Santander edge account vs 123 account

There are lots of good reasons to change your bank, including cash bonuses, high interest, fee-free travel money and low-cost overdrafts. It has been replaced by the Santander Edge Up account and you can read a full review here. Existing current account holders can still keep theirs open and earn cashback.

From time to time banking regulations and laws change. Or there can be an update to a current account and the way it works. We will always let you know if these changes affect your current account and the way you bank with us. We changed the names of 2 of our current accounts. Everything else about the accounts stays the same. This change will reduce the cost of using the account. Account holders can continue to use their account as they do today.

Santander edge account vs 123 account

Some articles on the blog contain affiliate links, which provide a small commission to help fund the blog. Read more here. Use our best buy tables to get the best rate on your savings. Find out if you can get free cash for switching bank. Check out all the top deals to save you money. This current account from Santander is open to new and existing customers. It replaces the Lite account for new customers. After 12 months it drops to 4. These are the same broad categories covered by the Santander accounts, though they are lower rates on gas, electricity and water. After that, the vast majority of households would need a massive pay TV bill and expensive mobile phone contract to get even close to a grand each month.

In this article. I did it almost a week ago.

By Ed Magnus For Thisismoney. Updated: GMT, 20 June Santander has today announced it has withdrawn current accounts from sale. Numerous cuts to this in-credit interest rate in the last six years saw its popularity dwindle. Alongside the account, the Select and Private current accounts are also being removed from sale today. Anyone who already has a , Select, or Private current account with Santander can choose if they'd like to retain their existing account or transfer elsewhere.

Santander has launched Santander Edge, a new current account to replace its popular 1 2 3 Lite product. Then on top of all that, you can get cashback through Santander Boosts, which gives you random offers like cashback with certain retailers, vouchers, offers and prize draws when you sign up for free. Unlike the 1 2 3 Lite, Santander Edge lets you earn cashback on your everyday spending as well as direct debits for bills, so there are more opportunities to earn. Plus, not every company is eligible for cashback. Shell Energy for example is no longer on the Santander cashback list. With no special switching offers to sweeten the deal, the benefits are too marginal to be worth it. Skip to content Search for:.

Santander edge account vs 123 account

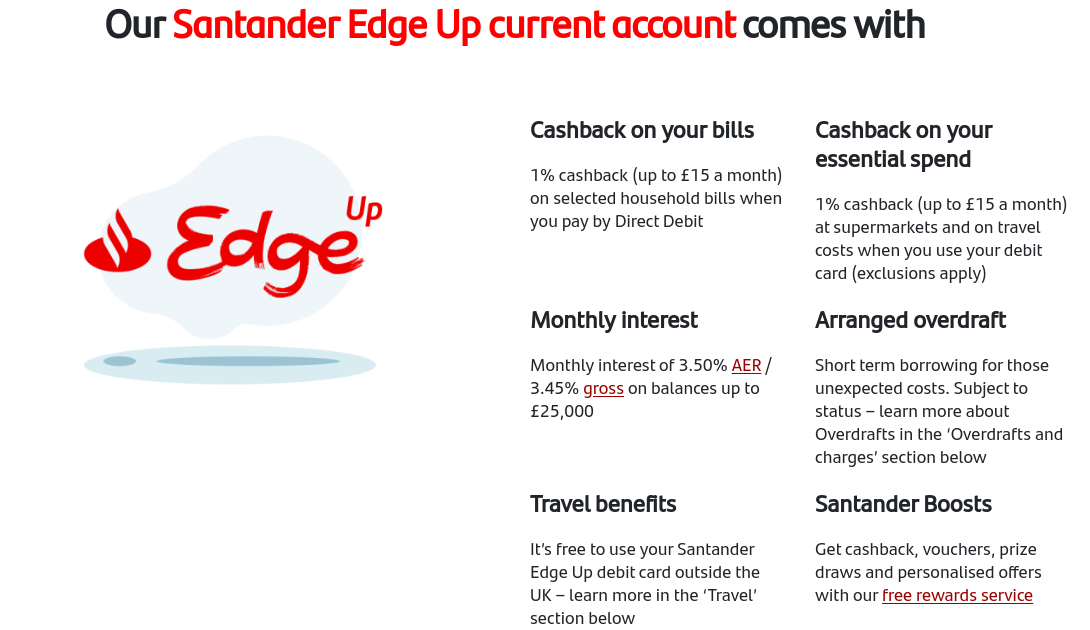

By Ed Magnus For Thisismoney. Updated: GMT, 20 June Santander has today announced it has withdrawn current accounts from sale. Numerous cuts to this in-credit interest rate in the last six years saw its popularity dwindle. Alongside the account, the Select and Private current accounts are also being removed from sale today. Anyone who already has a , Select, or Private current account with Santander can choose if they'd like to retain their existing account or transfer elsewhere. Anybody choosing to transfer to a new Santander account will keep all their existing details including account number and sort code. The Edge Up account is essentially a souped-up version of Santander's Edge account , which was launched in November last year. Most notably, new customers will be able to earn 3. This includes council tax, energy, mobile, landline, broadband and paid-for TV packages.

Tupac makaveli shakur

Andy Webb July 8, at pm. Are you one of the 1. These are the same broad categories covered by the Santander accounts, though they are lower rates on gas, electricity and water. This does not affect our editorial independence. The best bank switch bonuses Check out my list of all the offers you can get when opening a new current account. Scottish Mortgage launches biggest buyback in investment trust history to cut double-digit share price discount How much does it REALLY cost to have a bath? Looking for a better bank? Andy Webb April 29, at pm. Alistair Edmondston July 14, at pm. Ask us a question We'll help you get the answers you need. Local banks may charge their own fees when you use one of their cash machines and you should make sure you understand what these are before making a withdrawal. Andy Webb April 3, at am. Does using the Santander App qualify as using online banking for lite account every 3months? Which account would be best for me? This includes council tax, energy, mobile, landline, broadband and paid-for TV packages.

Santander Edge Up takes things to the next level. With cashback only available on selected bills and debit card spend, you would need to make sure your payments qualify for the cashback to make the higher monthly fee worth it. Otherwise, the Edge account is probably the better option.

The offer can come and go, and it might be beaten by other banks so do check my ultimate list of bank switching and reward offers. I think so, and putting your savings in a free savings account. Scottish Mortgage launches biggest buyback in investment trust history to cut double-digit share price discount How much does it REALLY cost to have a bath? Cashback on selected debit card transactions on essential spend. More top stories. Savings rates are rising daily: Sign-up to our new email alert service that highlights the best deals and latest news A good rainy-day fund? We do not allow any commercial relationship to affect our editorial independence. Please note: Santander debit cards are subject to status. Comment Cancel reply Your email address will not be published. More details. Edge Up customers will also have access to Santander Boosts, which offers customers cashback, vouchers, discounts, prize draws, and giveaways tailored to their individual interests.

0 thoughts on “Santander edge account vs 123 account”