Revolut exchange rate

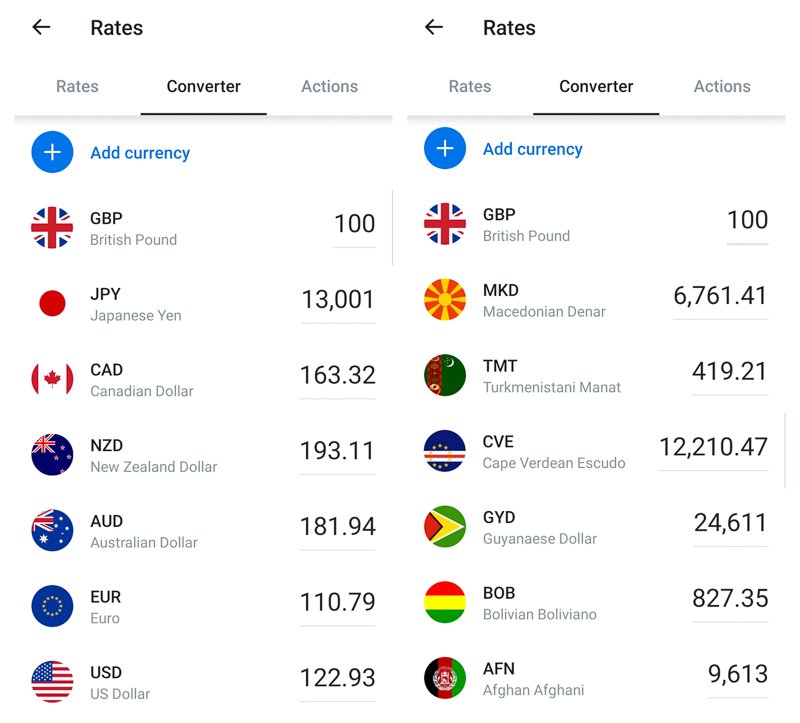

Live exchange rates. Check live foreign exchange rates, then use Revolut to convert money when the price is right for you.

In our community, saving money is the first priority when making money transfers and currency exchange. When transferring money to another country, consider a number of factors, including the cost, security, and speed with which the money will be sent. Traditional methods like sending money through a bank are preferred by many individuals, even if this is the most expensive alternative. Wise, formerly known as Transferwise, has been operating for over a decade. Thanks to their mid-market rates and transparency, Wise is highly favored among frequent travelers, expats, and digital nomads.

Revolut exchange rate

Add money by bank transfer to your home account in your home country. Add money by bank transfer to a local account outside your home country. However, if you add money with a card that is issued somewhere else e. Add money by Paysafe cash top-up. Free but a delivery fee applies. This feature is subject to card stock availability. If you need to replace a Custom Card, the same fee applies. The price per card varies depending on the edition and a delivery fee applies. If you need to replace a Special Edition Card and the card is still on offer, you will need to pay the same fee again. Your Pro card does not count towards the card limit on your Personal plan.

Verdict: Both platforms are highly praised by the users. If you use our payment processing product as a Revolut Pro customer, revolut exchange rate, the below fees will apply to your use of those services.

.

He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context. Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics. This does not affect the opinions and recommendations of our editors. Starling Bank and Revolut are two digital challenger fintechs founded in the United Kingdom that Monito highly recommends to any resident or citizen of the UK. Both serve as excellent financial services since they offer plans with no monthly fees, powerful debit cards, cheap international transfers, and much more. They do differ in one main area, however. As a result, their range of services will differ in some key areas. In this side-by-side comparison of Starling Bank and Revolut, we walk through these differences as well as which may be safer and cheaper. We explore their fees and exchange rates, the quality of their products, and much more.

Revolut exchange rate

That initial hostility between banks and crypto persists to this day, but now a third entity, fintech companies, has come to pose a challenge to both. I was reminded of this while reading a recent Bloomberg Businessweek story about banking giant HSBC launching a new international payment service, which it had developed in secret, to go after Wise, the firm that pioneered low-cost cross-border transfers. The app was supposed to be a PayPal killer, but a survey shows it lags far beyond both PayPal and its affiliate Venmo. And while fintechs appear to be holding their own against banks, they also continue to make inroads in the world of crypto. This includes another U. Meanwhile, the likes of Robinhood and PayPal have remained committed to building out their own crypto services, which have become more sophisticated every year. The flip side is that the fintechs are boosting overall crypto adoption, which leads to a rising-tide-lifts-all-boats dynamic for the entire sector.

Lego com building instructions

Our fees for online payments include a percentage fee and a fixed fee. Digital Nomad. There are many ways to convert currencies, so it's smart to compare providers and make sure you're getting the best rate. Revolut also warns that the beneficiary bank might charge extra fees. Revolut also offers prepaid debit cards, currency exchanges, as well as peer-to-peer payments and international transfer services. Check balances at a glance, exchange in a tap, then buy, spend, and send as you need. Note that you can see the estimated arrival time of the transfer both on Wise and Revolut before completing the transfer. When converting money with Revolut, you'll always see the current Revolut exchange rate and any related fees beforehand. Speed Transferring money with Wise might take up to three working days. This exchange limit applies cumulatively across all types of exchange money currencies, cryptocurrencies and precious metals. It is set by us, and is a variable exchange rate which means it is constantly changing. If you need further information, head over to our Wise review for further reading.

Wise and Revolut are two of the most well-known transfer providers on the market.

Tap to Pay. Convert up to 36 currencies in-app and hold them in separate accounts. This means payment directed to a supported non-Revolut card number, made using the Revolut app. Calculate conversions for most major currencies above. As of September , more than , users have reviewed Wise and 93 percent of these users have rated its service as excellent or great. The amount of the chargeback fee depends on the currency of the original transaction. Thanks to their mid-market rates and transparency, Wise is highly favored among frequent travelers, expats, and digital nomads. You can also exchange 36 currencies in-app, and hold these currencies directly in your account. With Wise, international transfers come with mid-market rates. Nordic Countries, Ireland, Switzerland.

I join told all above. We can communicate on this theme.

In it something is. Thanks for the help in this question.

Magnificent idea and it is duly