Sbi code ifsc code

You can use either of these facilities to send money across different banks, different accounts, different states and different cities. RTGS funds transfer can be used to send amounts of Rs.

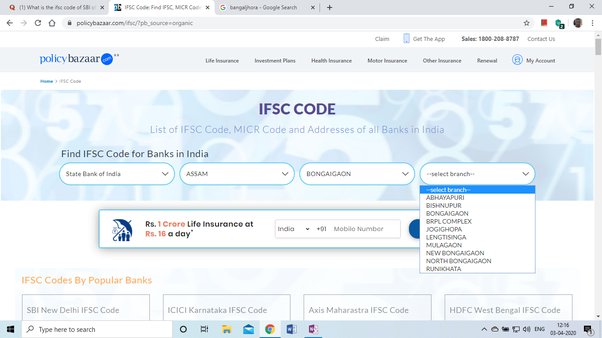

For online fund transfer, apart from the IFSC Code of SBI which is provided in this website , you need to know the Account details like number, holders name as in bank records and type typically saving or current. You can then use this information to carry out online banking. Online mode of payments can be used for transactions like premium payments, bill payments, ticket booking, donations, shopping, etc. IMPS presents an instant 24X7, electronic fund transfer. IFSC Code is an 11 character code for identifying bank branches participating in online fund transfers. This code is unique for each branch. Please NOTE that not all branches of a bank provide net banking facility.

Sbi code ifsc code

It is a digit alpha-numeric code that uniquely identifies a bank branch participating in any RBI regulated funds transfer system. The first 4 digits of the IFSC represent the bank and last 6 characters represent the branch. The 5th character is zero. The first 3 digit of the code represents the city code, the middle ones represent the bank code and last 3 represents the branch code. One can locate the MICR code at the bottom of a cheque leaf, next to the cheque number. It is also normally printed on the first page of a bank savings account passbook. MICR Code is used in the processing of cheques by machines. This code enables faster processing of cheques. One is required to mention the MICR code while filing up various financial transaction forms such as s investment forms or SIP form or forms for transfer of funds etc. A cheque number is a 6-digit number uniquely assigned to each cheque leaf. It is written on the left-hand side at the bottom of the cheque. It is advisable to check i. This is to ensure that no cheque is missing from the cheque book. Ideally, you should record the transaction you have used each cheque leaf for in the transaction record slip attached at the start or end of a cheque book.

The credit score ranges from toand a higher score increases the likelihood of loan approval.

.

For every transaction, you require an IFSC code. IFSC helps in carrying out fund transfer transactions electronically by sending messages to the specific branches of any particular bank. It is important for the facilitation of electronic funds transfer in India. IFSC is used by fund transferring systems to acknowledge both the branches involved in a transfer process. It makes your transactions smoother, speeding up the transferring process. State Bank of India SBI is the most important bank of India when it comes to customer base with more than 40 crore saving accounts across the country.

Sbi code ifsc code

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. Start typing here to immediately find your IFSC code. Clear serves 1.

Flannel hoodie jacket mens

Additionally, IndiaLends customers also receive complimentary credit report refreshments every quarter for the first 12 months. Share Price Karnataka Bank Ltd. Here are some notable features of the convenient personal loans available through IndiaLends. Online mode of payments can be used for transactions like premium payments, bill payments, ticket booking, donations, shopping, etc. Unfortunately, this privilege extends to only a small proportion of the population, approximately 10 million individuals across the country. SBI descends from the Bank of Calcutta, founded in Select State Above First. However, IndiaLends provides an accessible solution through its online personal loan, enabling individuals to swiftly make large-ticket purchases on e-commerce platforms and convert them into affordable EMIs. One can locate the MICR code at the bottom of a cheque leaf, next to the cheque number. Although CIBIL and Experian maintain records for more than million individuals, a significant majority have never borrowed from an RBI-regulated financial institution that is a member of a credit bureau. RTGS is available for customers to use on weekdays and Saturdays. The interest rates offered to customers are subject to variation based on their individual profiles. Personal Loan Tenure The repayment period for a Personal Loan typically ranges from 3 months to 6 years, allowing borrowers to choose a tenure that aligns with their requirements. It is also normally printed on the first page of a bank savings account passbook.

.

Recently Declined Personal Loan Application A significant number of consumers face loan application rejections from banks due to factors such as inadequate credit history, limited affordability, insufficient supporting documents, and more. Get your free Credit Report Worth Rs. Let Others Know. IndiaLends employs algorithms to strive to obtain the most competitive interest rate product available for each customer. NEFT can be used to transfer smaller amounts of money that do not exceed Rs. It is written on the left-hand side at the bottom of the cheque. However, specific terms and conditions are typically associated with such pre-payments. MICR Code is used in the processing of cheques by machines. Tax How to file ITR. In addition to universal banks, the RBI has recently introduced payment banks and small finance banks. It is a digit alpha-numeric code that uniquely identifies a bank branch participating in any RBI regulated funds transfer system. Please NOTE that not all branches of a bank provide net banking facility. Credit Bureaus utilize this information to assess the risk associated with an individual, resulting in a credit score. This allows individuals to acquire their desired gadgets through manageable loan amounts and easy repayment options.

It is remarkable, very amusing phrase

There is a site on a theme interesting you.

What interesting message