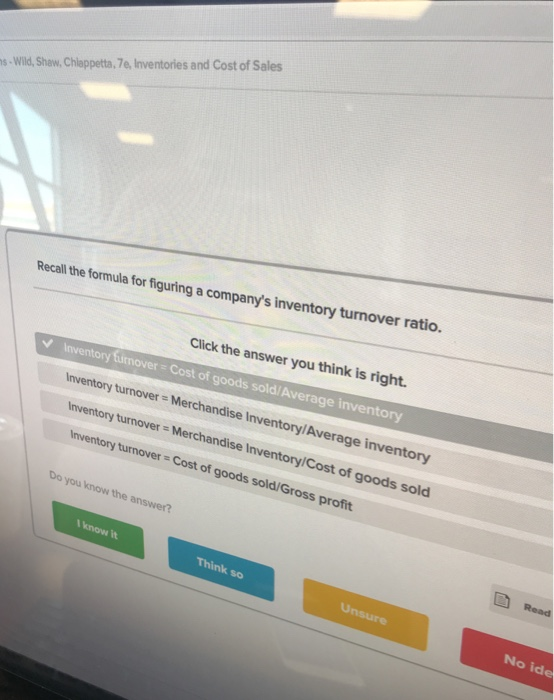

Recall the formula for figuring a companys inventory turnover ratio.

The Inventory Turnover Ratio measures the number of times that a company replaced its inventory balance across a specific time period.

To calculate inventory turnover, you need to know two things: the cost of goods sold and the average inventory. The cost of goods sold is the total value of all the merchandise that your company sells in a given period. The average inventory is the average value of all the merchandise that your company has on hand during that same period. To calculate this rate, simply divide the cost of goods sold by the average inventory. This means that your company is selling its merchandise more quickly and is not tying up as much money in inventory. Inventory turnover i. Inventory Turns is a financial ratio that shows how many times a company has sold and replaced its inventory in a specified period.

Recall the formula for figuring a companys inventory turnover ratio.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. Inventory turnover ratio measures how many times inventory is sold or used in a given time period. To calculate it, you must know your cost of goods sold and average inventory — metrics your inventory management software might be able to help you figure out. Cost of goods sold: Also known as COGS, cost of goods sold is the direct cost associated with producing or purchasing the products sold to a consumer. Average inventory: This refers to the average cost of inventory over multiple periods of time. A high turnover ratio usually indicates strong sales and low holding costs, for example, while a low ratio might mean your business is stocking too much inventory or not selling enough.

The two simple ways to calculate inventory turnover are by using the inventory turnover formula or an inventory turnover calculator.

The answer to the question, "What is a good inventory turnover ratio? You don't want your merchandise gathering dust; however, you don't want to have to restock inventory too often. The golden ratio is somewhere in between. In this article, we'll discuss how to find the ideal turnover ratio considering your industry and size and share practical tactics for reaching that goal. We will help you interpret that number and target the optimal inventory level for your business and industry. Inventory Turnover Ratio, or Inventory Turnover, measures how quickly a company sells and replenishes its inventory over a specific period.

The inventory turnover ratio is an efficiency ratio that shows how effectively inventory is managed by comparing cost of goods sold with average inventory for a period. In other words, it measures how many times a company sold its total average inventory dollar amount during the year. This ratio is important because total turnover depends on two main components of performance. The first component is stock purchasing. If larger amounts of inventory are purchased during the year, the company will have to sell greater amounts of inventory to improve its turnover. The second component is sales. Sales have to match inventory purchases otherwise the inventory will not turn effectively.

Recall the formula for figuring a companys inventory turnover ratio.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Jessica reyes

Many companies get so caught up in increasing revenue that they compromise profits. Read our privacy statement here. The Relationship Between Cashflow and Inventory Control How you manage your inventory will directly impact the cashflow of your small business and when you fail to effectively manage stock you are putting y Our opinions are our own. These systems provide an estimate of the inventory that must be acquired to meet customer requirements, helping businesses plan their purchases and avoid scenarios of overstocking or understocking. It can optimise your inventory management, par levels, and replenishment processes. Book a quick call with our experts to see how WeSupply can help you streamline your return management. This, in turn, will help you reduce holding costs, increase sales, and ultimately boost your bottom line. Shipping costs impact your business. That means you sold and replaced your inventory five times. Log In.

Explore the fundamentals of inventory turnover and its impact on business.

Log In. Reply to calcuing. In the retail sector, inventory turnover is a key performance indicator that reflects the efficiency of your inventory management. Regularly monitoring inventory levels, sales data, and customer preferences can help you have the know-how to make informed decisions and prevent excessive accumulation of unsold inventory in the future to increase your bottom line. In this article, we cover the inventory turnover ratio formula and its importance in inventory management. If you enjoyed this article, you might also like our article on raw materials inventory or our article on inventory to sales ratio. Your Download is Ready. Consumer demand for a product changes as the item moves through its life cycle. WIP inventory turnover ratio The Work-In-Process WIP inventory turnover ratio measures the rate at which your inventory of WIP materials moves on to the completion or finished goods stage and is replaced within a specific timeframe. Don't forget to share this post!

0 thoughts on “Recall the formula for figuring a companys inventory turnover ratio.”