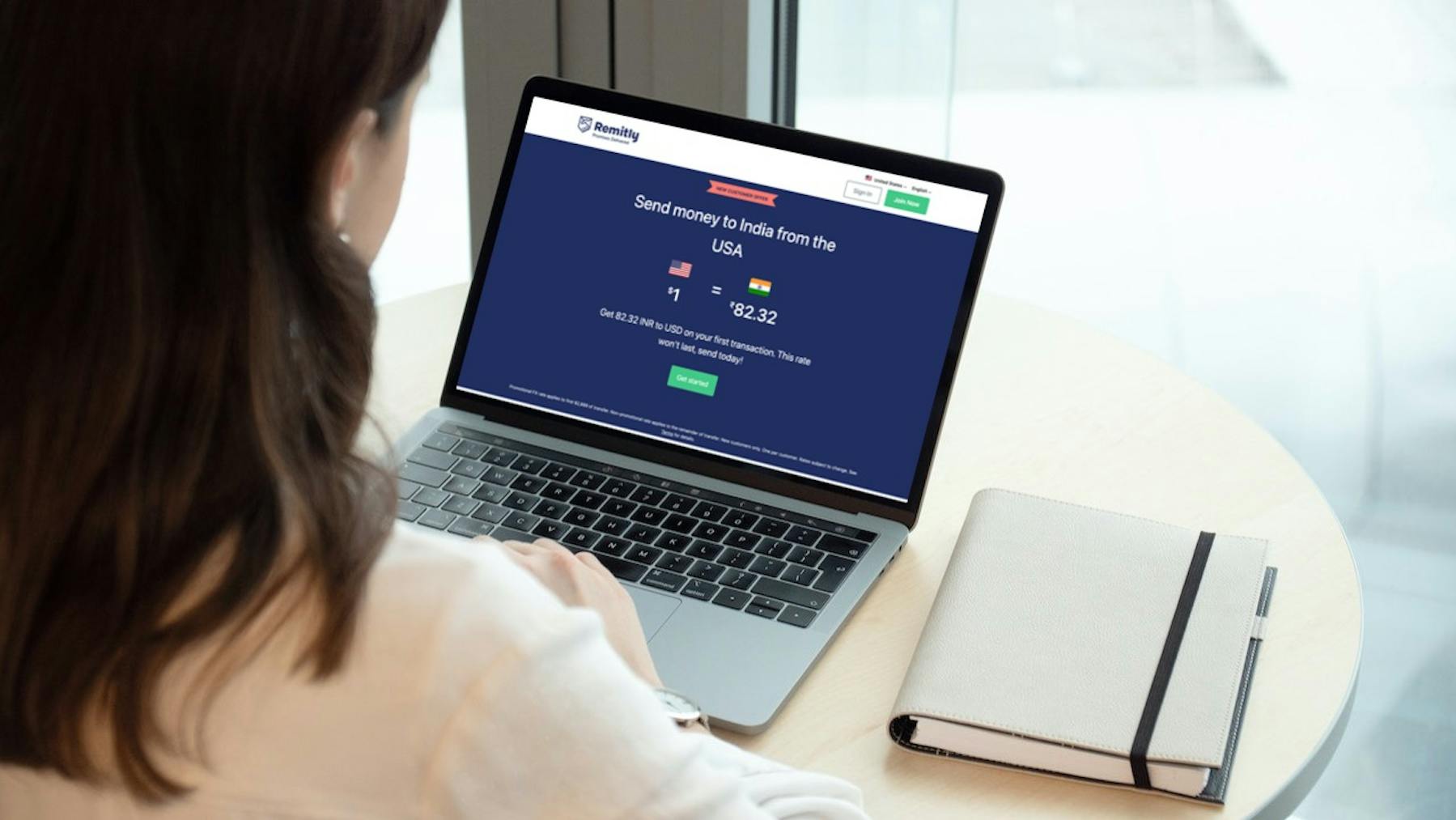

Remitly usd to inr

No fees on your first transfer. Try Remitly today.

New customers only. One per customer. Limited time offer. Any rates shown are subject to change. See Terms and Conditions for details. You and your loved ones can track your transfer every step of the way. Enjoy consistently great rates and no hidden fees.

Remitly usd to inr

Depending on the destination, you may be able to have your payment deposited in the recipient's bank or mobile money account, or collected in cash via a local agent for convenience. Find the Remitly exchange rate conveniently by checking out the Remitly website or app. You can also use our comparison table to get an idea of the Remitly exchange rate you need to know. Don't forget that exchange rates change all the time, and can vary depending on how you arrange your transfer. Let's take a look at the exchange rate for some major currencies offered by Remitly and how they compare to the mid-market rate. Normally the easiest way to find the Remitly exchange rate is on their website or app. You may find you need to create an account or model a money transfer online or in the Remitly app to understand the exchange rates and fees that may apply to your payment. This is This means that Remitly does not use the mid-market rate, but rather adds a mark-up an extra fee to the rate used for transferring money abroad. This means that Remitly uses the mid-market rate and does not add a mark-up to the exchange rate used for transferring money abroad. The mid-market exchange rate matters because it's the rate banks and money transfer services get when they buy currencies themselves. That makes it a good benchmark to compare when you're checking out the fees charged by different services offering currency conversion and international payments.

You send. Read more about Instarem. Sending money to India through Remitly is fast and secure.

Home Compare. International Students International Education Loans. All Profiles. Overall Ratings. What we don't like about Remitly Strict monthly limits on transferable amount Lower exchange rates for fast transfers Longer transfer time for higher exchange rates. How much fees does Remitly charge?

The best way to receive money in is to use bank deposits. Send money directly to bank accounts throughout. Deposited in minutes. It's quick and easy to send money to with Xe. Simply sign in to your Xe account or sign up for a free account. Then, enter the currency you'd like to transfer and the amount. Next, add your recipient's payment information. Finally, confirm and fund your transfer, and leave it to us!

Remitly usd to inr

If you're sending money home to India, use this page to get started or find help with your transfer. If you're sending money to India, you can use this page to help you get started or find help with your transfer. In this article:.

New codes for blade ball

This is a comprehensive document that will help you understand so many factors that affect the speed of your money transfers, and therefore, pick the providers that can execute your transaction fastest. If speed were the only factor to consider, and sometimes it is for emergency needs, cash transfers may be your best bet as there are no bank to bank transactions involved which will certainly introduce a lag in your Indian Rupee amount reaching USA. There are various areas you would want to inspect when evaluating these providers to gauge the best fit for sending money overseas to USA. Indicative Rate. Compare fees for Remitly. This is especially relevant if you are up against time and need to send money urgently. Step 7 - Validate all the information for accuracy and start your transaction. Read more about Instarem. Compare Remitly rates and fees When it comes to sending money overseas, exchange rates are important. You send. When sending money overseas, there are a lot of options at your disposal these days. Get help. Remitting money abroad can be a confusing and costly process.

He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context. This does not affect the opinions and recommendations of our editors.

Some companies deal with only small amounts, while others specialize in larger ones. Home Compare. What is the minimum amount I can transfer with Remitly? I'm very happy that I tried it. Does Remitly offer a cash pick-up facility? All you need to do is simply create an account with your name, email address, and your US Bank account information. International Students International Education Loans. But, if you are armed with the right knowledge, it will help you make a more informed decision and, therefore, make the most of your hard earned money. We carefully select providers to give you the best choices for sending money internationally. How to get the best exchange rate for your money transfers from India to USA? Please be aware that you will likely be asked for identification documents and personal information. When sending money overseas, there are a lot of options at your disposal these days. The best part about Remitly is that you get real-time conversion rates without having to worry about exchange fees and hidden charges. Learn more about mid-market rate here. Exchange Rates

0 thoughts on “Remitly usd to inr”