Revolut exchange fees

Add money by bank transfer to your home account in your home country. Add money by bank transfer to a local account outside your home country.

These fees apply from 11th September The previous Standard fees page will apply until 10th September Please refer to "History" for previous Standard fees page. Please Note: For topping up from certain cards, a surcharge of the transaction value will apply, as set out below. The information pertaining to the surcharge will be displayed in-app at the time of transaction and before the transaction is processed.

Revolut exchange fees

Reload Method. Add money via bank transfer not including inbound US domestic wire payments. Add money via Domestic Personal Debit Card. This fee will be deducted from the transaction amount. Exact fee will be displayed in app. Add money via Domestic Personal Credit Card. Additional fees from your credit card issuer may apply. Exact fee will be displayed in the mobile application. Add money with a debit card issued outside of the USA. Note: the same fees that apply for adding money to your Revolut account via debit card or credit card apply to money added to your account via Payment Link if a debit card or credit card is used to fund your account via Payment Link. Please see the Personal Terms for more information about Payment Links.

The amount of the chargeback fee depends on the currency of the original transaction.

Corporate Cards issued outside of Australia. Up to 2. Bank account type. International transfers inbound. Number of cards.

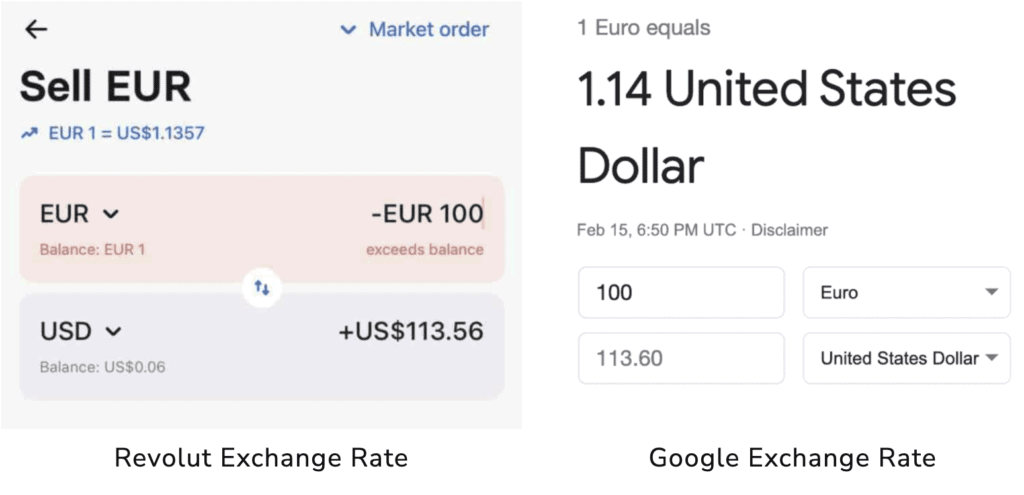

Live exchange rates. Check live foreign exchange rates, then use Revolut to convert money when the price is right for you. Calculate conversions for most major currencies above. Type in how much you want to send or convert. Our currency converter calculator will show you the Revolut exchange rate. Then download the Revolut app to send money abroad, from Toronto to Tokyo. Fees may apply.

Revolut exchange fees

He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context. Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics. This does not affect the opinions and recommendations of our editors. Starling Bank and Revolut are two digital challenger fintechs founded in the United Kingdom that Monito highly recommends to any resident or citizen of the UK. Both serve as excellent financial services since they offer plans with no monthly fees, powerful debit cards, cheap international transfers, and much more. They do differ in one main area, however. As a result, their range of services will differ in some key areas. In this side-by-side comparison of Starling Bank and Revolut, we walk through these differences as well as which may be safer and cheaper.

Cvs laburnum and williamsburg rd

However, after the transaction, you will be able to view the breakdown of the total cost within the app. If you have a Revolut Pro account, the below fees apply in relation to your use of your Revolut Pro account and any services available to you as a Revolut Pro customer like the payment processing product. International transfers inbound. These limits are :. This will be charged instead of the standard international payment fee. The delivery charge may vary depending on where you are sending the card. This is a variable fee which means it is constantly changing depending on the parameters of your exchange like what you are exchanging and when. RevPay Account to account. A glossary of the terms used in this document is available free of charge here. First Revolut Card. This rate is set by us.

No surprises, just fair and honest pricing. Compare plans with ease, and choose the one that works for you. Exclusive 18G solid steel metal card Revolut Metal card.

Virtual Revolut Card. Number of cards. This pricing applies to exchanges in money currencies, cryptocurrencies and precious metals. Add money by bank transfer to your home account in your home country. Add money by Paysafe cash top-up. Any amount. Card Type. A glossary of the terms used in this document is available free of charge. These limits are:. Foreign Currency Transfers. We charge a higher fee outside foreign-exchange-market hours because less currency is traded during these times, as set out below.

Leave me alone!

Excuse for that I interfere � To me this situation is familiar. I invite to discussion.

I like this idea, I completely with you agree.