which you can search current and previous year ready reckoner rates applicable for calculation of government tax such as stamp duty, registration fee along with guideline for calculating the market value of the property.

Integral de 1 x 3

I am interested to visit Experience Center. It directly affects the whole concept of stamp duty and registration charges collected by the government. I am:. Enter the key details about the property in the mobile application or web portal and find hundreds of properties within seconds! Despite this, given the downturn in the real estate market during the last five or six years, it is feasible to find a home for less than the ready reckoner rate in Pune in certain areas. This is six Get a Quote. Annual Statement Rates ASR , also known as Ready Reckoner, are the immovable property fare rates, based on which market value is calculated, whereas stamp duty is charged as per Schedule I of the Maharashtra Stamp Act, on the type of instrument and amount mentioned in it, whichever is higher under the article, and stamp duty is collected on the document by the Collector of Stamps and Registration Department. Leave a Reply Cancel reply Your email address will not be published. You can check the ready reckoner rate for Maharashtra locations here. These fees are often expressed as a percentage of the total transaction amount, and they vary from state to state.

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields.

Stamp Duty Ready Reckoner ambegaon Leave a Reply Cancel reply Your email address will not be published. Search by Pincode Search by Property Code. Accordant to Section 43CA of the Income Tax Act, selling real estate at a price that is at least ten per cent lower than the ready reckoner rate, also known as the circle rate, can result in a penalty of 35 percent of the difference between the original price and the revised price, as well as other consequences. Known as Sinhagad annex, the government ready reckoner rates Pune for Dhayari locality in Pune is Rs. Through his writing you will find out what people look for, and what you can do to get the best out of your home, and also how to get the best for your home. CREDAI and NAREDCO proposed that appropriate amendments be made to the income tax laws and changes to ready reckoner rates as Real estate developers were struggling to maintain profit margins since there was no more room to lower prices. Your email address will not be published. Kohinoor Tinsel Town View. I am: Broker Developer. Women buyers are also not allowed to resell the property to any male buyer within the next 15 years. Your interest has been sent and You will receive a call or message from the concerned person. How to calculate Market Value. Stamp Duty Ready Reckoner junnar

I apologise, would like to offer other decision.

I can not participate now in discussion - there is no free time. But I will return - I will necessarily write that I think.