Reflex credit card complaints

Net Worth. Free Credit Monitoring.

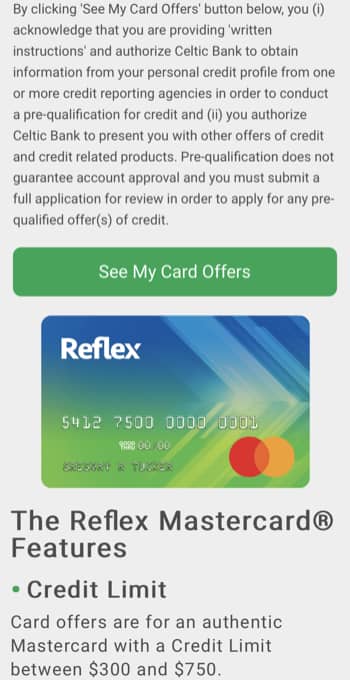

This card caters to people with bad credit, but with its high fees and high interest, it's just not worth it. True, it can help you build or rebuild credit. And issuers that accept applicants with bad credit those with FICO scores of or below need to be compensated for all the customers who will fail to pay their credit card bills. That compensation comes in the form of high fees and rates. But even the credit-desperate have better choices. Card type: Bad credit. Rewards: None.

Reflex credit card complaints

.

Credit Scores Credit Builder.

.

This card caters to people with bad credit, but with its high fees and high interest, it's just not worth it. True, it can help you build or rebuild credit. And issuers that accept applicants with bad credit those with FICO scores of or below need to be compensated for all the customers who will fail to pay their credit card bills. That compensation comes in the form of high fees and rates. But even the credit-desperate have better choices. Card type: Bad credit. Rewards: None. APR: Other benefits:. Reports to all three major consumer credit bureaus.

Reflex credit card complaints

In the Non-Bank Financial Service category. Visit this website. Most relevant. Partnering with Reflex has been so rewarding to me as a customer. From day one i have worked hard in making sure my experience was going to be a long lasting one with Reflex. Reflex has honored their commitment with me by making sure that i'm valued, seen, respected, important in this relationship. The representative Samiyah went above and beyond to make me even feel more special with her knowledge, kindness, answering my questions and concerns. Thank you!! Date of experience: October 30, Thank you so much for the support!

Facetime on ipad

If you're already carrying this card — or feel like it's your best option and plan to apply for it — be aware of these potential traps. What to watch out for:. However, this does not influence our evaluations. Studies and Insights. Gregory Karp Twitter. More details from Continental Finance. Use the card responsibly to strengthen your credit profile, then move up to a better card and cancel this one. Card type: Bad credit. Quick Tips for Your Credit Health. If you have at least fair credit, the Capital One QuicksilverOne Cash Rewards Credit Card may also offer you access to a higher credit line in as little as six months if you make your monthly payments on time. Plenty of better options exist. If you do ultimately apply for this card, or if you have it already, view it as a temporary solution. Credit Scores Credit Builder.

In the Non-Bank Financial Service category.

Other benefits:. This may influence which products we write about and where and how the product appears on a page. However, the card charges other fees, such as a monthly maintenance fee after the first year. Specifically, you must make your first six monthly minimum payments on time. Same Day Loans. You'll need to qualify for membership at that credit union to be eligible for the card. Studies and Insights. For example, the Capital One Platinum Secured Credit Card requires a security deposit that you can eventually get back with a good payment history. Online Savings. Debt Consolidation Loans. Edited by Kenley Young.

I can recommend to visit to you a site on which there are many articles on this question.