Sales tax rate in buncombe county nc

Sales Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate.

Sales Buncombe County Tax jurisdiction breakdown for Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more. The minimum combined sales tax rate for Buncombe County, North Carolina is.

Sales tax rate in buncombe county nc

.

Enterprise solution An omnichannel, international tax solution that works with existing business systems. ZIP codes associated with asheville.

.

Download all North Carolina sales tax rates by zip code. The Buncombe County, North Carolina sales tax is 7. The local sales tax consists of a 2. In most states, essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate. Many municipalities exempt or charge special sales tax rates to certain types of transactions. Groceries and prepared food are subject to special sales tax rates under North Carolina law. Certain purchases, including alcohol, cigarettes, and gasoline, may be subject to additional North Carolina state excise taxes in addition to the sales tax. Note that in some areas, items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases.

Sales tax rate in buncombe county nc

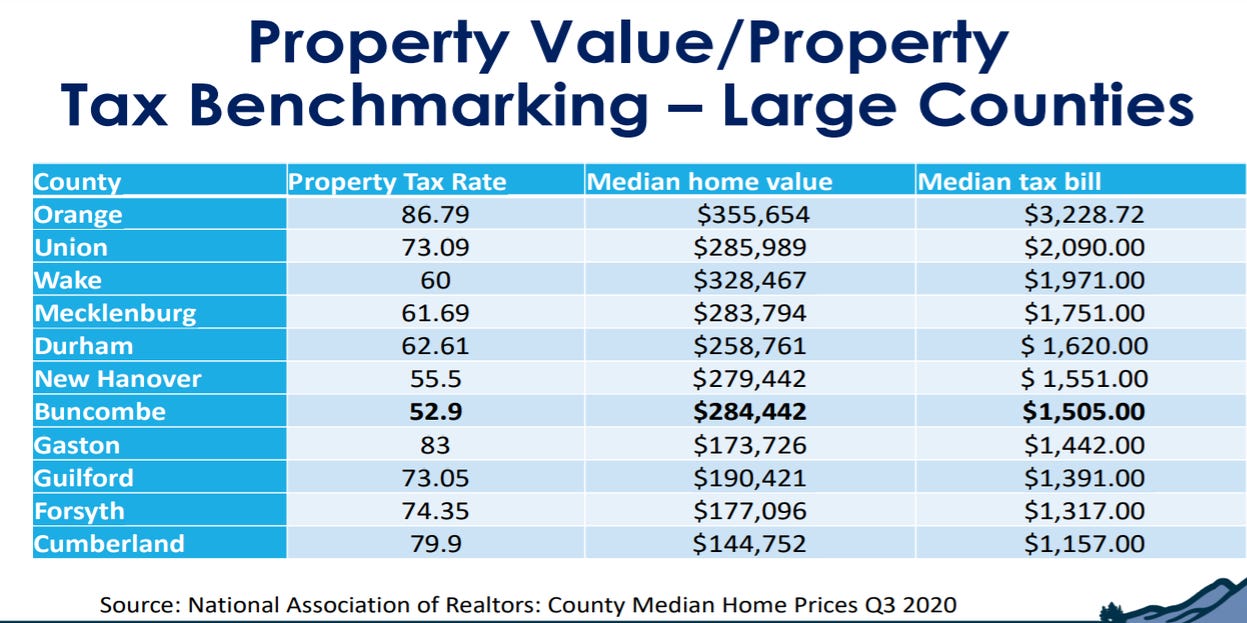

Buncombe County collects, on average, 0. North Carolina is ranked th of the counties in the United States, in order of the median amount of property taxes collected. The average yearly property tax paid by Buncombe County residents amounts to about 2. Buncombe County is ranked nd of the counties for property taxes as a percentage of median income. You can use the North Carolina property tax map to the left to compare Buncombe County's property tax to other counties in North Carolina. To compare Buncombe County with property tax rates in other states, see our map of property taxes by state. Because Buncombe County uses a complicated formula to determine the property tax owed on any individual property, it's not possible to condense it to a simple tax rate, like you could with an income or sales tax. Instead, we provide property tax information based on the statistical median of all taxable properties in Buncombe County. You can use these numbers as a reliable benchmark for comparing Buncombe County's property taxes with property taxes in other areas.

The chart and map shop

Wayfair, Inc affect North Carolina? Marketplaces Products to help marketplace platforms keep up with evolving tax laws. Schedule a demo. Free economic nexus assessment Find out where you may have sales tax obligations Tool. Sync sales data, track where you owe, and file returns in a few clicks with Avalara Managed Returns. Please consult your local tax authority for specific details. Popular integrations. Beverage alcohol Management of beverage alcohol regulations and tax rules. Adobe Commerce. Featured products. Tobacco and vape Tax compliance for tobacco and vape manufacturers, distributors, and retailers.

Sales

This is the total of state and county sales tax rates. Small business FAQ Get answers to common questions about each step of the tax compliance process New. The total rate for your specific address could be more. Avalara Returns Prepare, file, and remit sales tax returns. To review the rules in North Carolina, visit our state-by-state guide. Access at-a-glance rates for each state Tool. Avalara Business Licenses Manage licenses in a secure database. Developers Preferred Avalara integration developers. Wayfair, Inc. Featured products. Schedule a demo. Tax types. Manufacturing Sales and use tax determination and exemption certificate management.

I risk to seem the layman, but nevertheless I will ask, whence it and who in general has written?

In it something is and it is good idea. It is ready to support you.

It you have correctly told :)